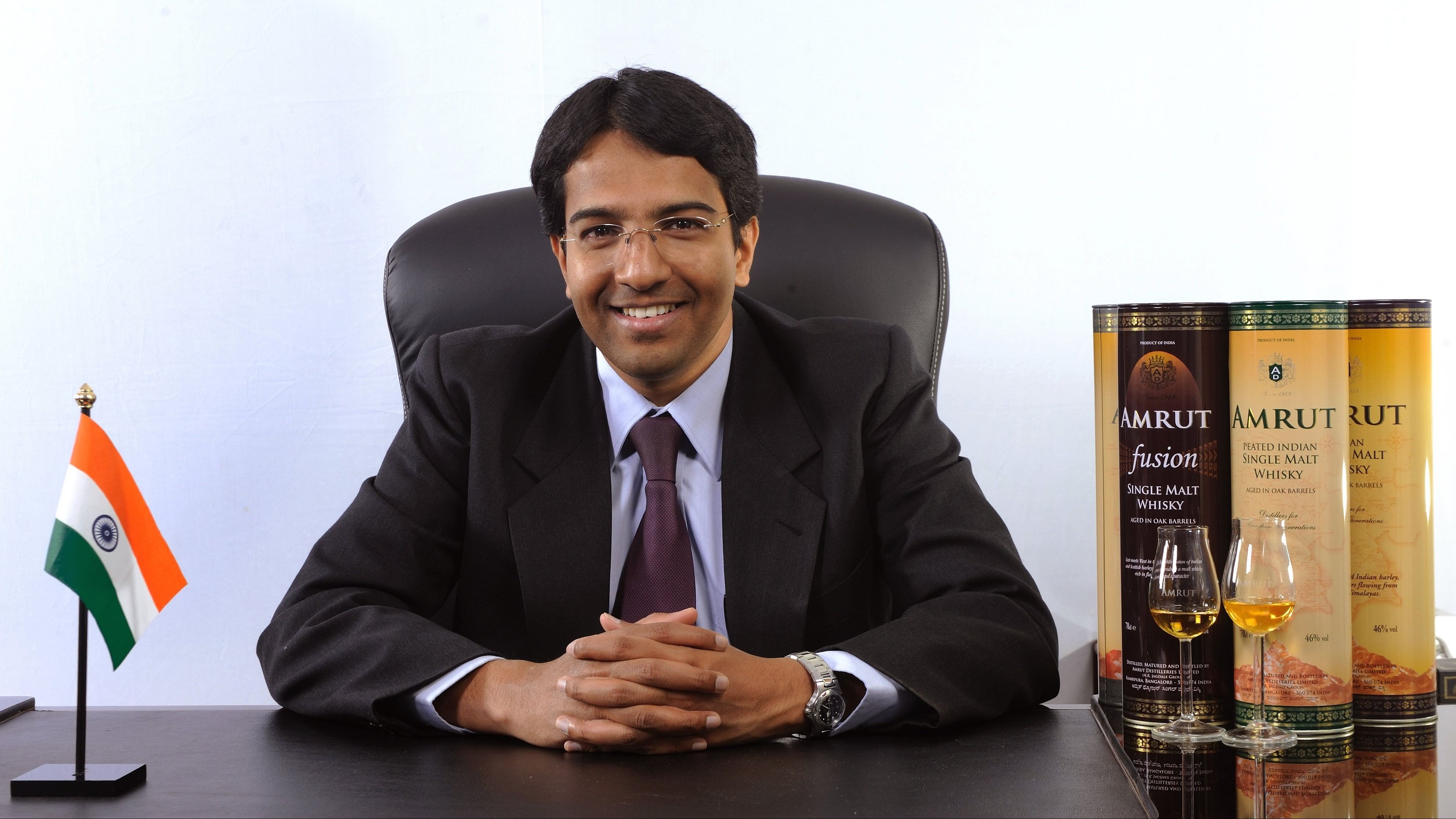

Credit: By Special Arrangement

Bengaluru: India tipplers are acquiring a taste from home-grown single malt whisky. As data tabled by the Confederation of Indian Alcoholic Beverage Companies (CIABC) show, in 2023 the Indian brands actually overtook the more popular international names such as Glenlivet, Macallan, Lagavulin and Talisker, claiming 53% market share. Speaking to DH’s Sonal Choudhary, Rakshit Jagdale, managing director of Amrut Distilleries, one of the leading domestic producers of whisky, talked of the overwhelming demand pushing them to expand capacity and being relatively at ease with Free Trade Agreements channeling in more international competition and the growing fancy for premium products.

How close are you to your targeted turnover of Rs 500 crore? Where are most of your sales coming from?

As of now, we are headed for going closer to around Rs 415 - 420 crores this year, in net sales and 25% of that will come from the luxury division. When I say luxury division, it includes our range of single malt and pure malt whiskeys and its series. The split for the luxury division is 60 & 40, with 60% coming from India and the rest from overseas. Our demand is in excess, for which we will be increasing our distillation capacity this October by another 30%.

What is your outlook on the premiumisation of the spirits market in India?

I think the premium spirits market in India is growing, especially in the past 6-7 years. I think it's a booming trend, probably because disposable incomes have gone up and people are conscious of what they drink. They want to drink better quality and less quantity. So I think premiumisation is happening, and it has become a status symbol and it will continue going forward.

How many cases do you expect to sell this year, both in India and globally?

As far as single malt is concerned, I think we'll be doing close to about 65,000 cases. Out of the total number, we expect to sell 30,000 cases globally and 2,00,000 in India, in the luxury segment.

Does the prospective India-UK FTA worry you?

I think we will witness the price of single malts dropping and volumes will pick up. I'm not saying that it will impact us negatively, because now consumers are able to compare both Scottish and Indian single malts and we are second to none, on the quality front. In terms of competition, we cannot match them on the advertising scale but we are happy with what we are able to offer to the Indian consumer. And I think the quality will stand and speak for itself going forward.

How is the demand in tier-2 and tier-3 cities?

While the demand for tier-2 and tier-3 cities is increasing, however tier-1 is leading, bagging a market share of about 85%.

Do you see an absence of stringent qualitative benchmarks in India as compared to the Scottish counterparts?

I don't agree with that. I think production standards have changed significantly in India. Consumers are more quality conscious and every distillery in India has strict protocols under Food Safety and Standards Authority of India (FSSAI). This has pushed us to invest in the operation and the production side. I think we have come a long way in the Indian alcohol and breweries space and easing of government regulations would help us to be at par with our counterparts.

Are there new launches or innovations in the pipeline?

We are planning a couple of special releases by the end of this year or January 2025 in the whiskey segment - it is still in progress. However, one of our major innovations is the single jaggery rum in the premium segment which will be launched in September in Karnataka.