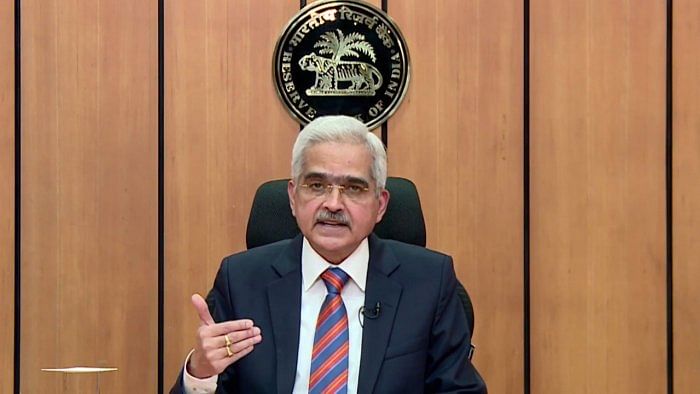

Governor Shaktikanta Das on Thursday said the Reserve Bank's assessment of the capital requirement to make the transition to the expected credit loss-based provisioning will be "manageable" for the lenders.

He said the lenders will be given time before implementing the intent to adopt the newer system of setting aside money for stressed accounts compared to the current system of creating provisioning after non-payment of loans.

The RBI has already come out with a discussion paper on the ECL system but has not yet given an exact timeline to adopt the newer system. Banks' lobby grouping IBA has gone public with its demand to ask for one more year for the implementation of the newer framework.

"The comments have been received...they are under examination, and we will issue the circular (to implement it). But, we are mindful of the fact that banks will need some time to implement it," Das told reporters at the customary post-policy review press conference at the central bank headquarters here.

When asked about the capital required to take care of the heightened provisioning under the new framework, Das said, "We have assessed it. It is quite a manageable limit".

Das said the RBI always gives time to adopt newer regulations and does not change rules by giving limited time for the change.

Deputy Governor M Rajeshwar Rao made it clear that the RBI is not going to implement the newer system from June 30.

Replying to a specific question on a lack of convergence between the RBI and the government on the issue, he said, "We have received comments from all the concerned stakeholders, they are being evaluated. Some more refinement and work are on. So, at this point in time, I don't think it is correct to infer that June 30 will be the date when it is going to be launched that is an incorrect assumption".

Meanwhile, Deputy Governor Michael Patra asked technology players to ensure that their app stores do not include unauthorised apps engaged in forex trading.

Speaking a day after the central bank came up with a list of 56 unauthorised apps, Patra said, "The tech companies that are uploading the mobile apps should apply caution and ensure that what they are uploading is by the laws of the land".

He also said the RBI is building awareness by publishing a list of both authorised and unauthorised apps and also interacts closely with law enforcement agencies on this issue.