Sebi charged Hindenburg of making 'unfair' profits from 'collusion' to use 'non-public' and 'misleading' information and induce 'panic selling' in Adani Group stocks.

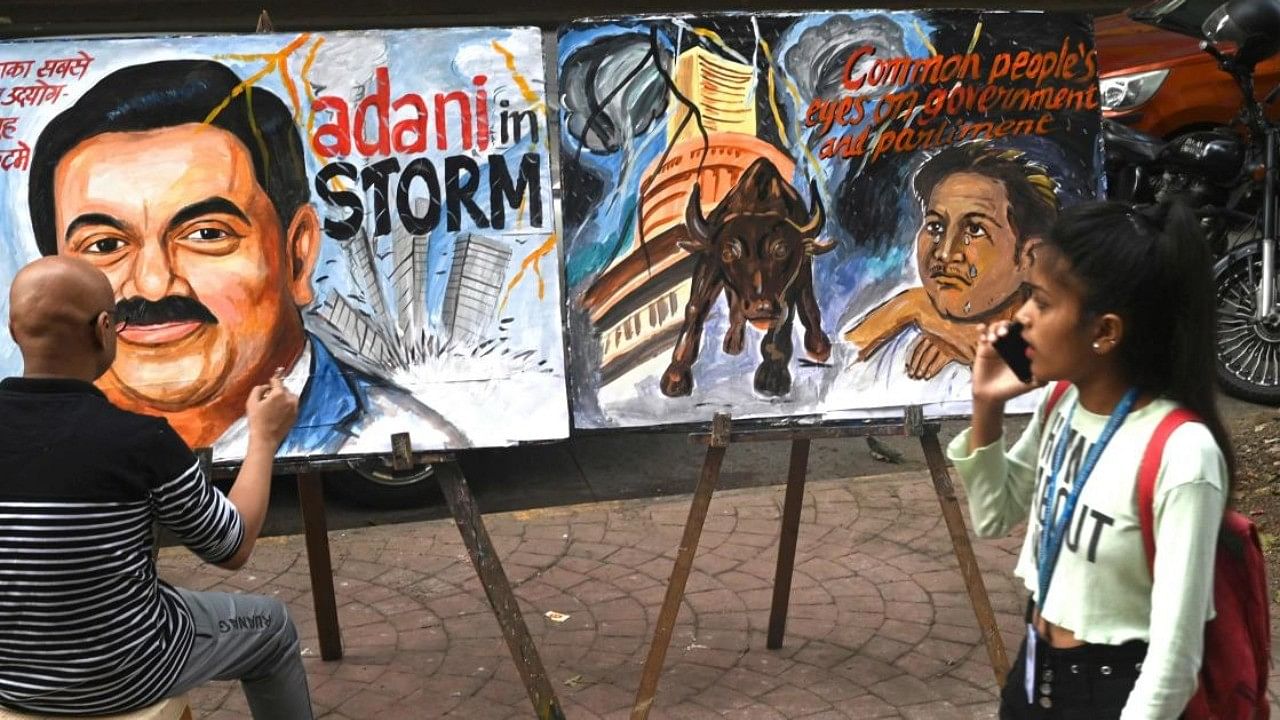

Credit: PTI Photo

New Delhi: US short-seller Hindenburg Research had shared an advance copy of its damning report against Adani group with New York-based hedge fund manager Mark Kingdon about two months before publishing it and profited from a deal to share spoils from share price movement, according to market regulator Sebi.

The Securities and Exchange Board of India (Sebi), in its 46-page show cause notice to Hindenburg, detailed how the US short seller, the New York hedge fund and a broker tied to Kotak Mahindra Bank benefited from the over $150 billion routs in the market value of Adani group's 10 listed firms post-publication of the report.

Sebi charged Hindenburg of making "unfair" profits from "collusion" to use "non-public" and "misleading" information and induce "panic selling" in Adani Group stocks.

Hindenburg, which made public the Sebi notice, in its response, has described the show cause as an attempt to "silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India" and revealed that the vehicle used to bet against Adani's flagship firm Adani Enterprises Ltd belonged to Kotak Mahindra (International) Ltd, a Mauritius-based subsidiary of Kotak Mahindra Bank Ltd.

KMIL's fund placed bets on Adani Enterprises Ltd for its client Kingdon's Kingdon Capital Management.

Sebi notice includes extracts of time-stamped chats between an employee of the hedge fund and KMIL traders for selling future contracts in AEL.

Kotak Mahindra Bank has stated that Kingdon "never disclosed that they had any relationship with Hindenburg nor that they were acting on the basis of any price-sensitive information".

Sebi -- which last year told a Supreme Court-appointed panel that it was investigating 13 opaque offshore entities that held between 14 per cent and 20 per cent across five publicly traded stocks of the Adani group -- has sent notices not just to Hindenburg but also to KMIL, Kingdon and Hindenburg founder Nathan Anderson.

Senior lawyer Mahesh Jethmalani, who had in the past spoken for the Adani group, in a post on X claimed that Kingdon had a Chinese link.

Kingdon is married to "Chinese spy" Anla Cheng, he claimed.

"Accomplished Chinese spy Anla Cheng, who along with her husband Mark Kingdon, hired Hindenburg for a research report on Adani, engaged the services of Kotak to facilitate a trading account to short sell Adani shares; made millions of dollars from their short selling; eroded Adani market cap enormously," he alleged.

Kingdon, which had a controlling stake in KMIL's K-India Opportunities Fund Ltd, had a pact to share with Hindenburg 30 per cent of profit made from trading in securities based on the report, the Sebi letter said, adding this profit share was cut to 25 per cent due to the extra time and effort needed to reroute trades via the K India fund.

The market regulator said Kingdon transferred $43 million in two tranches to build short positions in AEL. The K India fund built short positions for 8,50,000 shares ahead of the report release and squared off these positions soon after the report was released.

According to Sebi, Hindenburg published a report titled 'Adani Group: How the World's 3rd Richest Man is Pulling The Largest Con in Corporate History' on January 24, 2023 (United States time - January 25, 2023, according to IST) during pre-market hours.

"Prior to the release of the Hindenburg Report, concentration in short-selling activity was observed in the derivatives of Adani Enterprises Ltd," it said. "Pursuant to the release of the said report, the price of AEL fell by around 59 per cent during the period from January 24, 2023 to February 22, 2023" -- from Rs 3,422 to Rs 14,04.85 per share.

Sebi said K India Opportunities Fund Ltd - Class F (KIOF Class F) opened a trading account and started trading in the scrip of AEL just a few days prior to the publication of the report and then squared off its entire short position post-publication of the Hindenburg Report, making significant profits of Rs 183.23 crore ($22.25 million).

"The net profit after trading and legal expenses comes to $22.11 million," Sebi said.

As part of the deal, Kingdon owned Hindenburg $5.5 million, of which $4.1 million had been paid as of June 1, the notice said.

In its response to Sebi, Kingdon Capital said it had got legal option that it could "enter into a research services agreement with a third-party firm that publicly releases short reports on companies, pursuant to which Kingdon Capital would be given a draft copy of the report before it is made publicly available and would have the opportunity to accordingly made investments before the report's public dissemination".

A show-cause notice is often a precursor to formal legal action that may include imposing financial penalties and barring participation in the Indian capital market. Sebi can also seek government help to geoblock the research firm's website.

Sebi has given Hindenburg 21 days to respond to its allegations.

Hindenburg, which published the Sebi notice on its website, in its response stated that it made just $4.1 million from its declared positions on Adani stocks and criticised the regulator for not focusing its investigation into the January 2023 report "providing evidence" of the conglomerate creating "a vast network of offshore shell entities" and moving billions of dollars "surreptitiously" into and out of Adani public and private entities.

It said that while Sebi was seeking to claim jurisdiction over a US-based investor, the regulator's notice "conspicuously failed to name the party that has an actual tie to India: Kotak Bank," which created and oversaw the offshore fund structure used by Hindenburg's investor partner to bet against Adani.

The regulator "masked the "Kotak" name with the acronym "KMIL", it added.

KMIL refers to Kotak Mahindra Investments Ltd, the asset management company.