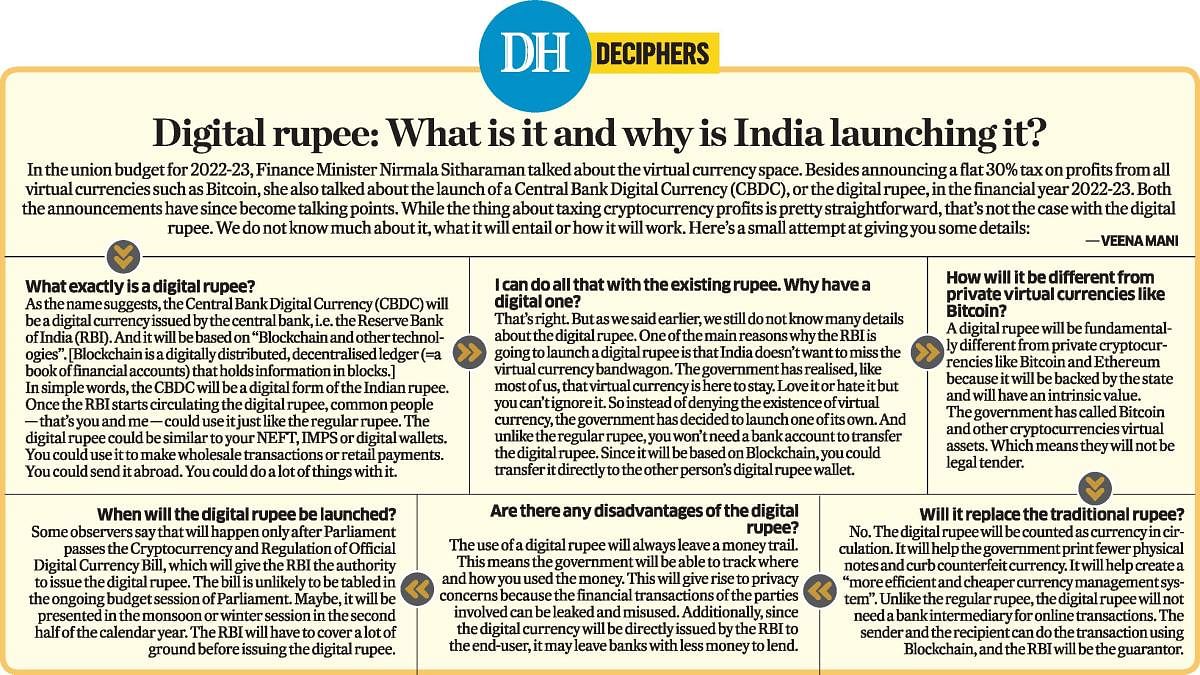

In the Union Budget for 2022-23, Finance Minister Nirmala Sitharaman talked about the virtual currency space. Besides announcing a flat 30% tax on profits from all virtual currencies such as Bitcoin, she also talked about the launch of a Central Bank Digital Currency (CBDC), or the digital rupee, in the financial year 2022-23. Both the announcements have since become talking points. While the thing about taxing cryptocurrency profits is pretty straightforward, that's not the case with the digital rupee. We do not know much about it, what it will entail or how it will work. Here's a small attempt at giving you some details:

What exactly is a digital rupee?

As the name suggests, the Central Bank Digital Currency (CBDC) will be a digital currency issued by the central bank, i.e. the Reserve Bank of India (RBI). And it will be based on "Blockchain and other technologies". [Blockchain is a digitally distributed, decentralised ledger (=a book of financial accounts) that holds information in blocks.]

In simple words, the CBDC will be a digital form of the Indian rupee. Once the RBI starts circulating the digital rupee, common people — that's you and me — could use it just like the regular rupee. The digital rupee could be similar to your NEFT, IMPS or digital wallets. You could use it to make wholesale transactions or retail payments. You could send it abroad. You could do a lot of things with it.

I can do all that with the existing rupee. Why have a digital one?

That's right. But as we said earlier, we still do not know many details about the digital rupee. One of the main reasons why the RBI is going to launch a digital rupee is that India doesn't want to miss the virtual currency bandwagon. The government has realised, like most of us, that virtual currency is here to stay. Love it or hate it but you can't ignore it. So instead of denying the existence of virtual currency, the government has decided to launch one of its own.

And unlike the regular rupee, you won't need a bank account to transfer the digital rupee. Since it will be based on Blockchain, you could transfer it directly to the other person’s digital rupee wallet.

How will it be different from private virtual currencies like Bitcoin?

A digital rupee will be fundamentally different from private cryptocurrencies like Bitcoin and Ethereum because it will be backed by the state and will have an intrinsic value. The government has called Bitcoin and other cryptocurrencies virtual assets. Which means they will not be legal tender.

Will it replace the traditional rupee?

No. The digital rupee will be counted as currency in circulation. It will help the government print fewer physical notes and curb counterfeit currency. It will help create a "more efficient and cheaper currency management system". Unlike the regular rupee, the digital rupee will not need a bank intermediary for online transactions. The sender and the recipient can do the transaction using Blockchain, and the RBI will be the guarantor.

Are there any disadvantages of the digital rupee?

The use of a digital rupee will always leave a money trail. This means the government will be able to track where and how you used the money. This will give rise to privacy concerns because the financial transactions of the parties involved can be leaked and misused. Additionally, since the digital currency will be directly issued by the RBI to the end-user, it may leave banks with less money to lend.

When will the digital rupee be launched?

Some observers say that will happen only after Parliament passes the Cryptocurrency and Regulation of Official Digital Currency Bill, which will give the RBI the authority to issue the digital rupee. The bill is unlikely to be tabled in the ongoing budget session of Parliament. Maybe, it will be presented in the monsoon or winter session in the second half of the calendar year. The RBI will have to cover a lot of ground before issuing the digital rupee.

Check out DH's latest videos: