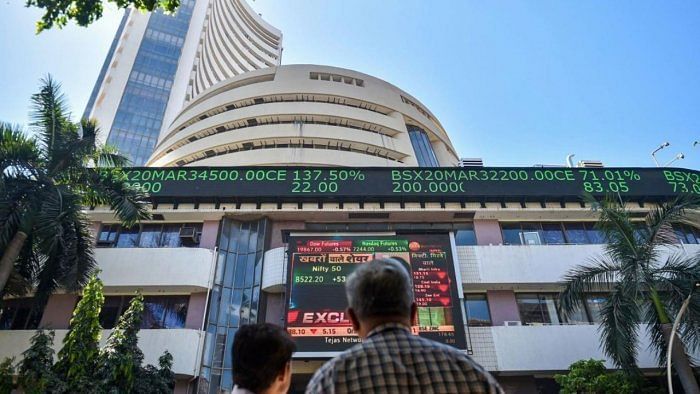

Equity benchmark indices Sensex and Nifty fell in early trade on Friday amid weak trends in global markets and as investors preferred to stay on the sidelines ahead of the release of domestic inflation data.

The 30-share BSE Sensex fell 244.01 points to 61,660.51. The NSE Nifty declined 77.95 points to 18,219.05.

Among the Sensex firms, Larsen & Toubro, Tata Steel, Infosys, Asian Paints, Power Grid, Bajaj Finserv, IndusInd Bank and ITC were the major laggards.

Mahindra & Mahindra, Tata Motors, Axis Bank and Titan were among the gainers.

In Asia, Seoul, Shanghai and Hong Kong markets were trading lower, while Tokyo quoted in the green.

The US market ended mostly in the negative territory on Thursday.

"Markets may falter in early trade on the back of weakness in other Asian indices after the US markets shed ground overnight. Profit-booking is likely to be the preferred theme, as the advantage of softer US CPI and PPI optimism is seen fading, with Chinese growth concerns also weighing on the sentiment," said Prashanth Tapse, Senior VP (Research), Mehta Equities Ltd.

The domestic inflation data for the month of April and industrial production for March is scheduled to be announced later in the day.

Meanwhile, global oil benchmark Brent crude declined 0.45 per cent to $74.59 per barrel.

Foreign Institutional Investors (FIIs) were net buyers on Thursday as they bought equities worth Rs 837.21 crore, according to exchange data.

The BSE benchmark had declined 35.68 points or 0.06 per cent to settle at 61,904.52 on Thursday. The Nifty dipped 18.10 points or 0.10 per cent to end at 18,297.