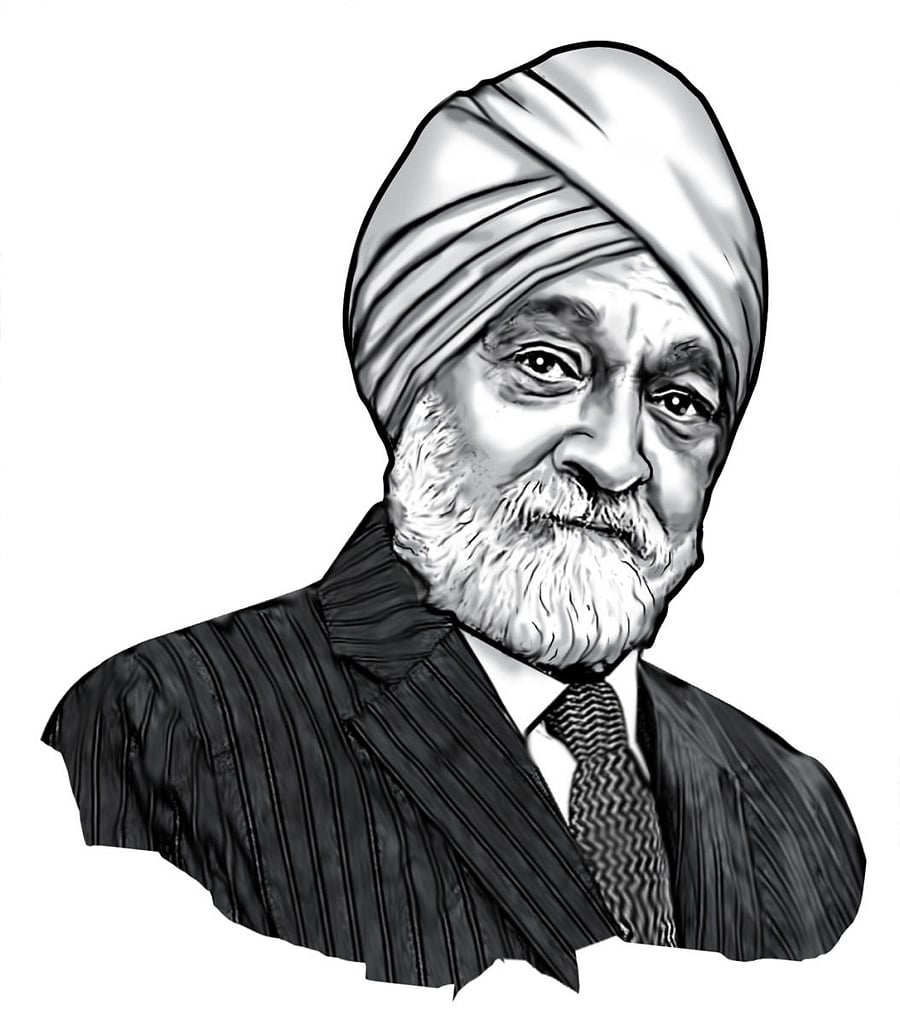

Divesting a part of government's share in LIC and corporate tax cuts are good moves by the government, but it needs to do more on the banking reforms and, stay away from protectionism to spur exports, without which high economic growth is not possible, feels former planning commission chairman Montek Singh Ahluwalia. Talking to Annapurna Singh of DH, he says it is easy to blame it on the global slowdown but the fact is that Vietnam and Bangladesh have done very well in these times but India has not.

Q. Is the govt going on the right path for $5 trillion economy? What has gone wrong with the reforms?

A. It is difficult to judge what has gone wrong. But I feel, the first step is to acknowledge that we are seriously off track. We are going to get less than 5% rate of growth in 2019-20, next year we may do a little better. At this rate there is no chance of meeting the $5 trillion target by 2024-25. However that target is still being repeated as if we can achieve it.

Q. Which are areas that need urgent attention?

A. Let me mention a few. First, agriculture. Its performance has been worst in these six years than the previous six years. We need to have policies that increase agricultural production and productivity. We have PM-Kisan but that is just an income support for farmers. It does not necessarily ensure productivity increase.

Second is banking reform. Our banks are under severe stress. The growth of credit is very low. They are hesitant to lend. They have adopted a non-risk taking behaviour. We need to implement banking reforms that will encourage the banks to get back to the job of extending credit

Private investment has to be the driver of economic growth. But it is very strongly depressed at the moment and I do not see that problem being addressed. You need to talk to the private sector and work out what is worrying them and address that. Recently, Rahul Bajaj said that there is a " fear factor". The government has said that there is nothing to fear but they need to find out what is worrying private investors and engage with them.

Q. Are the banks not lending because of NPA worries?

A. Rise in NPAs at the time of economic slowdown is not an abnormal thing. But when NPAs arise they have to be dealt with. We have known there is a problem for some years now but we have not responded as we should have by recapitalising the banks adequately and implemented banking sector reforms. Now, the banking sickness has spread to non banking finance sector. So, you are really seeing a financial mess. We need a credible plan to handle that.

Q. The government has announced many mergers?

A. If you merge 10 un-reformed public sector banks to make four un-reformed PSU banks, that is not a reform. I wish the government had implemented the recommendations of the PJ Nayak Committee.

Q. Do exports need attention too?

A. Absolutely. No country has achieved high economic growth without a robust export performance. Our export performance for the past six years has been very poor. Indian exports in dollar terms have been flat in this period. It is easy to blame it on the world but the fact is that Vietnam and Bangladesh have done very well in these times but India has not.

It is unfortunate that we have relapsed into protectionism. We are raising import duties because Indian industry is not competitive. If the Indian industry is not competitive in its own market, do you think they will be able to compete in the world markets. Raising import duties will only raise costs.

Q. But, that is to promote Make in India

A. That is going back to import substitution strategy of the 1970s. We know that approach will not work. The purpose of the 1991 reforms was to get away from this legacy. The Narsimha Rao government with Manmohan Singh as Finance Minister started that process, The UF and also the Vajpayee government that followed continued that process. We are now reversing the trend. The dominance of China is being questioned right now and there will be a diversification out of China for many products. India is well positioned ideally to step in and start playing a bigger role in global value chains . But I fear the move to raise import duties will kill that effort.

Q. How about loans to MSMEs and Mudra loans. Do you see these piling up NPAs?

A. Credit decisions should be left to the banks. Mudra loans can become non performing in a few years if they are not given after appropriate due diligence.

Q. How do you see the reduction in corporate tax and its timing?

A. The reduction in corporate tax rate was an important reform. We have waited for it for a long time. But it is not the move that will give any immediate boost to the economy. It will not spur private investments if those investments are held back for other reasons.

Q. What is your view on LIC disinvestment?

A. I think it is a good move. However, selling minority share in big corporations does not lead to any change in the management .It would be better if they bring some strategic investors to LIC.

Q. Should we also privatise PSU banks?

A. We should certainly end the dual regulation of public sector banks by both the Finance Ministry and the RBI. The RBI must have .the same powers over public sector banks that it does over private banks.