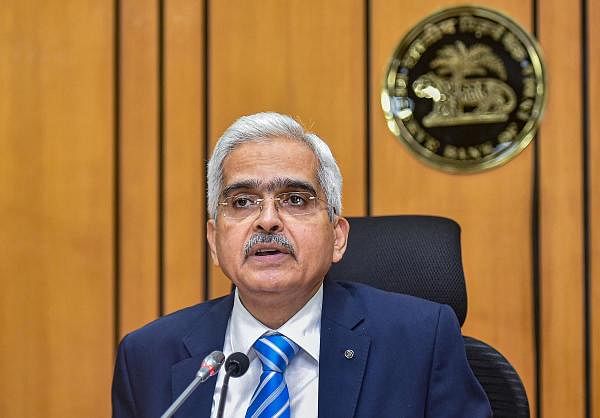

RBI Governor Shaktikanta Das addressed the media on Friday in the wake of the coronavirus outbreak in India and announced fiscal measures to contain the impact of COVID-19 on the Indian economy.

Here are the five key takeaways from his address:

1. The RBI cut repo rate by a whopping 75 bps to 4.4% from 5.15%. It also reduced the reverse repo rates by 90 basis points.

2. Das announced EMI relief by deferring EMI payments on long-term loans for the next three months. All banks and shadow banks are being permitted to allow a moratorium of three months for repayment of instalments on term loans, Das said. He added that the non-payment of moratoriums will not be termed as default.

3. He said that COVID-19 stocks the global economy and the outlook is highly uncertain and negative. Several nations are battling its exponential contagion. Countries are shutting down to prevent being sucked into a kind of black hole. There is a rising probability that large parts of the world will slip into recession, he said.

4. The RBI reduced the Cash Reserve Ratio (CRR) of all banks by 100 basis points to 3% of Net Demand and Time Liabilities with effect from the fortnight beginning March 28 for a period of one year.

5. In spite of the challenging environment, I remain optimistic, says Das. "This too shall pass," he adds.