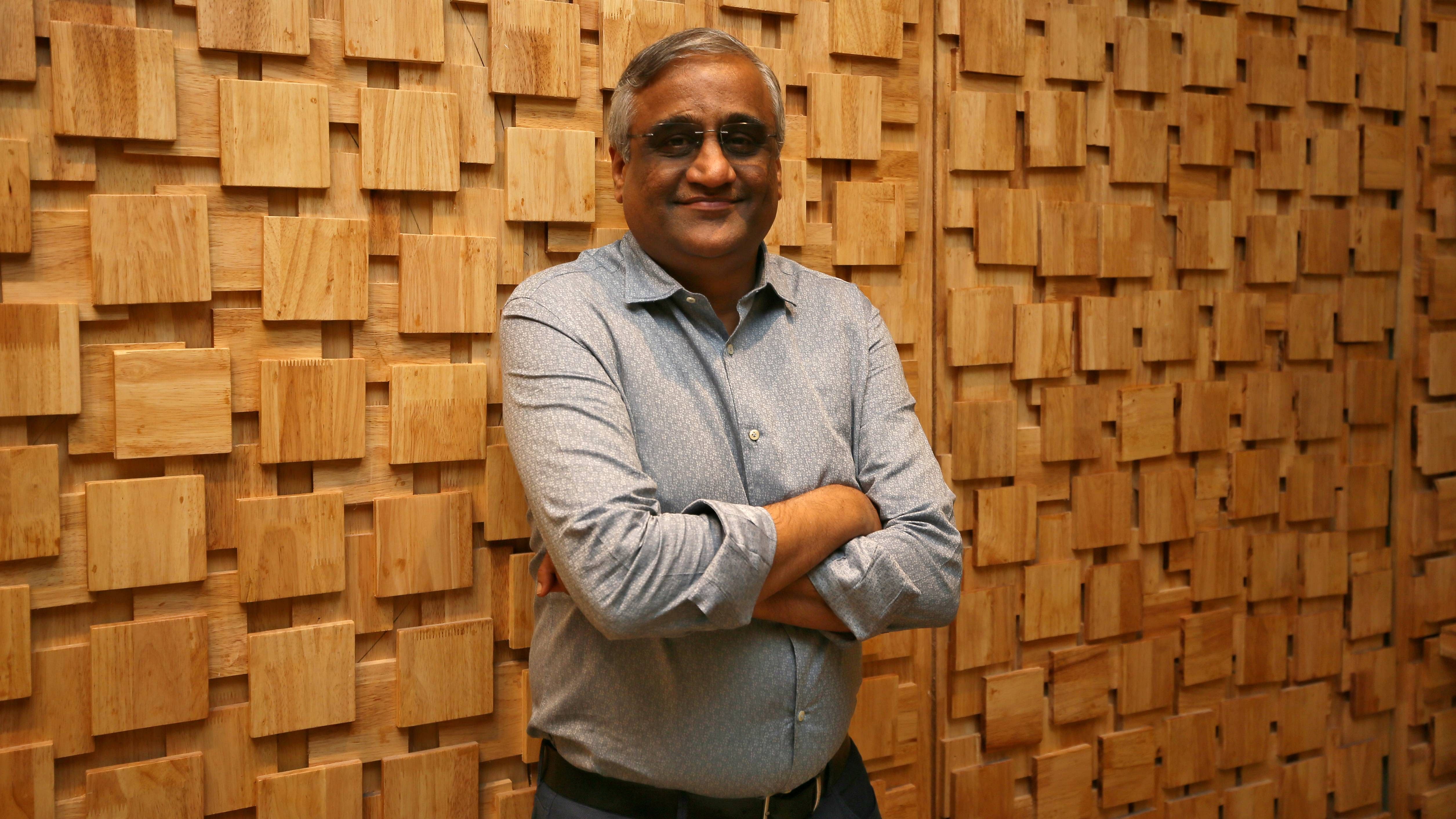

As Future Group and Amazon lock horns in the retail business battle, Kishore Biyani -- founder and CEO of the Future Group -- for the first time broke his silence and divulged that Amazon was not open to helping the cash-strapped group with its financial woes even though Biyani reached out to them eight times.

In August last year, the Future Group had announced a deal to sell its retail, wholesale, logistics and warehousing units to the retail arm of billionaire Mukesh Ambani's Reliance Industries. Under the Rs 24,713-crore deal, certain Future Group companies engaged in the retail and wholesale business and the logistics and warehousing business would be merged into Future Enterprises and transferred to Reliance Retail Ventures Ltd (RRVL), a subsidiary of RIL.

Amazon slapped a legal notice on Future Group in October alleging that the retailer's Rs 24,713-crore asset sale to Reliance Industries violated an agreement with the ecommerce giant.

In 2019, Amazon had agreed to purchase 49 per cent stake in one of Future Group's unlisted firm -- Future Coupons Ltd -- with the right to buy into flagship FRL after a period of three to ten years. Future Coupons holds 7.3 per cent equity in FRL -- that operates popular supermarket and hypermarket chains such as Big Bazaar -- through convertible warrants.

In an interview to The Economic Times, Biyani said Reliance Retail came as a “saviour” as the asset sale was crucial for a bailout for Future Group.

Future Group last week requested SEBI to expedite the review of the proposed deal and issue a no-objection certificate, while Amazon urged that the review of the "impugned transaction" be suspended.

Future Group was well placed in the retail business, however, the Covid-19 pandemic hit its business hard. By March-end, promoter pledging was as high as 80-99 per cent in all listed Future Group companies, and stock prices fell by over 70 per cent, according to the report.

Speaking on how Amazon merely wanted Future Group's "employees, suppliers, vendors and lenders to suffer and the company to languish," Biyani said, "We also connected them with four-five investors but they never showed any interest in salvaging us and were only doing lip service."

Biyani said the American tech and retail giant did not offer help even when its shares were invoked. “They had the right to buy shares and become majority investors in three to 10 years. But once the promoter shares were invoked, even that was not possible and that’s when they should have helped us and replaced lenders. The Reliance deal was a saviour for us and the employees, stakeholders, shareholders and creditors,” Biyani was quoted as saying.

Biyani said he did not make a single penny from the transaction but lost his retail business. “Still, I am faced to fight with a $2 trillion behemoth. If there is a dispute, it is between the promoters and Amazon and why should they drag my listed companies where they have no say,” he told the publication.

(With PTI inputs)