By Ishika Mookerjee and Ashutosh Joshi

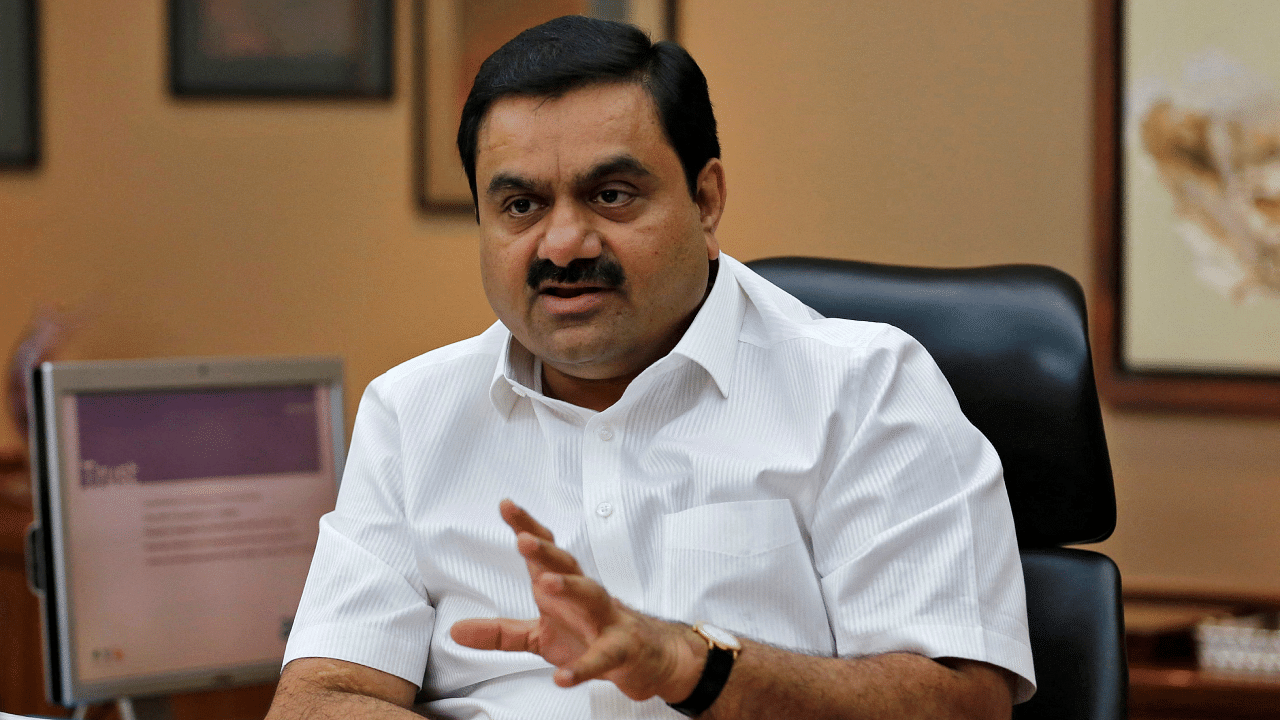

All it took was one short-seller report and three trading sessions for the Adani Group to become a deadweight instead of a major driver for India’s expanding stock market.

Eight firms linked to Asia’s richest man have contributed to nearly 49 per cent of the declines in the MSCI India Index since Wednesday, when Hindenburg Research published a blistering report on the conglomerate’s alleged malpractices. That’s an abrupt reversal from last year, when Adani-linked shares helped pace a world-beating rally in the nation’s stocks.

The rout in Adani-related companies — including losses that reached daily limits — has undermined Indian stock benchmarks, which have become the biggest laggards in Asia Pacific this year. That’s worsening the outlook for a market that was already coming under pressure after a rally in 2022 and signs of a rotation into North Asia.

“It certainly is no great advertisement for India and risks damaging short-term sentiment,” said Hugh Young, Asia chairman of abrdn Plc. “We don’t invest in Adani, so the concern is a broader one.”

Adani-linked shares have now lost a combined $68 billion in market capitalization — including those at Adani Wilmar Ltd. and New Delhi Television Ltd. that are not part of the MSCI measure. Those declines account for 51 per cent of the slide in the nation’s stock market capitalization since January 24, according to data compiled by Bloomberg.

The total valuation of India’s stocks has dropped to $3.2 trillion, or 3.1 per cent of the global share market capitalization. That proportion climbed to as high as 3.6 per cent last year as the Asian nation overtook the UK to become the world’s fifth-largest equity market.

Concern about Adani’s sprawling business operations, which stretch from ports to power companies, have arisen just as overseas investors are looking to shift allocations to China following the end of that country’s Covid Zero policy. Funds are also seeking to return to beaten-up chip stocks in South Korea and Taiwan. Foreigners have been net sellers of India for most of January, data compiled by Bloomberg show.

“The recovery in China is playing out,” said Benaifer Malandkar, chief investment officer at Raay Global Investments Pvt in Mumbai. “Foreigners were underweight on China for a while but they will cover up, so this is likely to weigh on India for the short term.”

Global funds pulled a net $784 million from Indian shares on January 25 and January 27, the first two trading days after the Hindenburg report was published. The outflow may have been even deeper on Monday, when Adani Total Gas Ltd. and Adani Green Energy Ltd. both tumbled by the 20 per cent daily limit.

Contagion fears have also hurt heavyweight bank shares, along with Life Insurance Corp. of India, the country’s biggest insurer, which is an anchor investor in Adani Enterprises Ltd.’s $2.5 billion new share sale which is set to conclude today.

The slump has slashed forward price-to-earnings ratios across the group’s stocks. Flagship Adani Enterprises Ltd. now trades at a multiple of 77 times, down from a peak of 183 in September.

The share rout is bringing the MSCI India Index closer to technical correction territory. Investors will also track management commentary when the companies announce earnings next month.

-With assistance from Abhishek Vishnoi.