Equity market opened sharply lower on Wednesday, with Sensex sliding more than 300 points as the US Federal Reserve's hawkish view on interest rate trajectory and weak global cues hit investor sentiments.

Most of the Asian markets, including Hong Kong, were also trading in the negative territory.

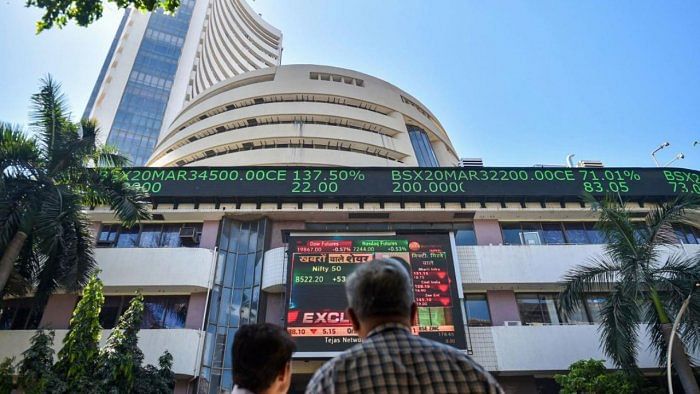

After registering gains for two straight sessions, the 30-share BSE Sensex plunged 315.30 points or 0.52 per cent to 59,909.16 points, while the broader NSE Nifty fell 88.95 points or 0.50 per cent to 17,622.50 points on Wednesday.

Stock, commodity and money markets were closed on Tuesday on account of Holi.

In the Sensex pack, only eight stocks, including Maruti Suzuki, HDFC Bank and HDFC, were in the green while the rest were in the red.

On Monday, Sensex closed at 60,224.46 points while Nifty ended the day at 17,711.45 points.

Federal Reserve Chair Jerome Powell on Tuesday said the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated.

"If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," he said.

In a pre-open market note, Deepak Jasani, Head of Retail Research at HDFC securities, said Indian markets could open lower, in line with negative Asian markets today and lower US markets.

He said the US stock indexes finished sharply lower on Tuesday as investors digested Powell's hawkish message that the central bank will not rule out bigger interest rate hikes at the coming March meeting in order to tame stubborn inflation.

On Monday, Foreign Portfolio Investors (FPIs) were net buyers, making investments worth Rs 721.37 crore, according to data available with BSE.