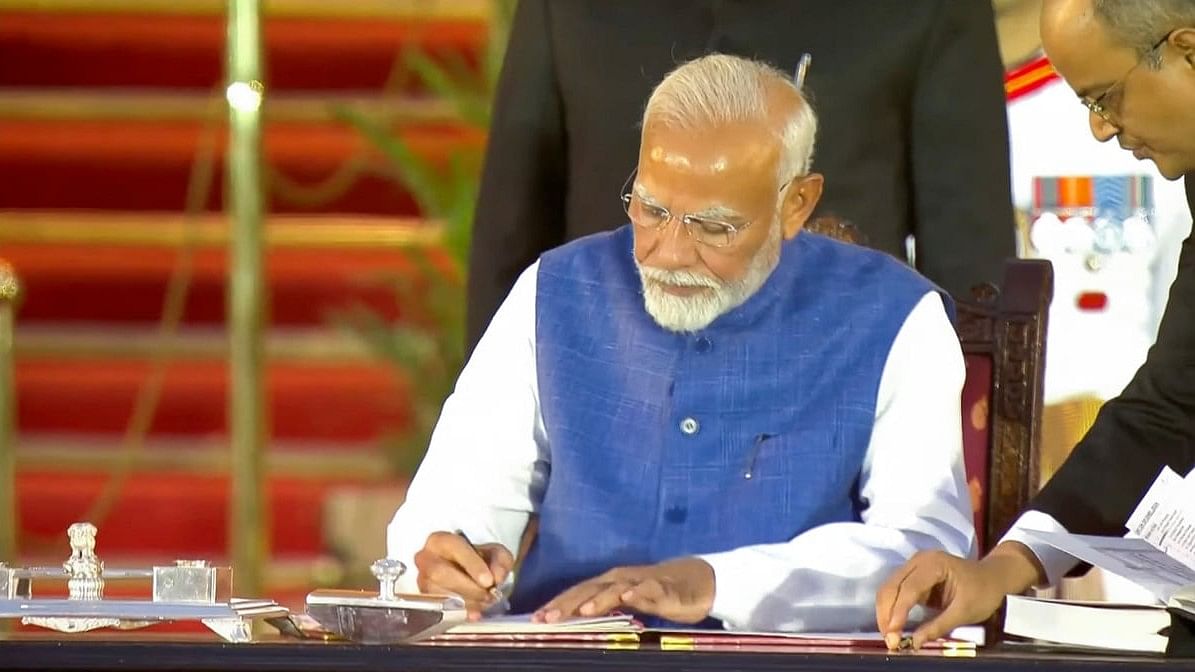

PM-designate Narendra Modi takes oath as Prime Minister for the third consecutive term, at Rashtrapati Bhavan in New Delhi.

Credit: PTI Photo

Domestic equities this week will focus on allocation of key cabinet portfolios such as Finance, Defense, Roads, Energy, Commerce, and Railways, once Prime Minister Narendra Modi takes oath. On the economic calendar front, India’s retail inflation and industrial output data, United States Federal Reserve and Bank of Japan interest rate meetings will keep investors busy. US inflation along with United Kingdom and Japan GDP will be other key macros to keep an eye on.

Last week, Nifty, after tanking more than 9 per cent post the election outcome, quickly revived and is just at a kissing distance to an all time high of 23,338 levels. The index rallied almost 2,000 points from Tuesday’s bottom of 21,300 and ended the week with gains of 760 points (3.4 per cent). Broader markets too gained about 3 per cent. India Volatility Index dropped to a one-month low, signaling reduced market anxiety over government formation.

Except for state-owned banks, all sectors ended in green with IT, fast moving consumer goods and automotives rallying 7-8 per cent. Expectation of a healthy monsoon is driving buying interest in FMCG and autos.

Domestic equities recovered as the sentiments got a boost post-confirmation that the National Democratic Alliance is forming the government for the third consecutive term. Investors regained confidence once key allies pledged their support to BJP. Interest rate status quo by Reserve Bank of India, along with dovish commentary, and a hike in FY25 GDP growth forecast boosted market sentiments.

Even global factors contributed to this week’s recovery as the hopes revived for rate cut possibility in US Fed’s September meet, after weaker than expected jobs data. The European Central Bank has gone ahead and announced a 25 basis points rate cut for the first time in nearly five years.

Once the overhang surrounding government formation and portfolio allocation is done away with, market focus will return back to macro and fundamentals which continue to remain strong. Despite the reduced seats, we expect the government focus to continue on Investment-led growth, capital expenditure, infrastructure creation, manufacturing, etc in the long term. The new government would be presenting the full budget for FY25 in the next few weeks where themes of rural economy, consumption, credit lending etc would be back in focus.

While the market volatility may continue in near term, retail investors should take this as an opportunity to accumulate quality names in three-four tranches.

NDA 3.0 augurs well for the economy and capital markets as it provides stability and continuity in policy-making, and will be expected to continue pushing its economic growth agenda. Fundamentally, India is witnessing excellent macros with GDP growth of 8.2 per cent in FY24, inflation at around 5 per cent, and fiscal deficit within the tolerance band.

Even corporate earnings have been solid. We expect the market to reach new highs given political stability, good macro trends, and solid corporate earnings. One can focus on manufacturing, capex, infrastructure and financials as themes for long term investment.

(The author is head of retail research, Motilal Oswal Financial Services Ltd)