Sensex closes over 848 pts, Nifty above 17,500

Budget 2022: India loosens purse strings to propel post-pandemic recovery

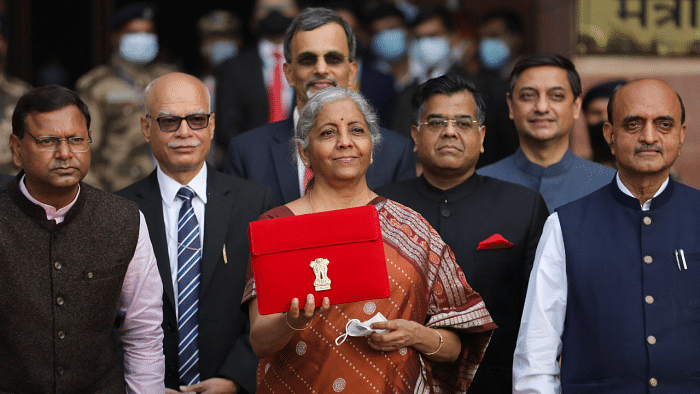

Armed with better-than-expected revenues, Finance Minister Nirmala Sitharaman presented a capital expenditure-led Budget aimed at reviving the Covid-hit economy and creating more jobs over the next 25 years.

Sometimes boring is good- From a market, investor/trader standpoint nothing has changed so this will largely play out as a non-event for the stock markets. It is a positive step to see that this budget will take steps to regulate virtual currency. While how this will be implemented will determine if establishing a CBDC will result in less expensive currency management and a boost to the economy as a whole:Nikhil Kamath, Co-founder, True Beacon and Zerodha

Rupee reverses gains, trading 22 paise lower at 74.87 post Budget speech

The rupee pared its initial gains and was trading 22 paise lower at 74.87 against the US dollar on Tuesday, even as the domestic equity market was trading with significant gains.

Investors were cautious after Finance Minister Nirmala Sitharaman on Tuesday said that the fiscal deficit in 2021-22 will be 6.9 per cent of GDP and 6.4 per cent in 2022-23, forex traders said.

Moreover, elevated crude oil prices and firm American currency weighed on investor sentiments.

IT, metal, FMCG stocks gain after Sitharaman's Budget speech

Markets weretrading in the positive territory supported by the metal, IT, FMCG and capital goods stocks.

The Sensex was up 738.11 points or 1.27% at 58752.28, and the Nifty was up 207 points or 1.19% at 17546.80.

Top gainers and losers on Nifty 50

Budget growth-inducing: HDFC Securities' Dhiraj Relli

The focus on boosting manufacturing as well as an underlined emphasis on areas such as startups, modern mobility and clean energy shows the Finance Minister has prioritised long-term growth. Individual taxpayers may feel a bit disappointed with the lack of direct tax cuts but this Budget lays the ground for a multi-year growth boom. The FY23 fiscal deficit has come in higher than expectations. Let’s hope the interest rates and inflation do not remain high for long:HDFC Securities' Dhiraj Relli

Indices trade higher amid volatility

Benchmark indices were trading higher amid volatility with Nifty above 17400.

The Sensex was up 415.78 points or 0.72% at 58429.95, and the Nifty was up 105.80 points or 0.61% at 17445.60. About 1409 shares have advanced, 1699 shares declined, and 76 shares are unchanged.

Benchmark indices give up today's gains after Budget announcements; Sensex at 200 pts, Nifty below 17.5K

Key takeaways from FM Nirmala Sitharaman's Union Budget speech

Finance Minister Nirmala Sitharaman on Tuesday presented the Union Budget 2022, the blueprint for 'amrit kal' of the next 25 years, in Parliament, ahead of elections in five states.

Read More

Sensex surges 900 points; Nifty at 17.5K as FM announces Budget 2022

Meanwhile, here are the top gainers and losers on BSE Sensex

double digit tax hike expected for cigarettes: Edelweiss Securities

We see a high probability of double-digit tax hike for cigarettes given last increase happened 2 years back. With high inflation in every product, no hike or single-digit hike in cigarette taxes looks unlikely to us.

Any increase beyond 15% will be seen as significantly negative, 10-12% will be seen as a mild negative and single-digit or no hike will be seen as a positive by the market.

Infrastructure stocks rise after FM announces slew of measures for road connectivity

IRB Infrastructure, Ashoka Buildcon and Dilip Buildcon shares were up four percent in late morning deals. L&T was up nearly one percent.

Road construction stocks in focus

Shares of road construction companies rose sharply on February 1 after the Finance Minister Nirmala Sitharaman said that the network of national highways in the country will grow by 25,000 km in 2022-23.

Alembic Pharma gets US regulator's nod for anti-bacterial drug

Top gainers and losers on Nifty

Finance Minister Nirmala Sitharaman begins Budget 2022 speech in Parliament

SBI becomes 3rd largest BFI unit by mcap, overtakes HDFC

Union Cabinet approves the Budget 2022

Union Cabinet approves the Budget 2022;the meeting underway at the Parliament has now concluded. Union Finance Minister Nirmala Sitharaman will present the Budget shortly.

Top gainers and losers on BSE Sensex at 10:30 am

Indian rupee opens 12 paise higher at 74.50 per US dollar

Indian rupee opened 12 paise higher at 74.50 per dollar on Tuesday against Monday's close of 74.62.

The US dollar slipped 0.40% on Monday on the back of a rise in risk appetite in the global markets and decline in US treasury yields. However, a sharp downside was prevented on better than expected macroeconomic data from the US, said ICICI Direct.

Sun Pharma near day's high

Sun Pharmaceutical Industries shares were near the day's high. The stock was up3.6 per cent at Rs 864.3 apiece on BSE at 10:10 am.

FM Sitharaman arrives at Parliament, to present Budget at 11 am

For latest updates on FM Sitharaman's Budget presentation, click here

Nifty Bank up 1.9%; IndusInd Bank, ICICI Bank lead

Motilal Oswal's on Sun Pharmaceutical Industries

We maintain our earnings estimate for FY22E/FY23E/FY24E. We continue to value SUNP at 25x 12-month forward earnings to arrive at a target price of Rs 1,000/share.

We expect a 13% earnings CAGR over FY22-24E, led by 17% sales CAGR in the US and 12% sales CAGR in emerging/RoW markets, supported by 100bp margin expansion.

Budget is likely to give more relief for the stressed MSME segment: VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services

"The Economic Survey's GDP growth projectionfor FY23 reflects good growth momentum in the economy, which needs to be sustained. Its confident message that there is enough fiscal room forcapexindicates that the government is likely to give a further push to infra spending in the Budget. Since growth is not widespread, the Budget is likely to give more relief for the stressedMSMEsegment,"VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services told CNBC TV18.

Sensex zooms 600 points at early trade

Top gainers on Nifty 50:

Gainers and losers on BSE Sensex: All stocks except Dr Reddy's trading in green

Sensex opens 500 points higher, Nifty above 17.5k

Indices opened in green.The Sensex was up 544.97 points or 0.94% at 58559.14, and the Nifty was up 145.70 points or 0.84% at 17485.50. About 1510 shares have advanced, 473 shares declined, and 65 shares are unchanged.

Sensex up 677 pts, Nifty near 17.5K in pre-open with Budget in focus

Financial markets in China, Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, South Korea and Taiwan are closed on Tuesday for public holiday.

How markets reacted to Budgets in the past

Every year, when the incumbent Union Finance Minister presents the annual Budget for the forthcoming fiscal, the stock markets have reacted with varying degrees of volatility as investors try to make sense of all the announcements made and their implication for the next year. The benchmark indices -- BSE Sensex and NSE Nifty -- have broadly reacted negatively to the Budget presentations since 2009. Last year, however,the markets cheered a growth-oriented Union Budget presented by Finance Minister Nirmala Sitharaman.

Oil prices edged higher on Tuesday, trading near seven-year highs hit last week, as investors bet supplies will stay tight, with a limited production hike by major oil producers and a strong post-pandemic recovery in fuel demand.

Brent crude for April delivery was up 14 cents, or 0.2% at $89.40 a barrel at 0150 GMT.

The front-month contract for March delivery expired on Monday at $91.21 a barrel, up 1.3%.