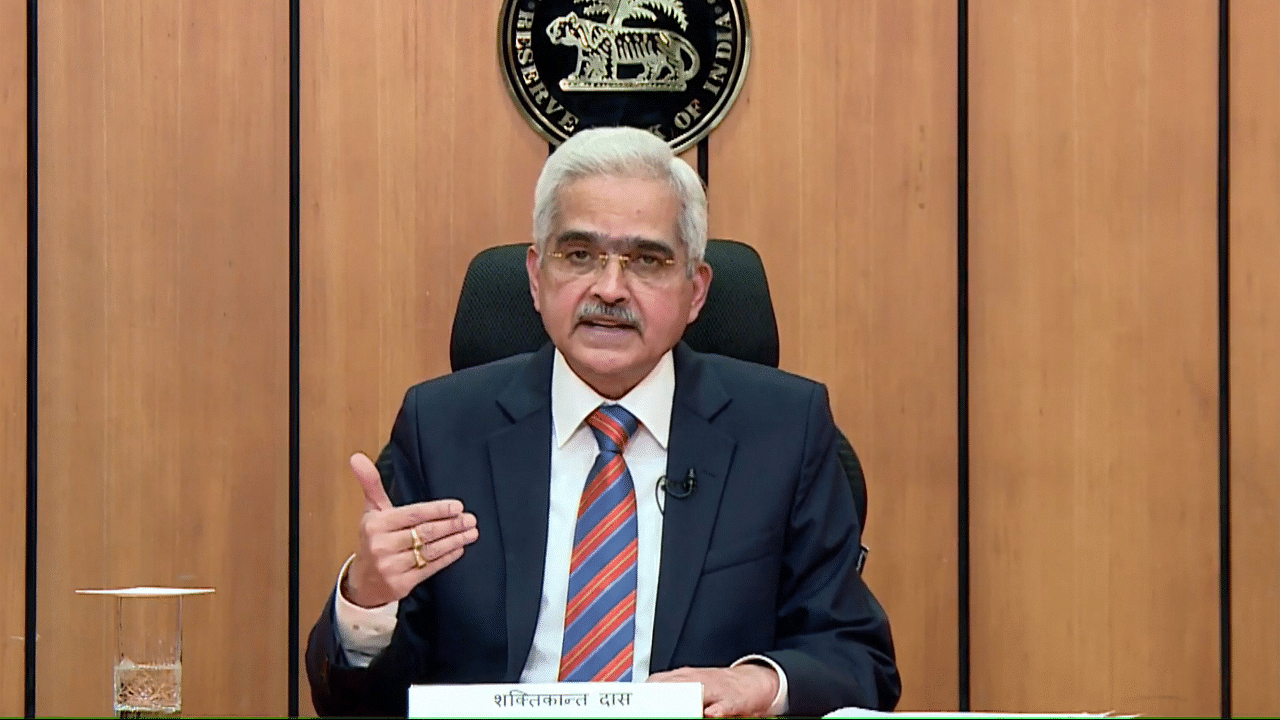

For the second time in a week, RBI Governor Shaktikanta Das on Tuesday expressed his concerns over cryptocurrencies, saying there are "far deeper issues" involved in virtual currencies that could pose a threat to the country’s economic and financial stability.

The statement comes within a few days of the Prime Minister holding a meeting on cryptocurrencies amid worries over misleading claims of huge returns on cryptocurrency investment. On Monday, PTI had reported that the Parliamentary Standing Committee on Finance discussed the pros and cons of crypto finance with various stakeholders, and several members were in favour of regulating cryptocurrency exchanges rather than an outright ban on such currencies.

The government is likely to introduce a bill on cryptocurrencies during the winter session of Parliament beginning November 29, according to the PTI report.

Addressing the 8th SBI Banking and Economics Conclave, Das said, "When the RBI, after due internal deliberation, says that there are serious concerns on macroeconomic and financial stability, there are deeper issues, which need much deeper discussions and much more well-informed discussions.”

However, Das said he was not privy to the discussions of the Parliamentary Standing Committee on Finance.

"We have received a lot of feedback that credit has been provided to open accounts and various other kinds of incentives are being provided to open accounts, but the total account balance is just about Rs 500, Rs 1,000 or Rs 2,000, and that covers about 70% to 80% of the accounts," he said.

Das admitted that the value of transactions and trading in virtual currencies have gone up, but said that the number of accounts is exaggerated.

The RBI governor, at an event last Wednesday, said that new-age currencies pose serious threats to the macroeconomic and financial stability of the country. On March 4, 2021, the Supreme Court had set aside an RBI circular of April 6, 2018, prohibiting banks and entities regulated by it from providing services in relation to virtual currencies.

The government is likely to introduce a bill on cryptocurrencies during the winter session of Parliament beginning November 29, according to the PTI report. While addressing the 8th SBI Banking and Economics Conclave, Das pointed out that when the RBI says it has serious concerns on cryptocurrencies, there are far deeper issues involved and a deeper discussion is needed.

"When the RBI, after due internal deliberation, says that there are serious concerns on macroeconomic and financial stability, there are deeper issues, which need much deeper discussions and much more well-informed discussions,” he noted.

At the recent meeting of the Parliamentary Standing Committee on Finance on cryptocurrencies, Das said he was not privy to what the Standing Committee discussed and deliberated. The governor doubted the current trading numbers in cryptocurrencies and said the investors are being lured to open accounts by offering credit.

Also Read | Crypto investors reap big returns in one year

"We have received a lot of feedback that credit has been provided to open accounts and various other kinds of incentives are being provided to open accounts, but the total account balance is just about Rs 500, Rs 1,000 or Rs 2,000, and that covers about 70 to 80% of the accounts," he said.

Das, however, said the value of transactions and trading in virtual currencies have gone up but the number of accounts is exaggerated. The RBI governor at an event on Wednesday last had said that new-age currencies pose serious threats to the macroeconomic and financial stability of the country, simultaneously expressing doubt over the number of investors trading on them as well their claimed market value.

On March 4, 2021, the Supreme Court had set aside an RBI circular of April 6, 2018, prohibiting banks and entities regulated by it from providing services in relation to virtual currencies.

Watch the latest DH Videos here: