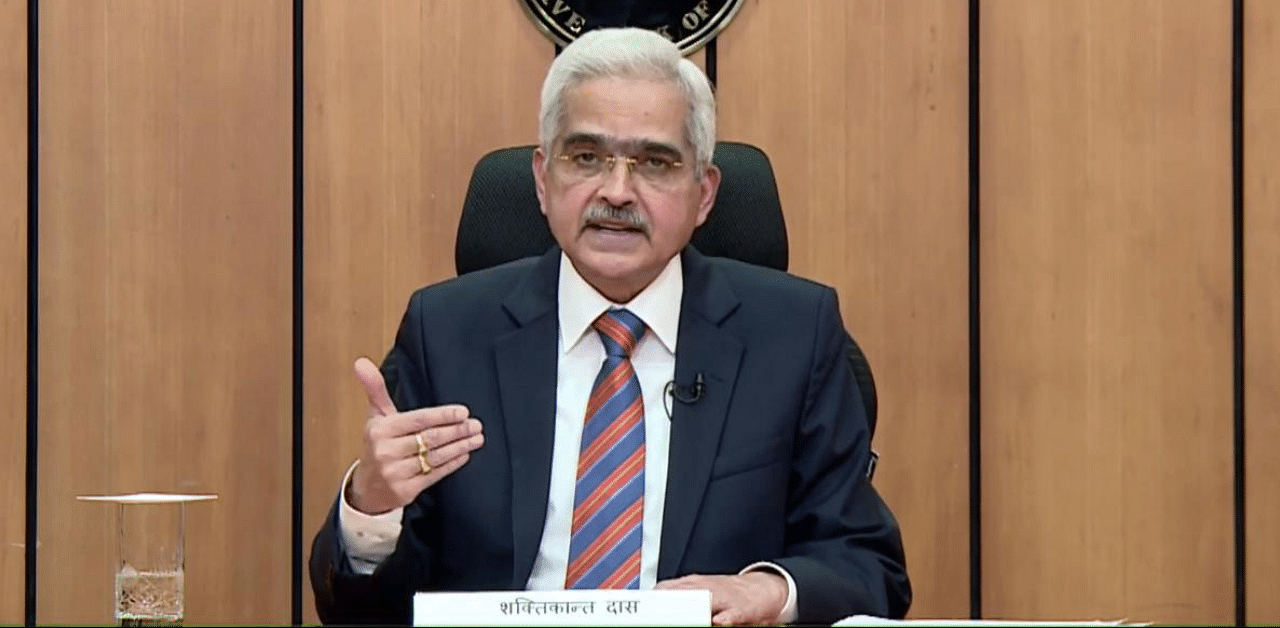

The Reserve Bank of India (RBI) has deepened its supervision and is making an assessment of the true state of non-performing assets (NPA) in all banks, its Governor Shaktikanta Das on Friday.

As part of its regular supervision, the RBI does an independent assessment to get clear pictures of bad loans in banks, he said.

Replying to a question on whether the RBI will go for an asset quality review (AQR), as suggested by the Economic Survey 2020-21, the governor said the central bank's supervision exercise is already doing what an AQR requires.

"As part of our supervisory process, we are doing a deep dive. We are making our own assessment of the true state of NPAs in each of the banks and have a sense of the overall situation.

"So, we are exactly doing what an AQR needs to do and that's already happening as part of our supervision," Das told reporters after the monetary policy announcement.

In the context of non-banking financial companies (NBFCs), the RBI two years ago had said that its supervision is doing a deep dive to get a clear picture about the true state of affairs with regard to their non-performing assets, he said.

The Economic Survey 2021 has called for an AQR for banks after the Covid-19-related forbearance is removed.

Read: RBI will manage high govt borrowing in FY22 non-disruptively: Governor Shaktikanta Das

It said forbearance represents emergency medicine that should be discontinued at the first opportunity when the economy exhibits recovery, not a staple diet that gets continued for years, the Survey said.

According to the Financial Stability Report (FSR) released by the RBI last month, under the baseline stress scenario, gross non-performing assets (GNPAs) of all banks may rise to a 22 years high of 13.5 per cent by September 2021, from 7.5 per cent in September 2020.

Das further said the RBI is collecting data from various banks with regard to the size of individual stress and the kind of NPAs in all banks.

The central bank is also taking it up with banks to make provisions proactively, he said.

"I am happy to note that many banks have proactively made provisions in anticipation of higher NPAs," he said. It is a positive development in the sense that there is a wide realisation in the banking sector that they need to provide adequately for the build-up of stress, he added.

The governor said the RBI is constantly monitoring the impact of the standstill which is there on asset classification and the coronavirus-related resolution framework.

"All these data are flowing into us on a daily basis. So, we will have a clearer picture as we move ahead," he said.

When asked about the structure of the asset reconstruction company and an asset management company (AMC) announced in the Union Budget 221-22, the governor said the formal proposal from the government is yet to come.

"We will examine the proposal when it comes and take a view on it. Unless the formal proposal comes to us it would not be correct to make any pre-mature comment on it," he added.