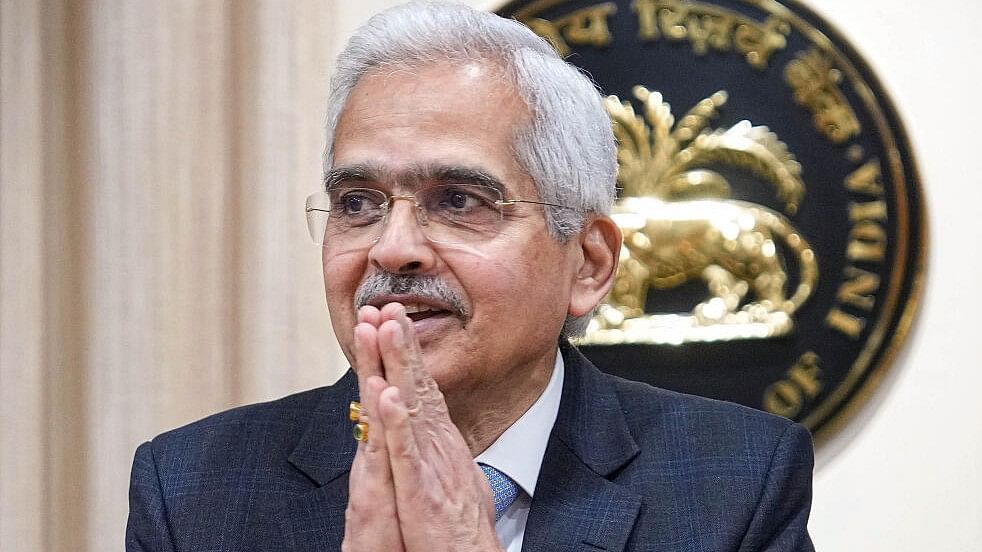

Reserve Bank of India (RBI) Governor Shaktikanta Das.

Credit: PTI Photo

The Reserve Bank of India’s Monetary Policy Committee on Friday unanimously decided to keep repo rates unchanged for the fifth time in a row, citing continued inflation concerns.

However, buoyed by the recent positive economic data, the MPC raised its forecast for India’s gross domestic product growth in the current financial year to 7% from 6.5%.

Addressing the media after the MPC meeting in Mumbai, Governor Shaktikanta Das also said that the UPI transaction limit for healthcare and education purposes is being increased to Rs 5 lakh from Rs 1 lakh.

“There has been broad-based easing in core inflation which is indicative of successful disinflation through monetary policy actions. The near-term outlook, however, is masked by risks to food inflation which might lead to an inflation uptick in November and December. This needs to be watched for second round effects, if any,” Das said.

The status quo on policy repo rate means the interest rates on retail as well as corporate borrowings would remain stable. Repo rate, currently at 6.5%, is the interest rate at which the RBI lends money to commercial banks. Thus, the interest rates on home, car and other loans are largely governed by this rate.

The repo rate was hiked cumulatively by 250 basis points between May 2022 and February 2023. This led to a sharp increase in equated monthly instalments (EMIs) on home, car and other loans. The key policy rates have remained unchanged since February 2023.

“The upward revision in GDP forecast to 7% for FY24 looks optimistic, reasonable and is likely to be overshot,” said Dr Soumya Kanti Ghosh, Chief Economic Advisor, State Bank of India.

RBI’s higher GDP forecast of 7% comes days after official data showed that India's economy expanded by a robust 7.6% in July-September quarter of FY24, sharply higher than analysts’ expectations of 6.8-7%, on the back of strong activity in manufacturing and construction sectors.

“The Indian economy is showing resilience with GDP growth for Q2 having exceeded forecasts, which is a good sign of a sustainable growth momentum. A broad-based easing in core inflation certainly points towards past monetary actions yielding desired results,” said Suresh Khatanhar, Deputy Managing Director, IDBI Bank.

Governor Das said the MPC had decided to keep inflation forecast for the year unchanged at 5.4%. He said that going ahead, inflation outlook would be considerably influenced by uncertain food prices. High frequency food price indicators point to an increase in prices of key vegetables which may push CPI inflation higher in the near-term.

“Looking ahead, private consumption should gain support from gradual improvement in rural demand, strengthening of manufacturing activity and continued buoyancy in services… The protracted geopolitical turmoil, volatility in global financial markets and growing geo-economic fragmentations, however, pose risks to the outlook,” Das said.

Among other measures announced, Das said the decision to hike the UPI limit for health and education transactions will help customers avail these services by paying higher amounts. He also announced that the RBI has decided to come out with a unified regulatory framework on connected lending for all regulated entities, which will further strengthen the pricing and management of credit by regulated entities.

“Several concerns relating to such web-aggregation of loan products harming consumers’ interest have come to our notice. It has, therefore, been decided to lay down a regulatory framework for web-aggregation of loan products. This is expected to result in enhanced customer centricity and transparency in digital lending,” he said.