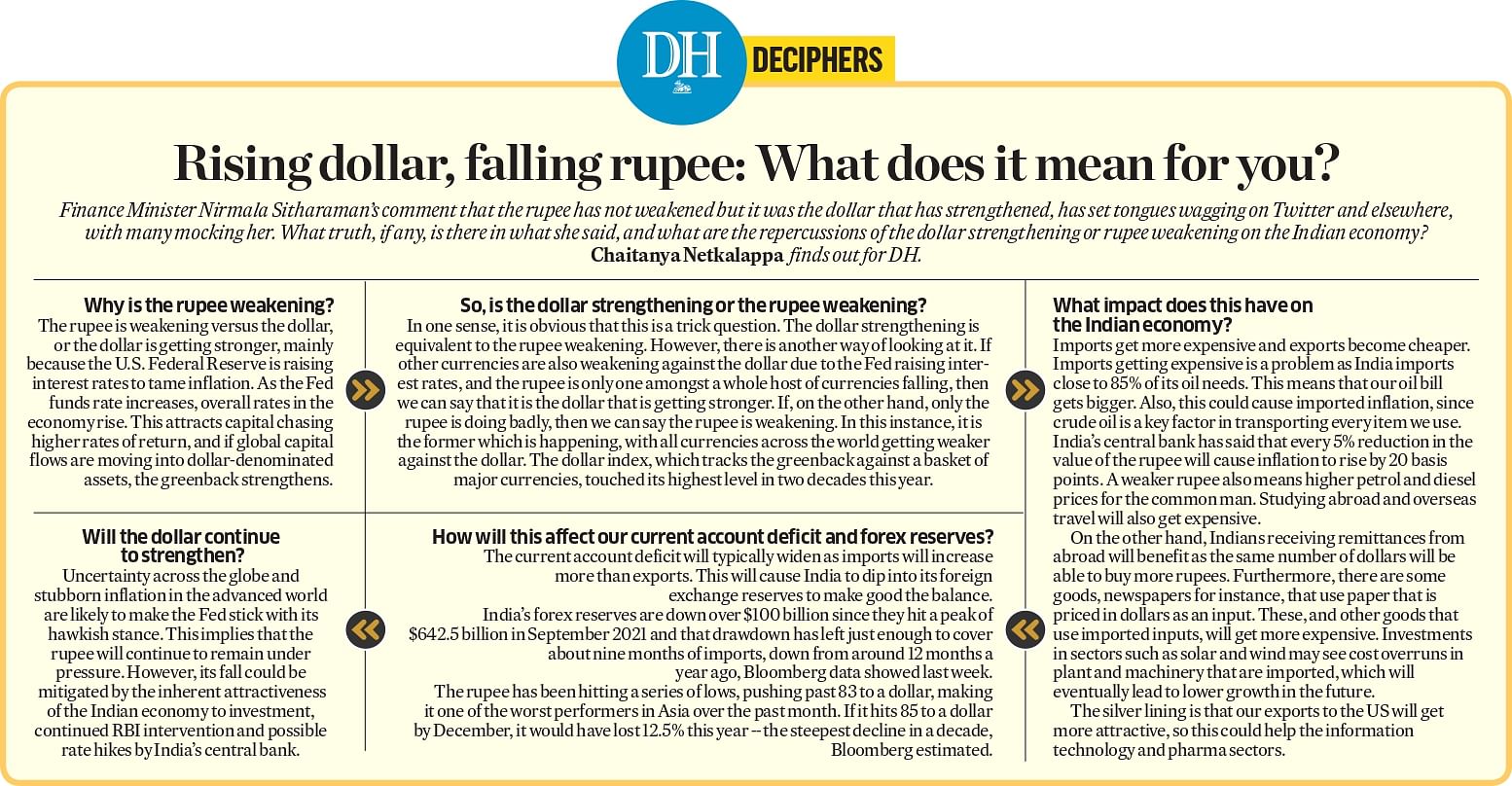

Why is the rupee weakening?

The rupee is weakening versus the dollar, or the dollar is getting stronger, mainly because the U.S. Federal Reserve is raising interest rates to tame inflation. As the Fed funds rate increases, overall rates in the economy rise. This attracts capital chasing higher rates of return, and if global capital flows are moving into dollar-denominated assets, the greenback strengthens.

So, is the dollar strengthening or the rupee weakening?

In one sense, it is obvious that this is a trick question. The dollar strengthening is equivalent to the rupee weakening. However, there is another way of looking at it. If other currencies are also weakening against the dollar due to the Fed raising interest rates, and the rupee is only one amongst a whole host of currencies falling, then we can say that it is the dollar that is getting stronger. If, on the other hand, only the rupee is doing badly, then we can say the rupee is weakening. In this instance, it is the former which is happening, with all currencies across the world getting weaker against the dollar. The dollar index, which tracks the greenback against a basket of major currencies, touched its highest level in two decades this year.

What impact does this have on the Indian economy?

Imports get more expensive and exports become cheaper. Imports getting expensive is a problem as India imports close to 85% of its oil needs. This means that our oil bill gets bigger. Also, this could cause imported inflation, since crude oil is a key factor in transporting every item we use. India's central bank has said that every 5% reduction in the value of the rupee will cause inflation to rise by 20 basis points. A weaker rupee also means higher petrol and diesel prices for the common man. Studying abroad and overseas travel will also get expensive.

On the other hand, Indians receiving remittances from abroad will benefit as the same number of dollars will be able to buy more rupees. Furthermore, there are some goods, newspapers for instance, that use paper that is priced in dollars as an input. These, and other goods that use imported inputs, will get more expensive. Investments in sectors such as solar and wind may see cost overruns in plant and machinery that are imported, which will eventually lead to lower growth in the future.

The silver lining is that our exports to the US will get more attractive, so this could help the information technology and pharma sectors.

How will this affect our current account deficit and forex reserves?

The current account deficit will typically widen as imports will increase more than exports. This will cause India to dip into its foreign exchange reserves to make good the balance.

India’s forex reserves are down over $100 billion since they hit a peak of $642.5 billion in September 2021 and that drawdown has left just enough to cover about nine months of imports, down from around 12 months a year ago, Bloomberg data showed last week.

The rupee has been hitting a series of lows, pushing past 83 to a dollar, making it one of the worst performers in Asia over the past month. If it hits 85 to a dollar by December, it would have lost 12.5% this year -- the steepest decline in a decade, Bloomberg estimated.

Will the dollar continue to strengthen?

Uncertainty across the globe and stubborn inflation in the advanced world are likely to make the Fed stick with its hawkish stance. This implies that the rupee will continue to remain under pressure. However, its fall could be mitigated by the inherent attractiveness of the Indian economy to investment, continued RBI intervention and possible rate hikes by India’s central bank.