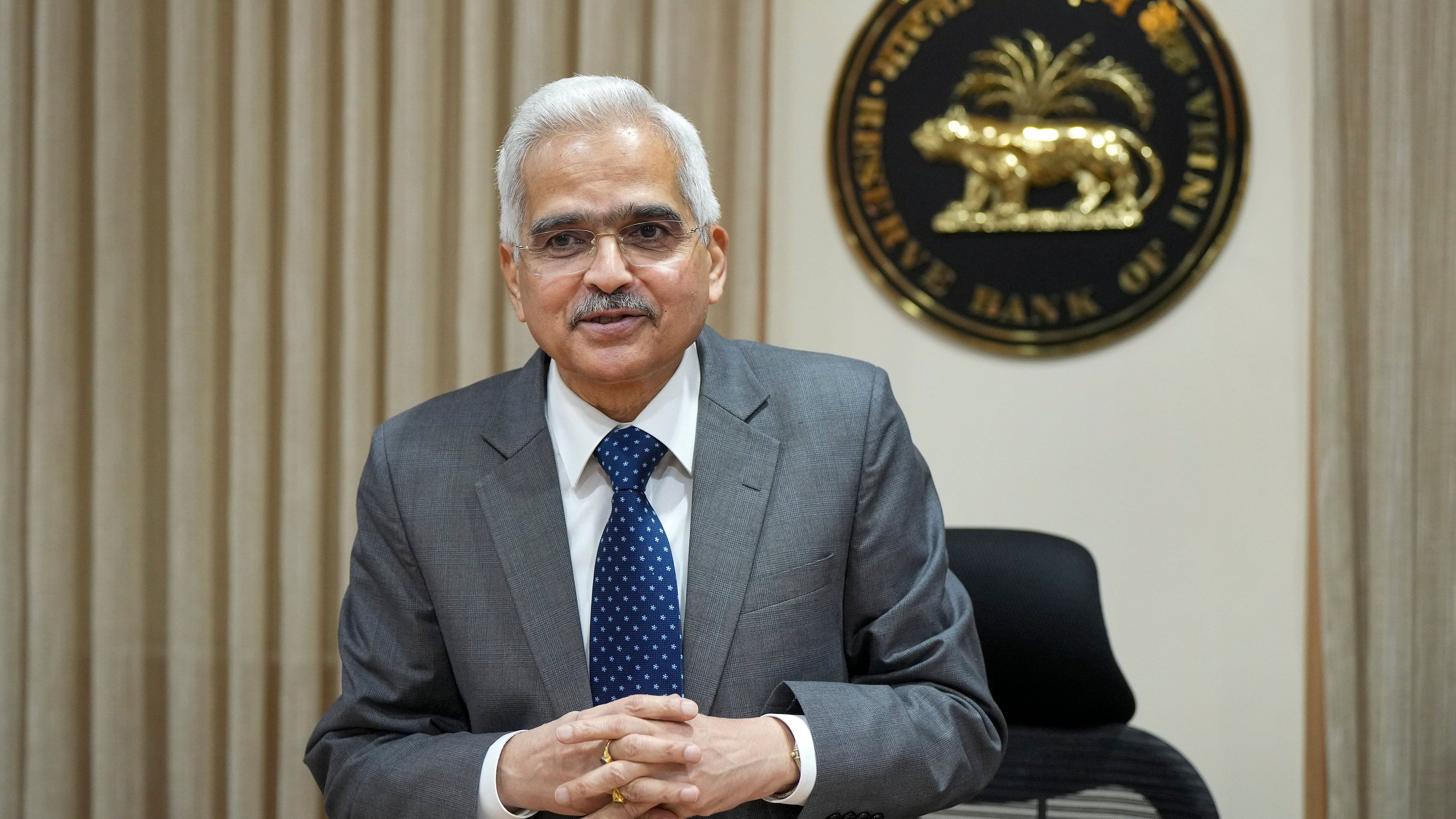

Mumbai: Reserve Bank of India (RBI) Governor Shaktikanta Das during a press conference on monetary policy statement, in Mumbai.

Credit: PTI Photo

New Delhi: The Reserve Bank of India's Monetary Policy Committee (MPC) on Wednesday started its deliberations on the current financial year's first meeting in which it is widely expected to agree on keeping key policy interest rates unchanged and raise economic growth projections.

The RBI didn't change policy repo rate during the financial year ended March 31, 2024 and is unlikely to change its position in the next two quarters, analysts said.

"RBI might cut rates only in the October-December FY25 quarter," Soumya Kanti Ghosh, group chief economic adviser, State Bank of India (SBI), said in a note.

The central bank last hiked the repo rate to 6.5% in February 2023. Since then it has held repo rates. In the past one year the RBI has also remained hawkish, reiterating its commitment to bring down headline retail inflation to the MPC’s mid-term target. The government has mandated the RBI to keep inflation at 4% with a comfort band of 2% in both directions.

While retail inflation has been in the RBI's comfort zone of below 6% in the recent months, it has eluded the 4% target. The Consumer Price Index-based (CPI) inflation stood at 5.09% in February, remaining above the medium-term target of 4% for 53 months in a row.

"Going ahead, we anticipate that the MPC will contemplate rate cuts in the second half of FY25 as headline inflation approaches the 4% threshold," said ratings agency CareEdge. Das is expected to announce the MPC’s decision on Friday.

According to SBI Research, inflation is expected to remain slightly above 5% in March. "Inflation is then expected to decline till July 2024 but increase thereafter to reach a peak of 5.4% in September followed by a deceleration," it said.

While the central bank is likely to maintain its FY25 projection for inflation at 4.5%, it may raise the GDP growth forecast to around 7.5% from its previous estimate of 7%.

India's GDP growth is likely to be above 8% in the just ended FY24, beating the RBI as well as the government's own projections.

Finance Minister Nirmala Sitharaman last week said that the GDP growth in January-March quarter would be 8% or above. India's GDP expanded by 8.2%, 8.1% and 8.4%, respectively, in the first three quarters of FY24

While the industry as well as the government have been pitching for rate cuts to support the economic growth momentum, the RBI seems to be focused on bringing down inflation to its targeted level.

Addressing the RBI’s 90th anniversary event on Monday, Prime Minister Narendra Modi asked the central bank to give top most priority to accelerating growth. Lower interest rates play an important role in accelerating growth.

"The RBI is likely to maintain a status quo on key policy rates in its April 5 policy announcement amid strong economic growth," said Dhruv Agarwala, Group CEO of REA India that runs proptech firms Housing.com and PropTiger.com

"Even though the year-long downward trend in core inflation is encouraging, inflation is still close to the upper band of the apex bank's 2%-6% target, leaving little room for any rate cut during this policy cycle," Agarwala added.