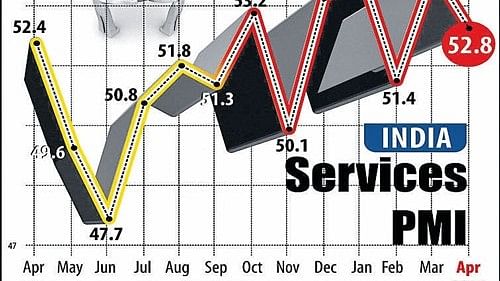

Graphical representation of PMI

Credit: PTI Photo

Bengaluru: India's services sector ended 2023 on a firm footing, with activity expanding at its fastest pace in three months in December on buoyant demand and an optimistic year-ahead outlook, a private survey showed.

The HSBC India Services Purchasing Managers' Index (PMI), compiled by SP Global, rose sharply in December to 59.0 from November's one-year low of 56.9. That marked the 29th month of expansion with the index well above the 50-mark separating growth from contraction.

"India's services sector ended the year on a high note, with an uptick in business activity, led by a three-month-high new orders index," noted Pranjul Bhandari, chief India economist at HSBC.

Favourable economic conditions and upbeat demand drove the new business sub-index up from a year low in November. However, international demand grew at the slowest pace in six months.

Services firms expected the momentum to remain strong this year, indicated by an uptick in the future activity sub-index— a key gauge for business optimism— from November's four-month low.

But the brighter sentiment was not enough to drive robust job creation. The pace of hiring quickened last month from November but remained muted.

Firms got some relief from inflationary pressures as operating costs rose at the weakest pace since August 2020.

All the same, they passed on extra costs to clients at a faster pace. It was the first time the rate of output price inflation outpaced that of input costs in well over three years, indicating improved corporate margins.

Inflation in India was expected to remain within the Reserve Bank of India's (RBI) target range of 2-6% this fiscal year and next, the latest Reuters survey showed. The RBI is expected to reduce interest rates in the third quarter of this year, around the same time when the US Federal Reserve is forecast to cut, according to a separate Reuters survey.

While a manufacturing sector index released on Wednesday dipped to 54.9 in December, strong services activity lifted the overall HSBC India Composite PMI Output Index to a three-month high of 58.5.