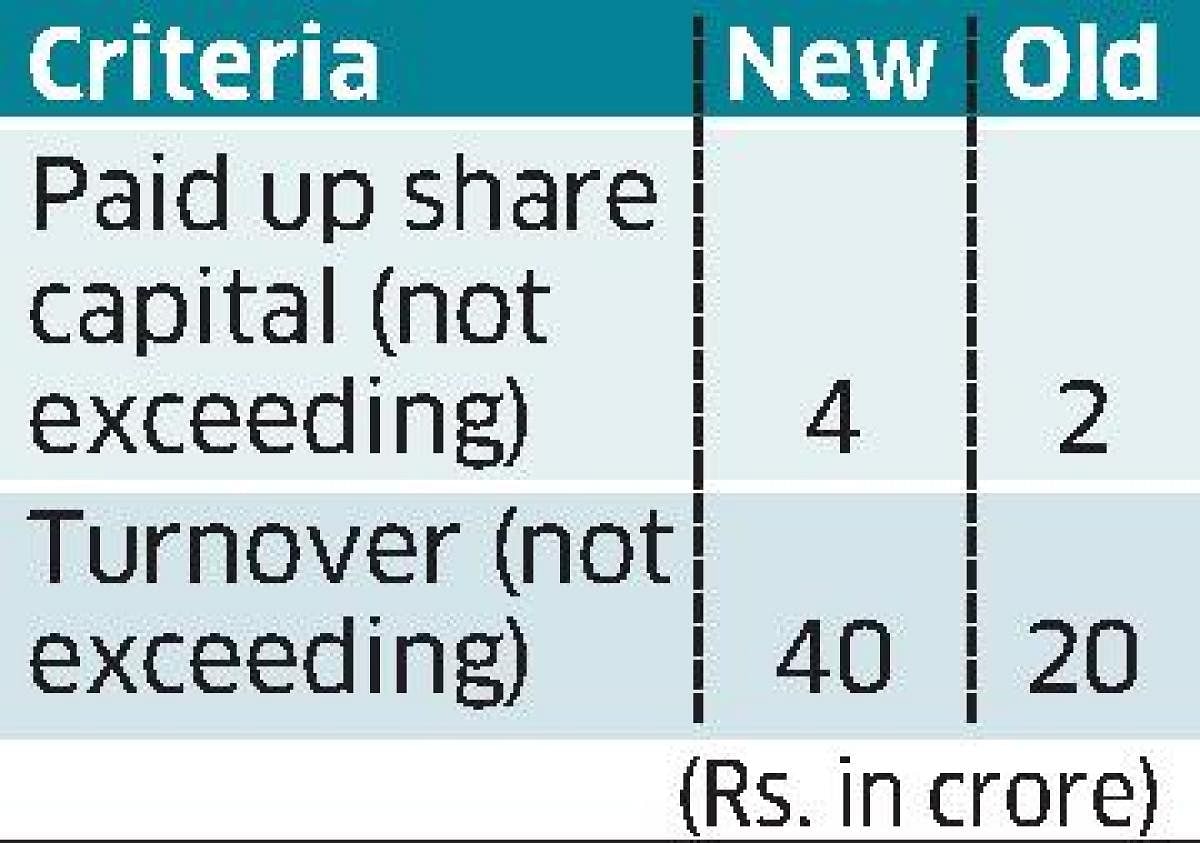

In furtherance of government’s commitment towards ease of doing business the Ministry of Corporate Affairs has yet again revised the threshold limit for classification as “small companies”. The cut off limits up to which an entity can be considered as small have been doubled in comparison to the earlier revision which was made during the Union Budget 2021 announcement. The revised limits and their earlier threshold have been tabulated below for ready reference:

As a result of the above change many more companies would now be covered under the definition and would be able to avail the benefit of the relaxations in financial reporting, etc. Some of the areas where small companies enjoy relaxation are:

1) Preparation of cashflow as a part of financial statements would not be applicable.

2) Such companies can file an abridged version of their annual return.

3) An auditor of a small company would not be required to report on:

a. Adequacy of internal financial controls over financial reporting and its operating effectiveness. This would substantially reduce the documentation and compliance burden.

b. Companies (Auditors Report) Order, 2020 (commonly known as CARO report). This contains 21 clauses with multiple sub-clauses on which the auditor of the Company needs to provide

information and comments.

4) Such companies would be required to hold only 2 board meetings as against the minimum requirement of 4 meetings in a year.

5) Lower penalties are prescribed for small companies.

This is a welcome change which is expected to benefit a large number of companies including start-up ventures.

(Prashant Daftary is Partner and Kapil Joshi is Assistant Manager (Audit & Assurance Department) at N.A. Shah Associates)