Jet Airways India Ltd., the second domestic carrier to ground its entire fleet in the past decade, is casting a shadow on India’s booming aviation sector.

Once the nation’s biggest airline by market value, Jet Airways’ shares nosedived by a record 31% on April 18 in Mumbai after saying it would suspend operations on a “temporary” basis as it ran out of money. A severe cash crunch had pushed Vijay Mallya’s indebted Kingfisher Airlines Ltd to ground its planes in 2012. It never flew again and Mallya is still fighting his extradition to India from London.

India’s aviation sector is an investment conundrum: it’s the world’s fastest-growing aviation market that has seen 54 consecutive months of double-digit percentage passenger growth and yet it’s notoriously difficult to make money in.

As Jet Airways’ lenders race to find an investor for the debt-ravaged airline, suitors will weigh the sector’s prospects against India’s high jet-fuel prices and a crushing fare war worsened by the entry of no-frills carriers.

“It’s a terrible setback for the entire industry. This makes the whole aviation story look doubtful,” said Parvez Damania, a Mumbai-based aviation expert. “Grounding of Jet Airways has impacted the credibility of double-digit growth of Indian civil aviation.”

The crisis at Jet Airways that risks 23,000 jobs, has come at an exceptionally sensitive time for Prime Minister Narendra Modi who’s seeking re-election in ongoing national elections, amid concerns on rising unemployment.

The Modi administration has in the past few years cracked down hard on India’s delinquent borrowers to repair the books of banks that currently have the world’s worst soured loan ratio.

“Since no emergency funding from the lenders or any other source is forthcoming, the airline will not be able to pay for fuel or other critical services to keep the operations going,” the carrier said in an April 17 statement. “With immediate effect, Jet Airways is compelled to cancel all its international and domestic flights.”

The carrier added that the decision was taken after a painstaking evaluation of all alternatives, with the ministries of civil aviation and finance and the aviation safety regulator informed in advance. It’ll continue to support a bid process initiated by lenders and that it aims to return to flying “as soon as possible.” That mechanism is due to conclude on May 10.

‘Reasonably Hopeful’

State Bank of India, on behalf of all Jet’s lenders, said in a Thursday statement that they had decided that “the best way forward for the survival of the carrier is to get the binding bids from potential investors” who were interested. Lenders are “reasonably hopeful” that the bid process is likely to be successful in determining a fair value for the carrier, it said.

Lenders have asked the government to protect Jet’s prime airport slots to prevent an erosion of its value, Business Standard reported on Friday, citing sources it didn’t name. The banks are said to have shortlisted Etihad Airways PJSC, India’s National Investment and Infrastructure Fund and private equity firms TPG Capital and Indigo Partners, people familiar with the discussions said, asking not to be identified as the information is private.

Potential investors in the beleaguered airline have asked lenders to take a haircut of as much as 80% on Jet’s debt, The Economic Times reported, citing unnamed sources.

Jet’s financial problems are not new, according to Dharmesh Kant, head of retail research at Mumbai-based Indianivesh Securities Ltd. “It had been kicking the can down the road but sooner or later the time had to run out and it did,” he said over the phone.

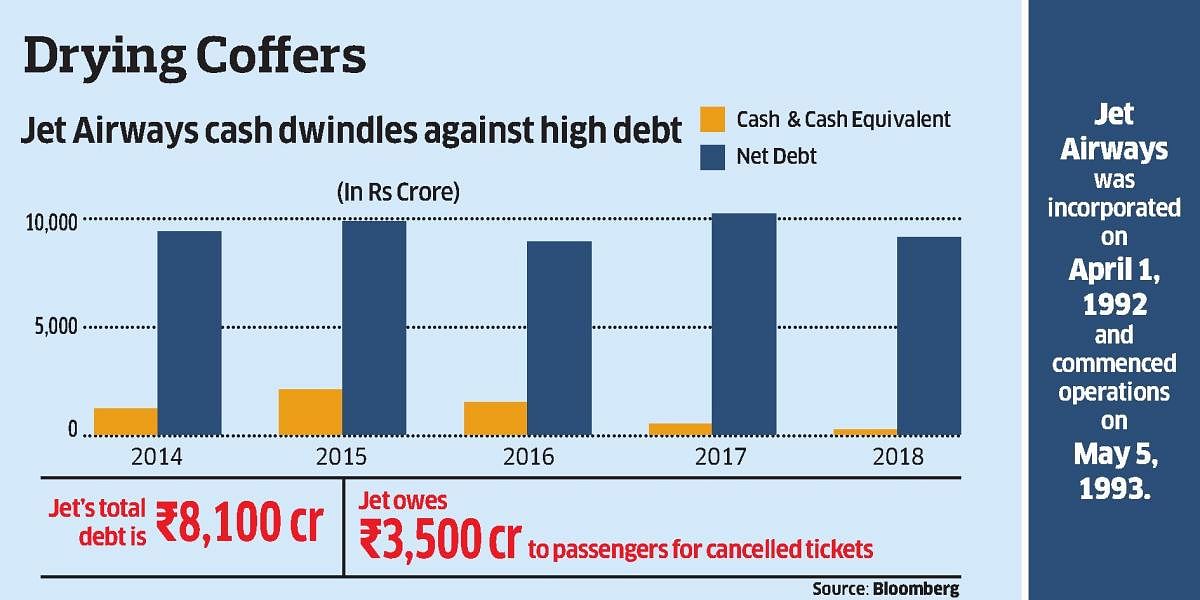

Jet, which broke the monopoly of state-run Air India Ltd. in the early 1990s, has been in decline since budget airlines started offering ultra-low fares that hurt profits and led it to pile up more than $1 billion in debt.

It also has unpaid dues to aircraft-leasing firms and employees including pilots, who have been agitating over non-payment of salaries.

Jet’s founder Naresh Goyal resigned as chairman of the ailing airline last month, caving in to pressure from creditors. Goyal, who started in aviation as a ticketing agent, rose to be among the nation’s elite after Jet became India’s premier full-service carrier.

It won’t be an easy task for Jet’s new owner to turnaround the airline, which has reported losses for four straight quarters and in nine out of 11 last financial years. Grounding the airline means its value is going to erode further, making the revival tougher for any suitor.

“With no aircraft, pilots, flight attendants and engineers, I certainly don’t see how any bidder will continue to see value in Jet Airways,” said Mark D Martin, founder of Martin Consulting. “History and our business dynamics prove that once an airline shuts down in India, it doesn’t restart.”

Dirt-cheap fares

Indian carriers, including Jet, have seen their profits hurt by the world’s highest jet-fuel taxes and a price war worsened by the entry of low-cost, no-frills airlines such as IndiGo and SpiceJet Ltd that offered dirt-cheap fares with lower overheads.

Foreign carriers from Malaysia’s low-cost AirAsia Group Bhd to Singapore Airlines Ltd and Jet’s minority shareholder Etihad, have all learnt how hard it is to make money in Indian skies.

Air India, the state carrier, has been propped up on bailouts from the exchequer for years. AirAsia, which entered in 2014 with a vow to break even in four months, is still nowhere close to its goal. Vistara, Singapore Air’s joint venture with the Tata Group that started in 2015, has yet to make any money. SpiceJet had almost collapsed in 2014.

The only exception in the sector is Indigo, run by Interglobe Aviation, which has reported annual profits since 2011 and whose stock has soared 33% this year. Spicejet, which has been on the mend, has also advanced as it leases more aircraft and starts more flights on the New Delhi-Mumbai route.

Airfares are expected to rise in the coming weeks, possibly denting the passenger growth story that was making India the world’s quickest-growing aviation market. Jet’s decision to stop flying will also push the fares higher.

Jet’s lenders could have done a bit more to keep the carrier up in the air, if only to preserve the value of the asset they have put on the block, according to Martin. “To think that no money was pumped in to resolve liabilities of lessors, fuellers and salaries is unforgiving,” he said.