Over 20,000 depositors of debt-ridden Punjab and Maharashtra Co-operative (PMC) Bank with over Rs 15 lakh in savings were disheartened as the draft amalgamation scheme with Unity Small Finance Bank (SFB) stipulates the return of their money only after 10 years.

The draft scheme of amalgamation by the Reserve Bank of India (RBI) envisages the takeover of the assets and liabilities of PMC Bank, including deposits, by USFB, thus giving a greater degree of protection for the depositors.

If the scheme is approved, retail investors with up to Rs 5 lakh in savings will get their funds instantly from the Deposit Insurance and Credit Guarantee Corporation (DICGC), which is nearly 96 per cent of the depositors, according to a report by the Business Standard. The bank will have to shell out around Rs 3,100 crore to 880,000 depositors instantly from DICGC.

If you have deposits of less than Rs 10 lakh, most of the money will be recovered within four years. And if you have up to 15 lakh deposits, you will be able to recover the funds in five years. However, customers with over Rs 15 lakh deposits will be able to recover the full amount only in ten years.

The disbursal break up is as follows: After the first release of Rs 5 lakh from the DICGC, retail depositors will be permitted to withdraw additional amounts in a phased manner — Rs 50,000 at the end of two years; Rs 1 lakh at the end of three years, Rs 3 lakh at the end of four years and Rs 5.5 lakh at the end of five years.

The report added that the bank has 924,345 depositors, of which, 20,645 have deposits of more than Rs 10 lakh to the tune of Rs 7,126 crore. This is 60 per cent of the bank’s total deposits worth Rs 11,800 crore.

The suggestions and objections to the draft scheme can be sent to the Reserve Bank till 5 PM on December 10, 2021. The Reserve Bank will take a final view thereafter. On and from the appointed date, the undertaking of the PMC Bank will stand transferred to, and vest in the Unity Small Finance Bank, the RBI said.

In November 2020, PMC Bank had invited expression of interest (EoI) from potential investors for investment or equity participation in the bank for its reconstruction. As per the EoI, bank's total deposits stood at Rs 10,727.12 crore and advances at Rs 4,472.78 crore as of March 31, 2020. Gross NPAs stood at Rs 3,518.89 crore as of March-end.

PMC's exposure to Housing Development and Infrastructure Limited (HDIL) was over Rs 6,500 crore or 73 per cent of its total loan book size of Rs 8,880 crore as of September 19, 2019.

After putting restrictions on the bank, the RBI had initially allowed depositors to withdraw Rs 1,000 which was later raised to Rs 1 lakh per account.

The draft said that in respect of every savings bank account, current account, or any other deposit account with the PMC Bank, the Unity Small Finance Bank shall open with itself a corresponding and similar account in the name of the respective holders crediting full amount including interest accrued till March 31, 2021.

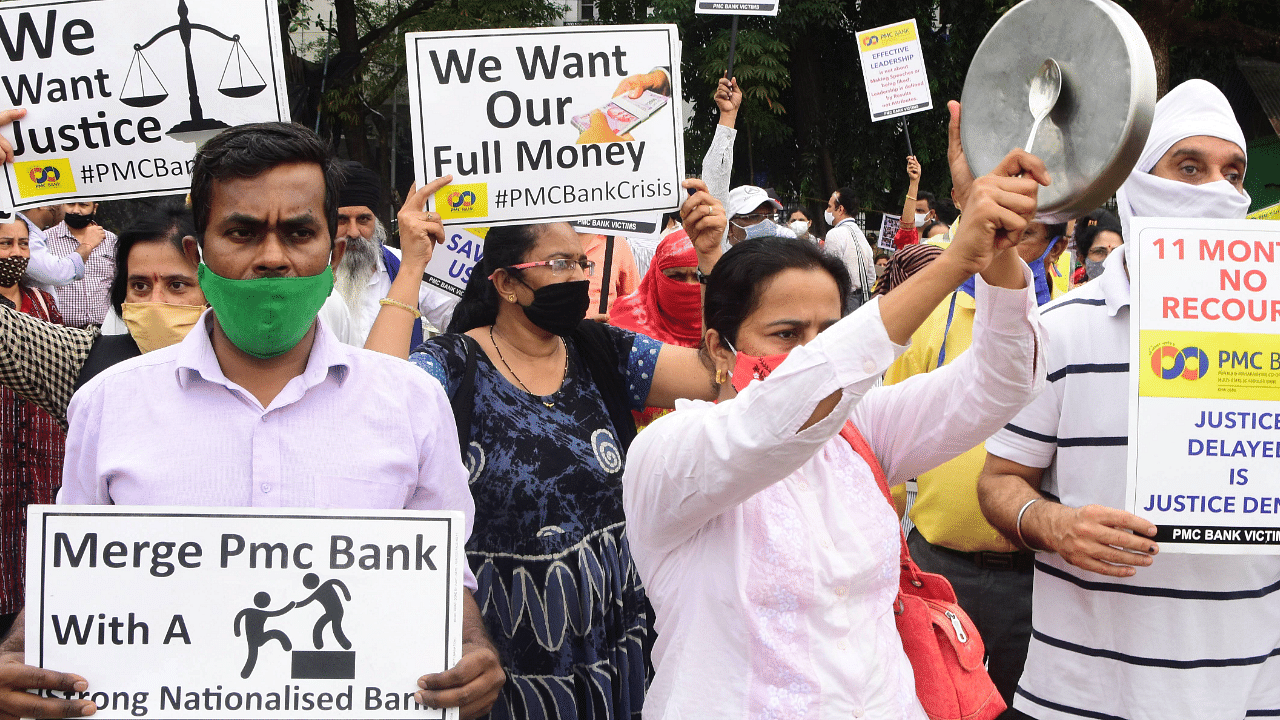

Depositors of the multi-state urban cooperative bank, PMC Bank, had held several protests at different offices of the RBI demanding their money back.

(With agency inputs)

Check out DH's latest videos