By Saritha Rai and Ben Bartenstein

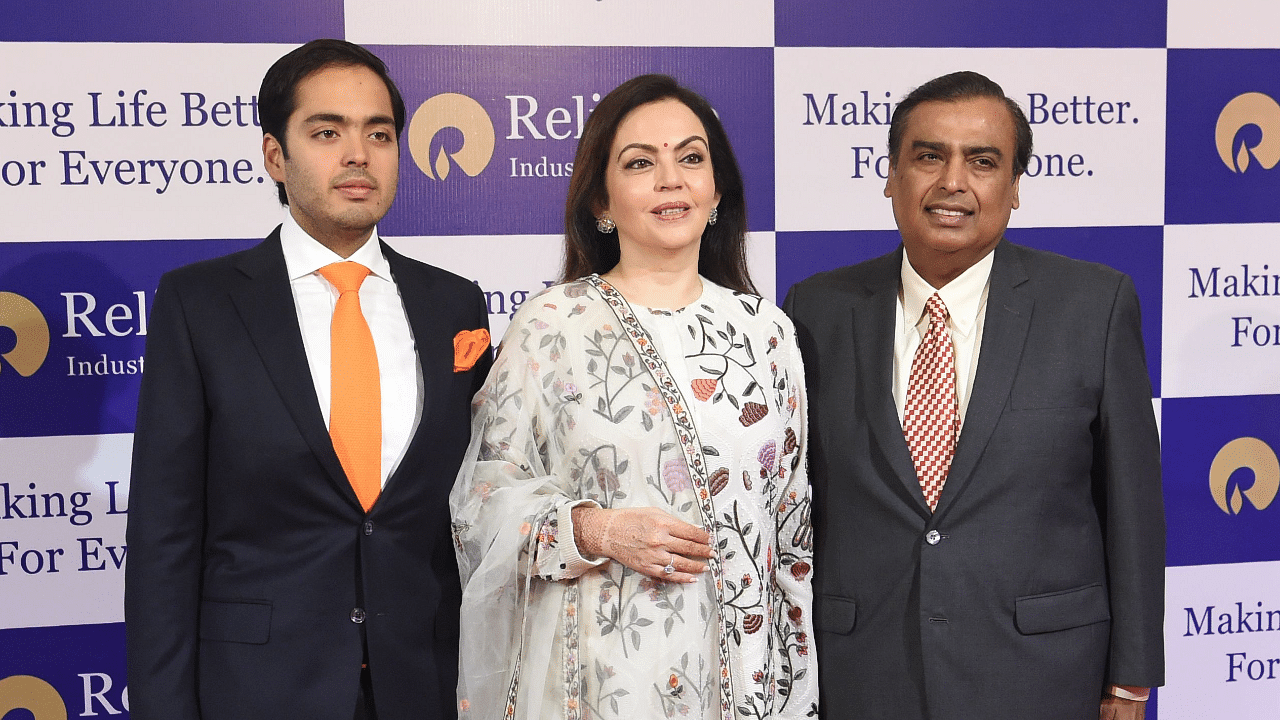

Mukesh Ambani’s Reliance Industries Ltd. is the mystery buyer of an $80 million beach-side villa in Dubai, the city’s biggest ever residential property deal, two people familiar with the deal said.

The property on Palm Jumeirah was purchased earlier this year for Ambani’s youngest son, Anant, one of the people said, asking not to be named as the transaction is private. The beach-side mansion sits in the northern part of the palm-shaped artificial archipelago and has 10 bedrooms, a private spa, and indoor and outdoor pools, local media reported without saying who the buyer is.

Dubai is emerging as a favorite market for the ultra-rich, whom the government has actively courted by offering long-term “golden visas” and relaxing curbs on home ownership for foreigners. British footballer David Beckham with his wife Victoria and Bollywood mega star Shah Rukh Khan will be some of Ambani’s new neighbors.

Anant is one of three heirs to Ambani’s $93.3 billion fortune, according to the Bloomberg Billionaires Index. The world’s 11th richest person, now 65-years-old, is slowly handing the reins to his children after a diversification push that expanded his empire into green energy, tech and e-commerce.

The family has been increasing its real estate footprint overseas, with all three siblings looking Westward for second homes, one of the people said. Last year, Reliance spent $79 million to buy Stoke Park Ltd. in the UK, which houses a Georgian-era mansion said to be for older son Akash, who was recently named chairman of telecom operator Reliance Jio Infocomm Ltd. His twin sister, Isha, is scouting for a home in New York, the person added.

The Dubai property deal has been covert and will be held by one of Reliance’s offshore entities, said one of the people, adding that the Ambanis will spend millions of dollars to customize it and ensure its security. Longtime Ambani associate Parimal Nathwani, a director of corporate affairs at the group and member of parliament, will manage the villa.

The Ambanis’ primary residence will remain Antilia, a 27-story skyscraper in Mumbai with three helipads, parking for 168 cars, a 50-seat movie theater, a grand ballroom and nine elevators.

Reliance did not respond to emails and calls seeking comment.

In addition to luxury homes, Palm Jumeirah’s string of islands comprises posh hotels, glitzy clubs, spas, restaurants and splashy apartment towers with breathtaking views of the Persian Gulf’s blue waters. Its construction began in 2001, with the first residents moving in around 2007.

Dubai’s property market, which contributes around a third of its economy, is recovering from a seven-year slump thanks to the city’s nimble handling of the Covid-19 pandemic and initiatives aimed at giving expatriates a bigger stake in the economy. Under new rules, investors can obtain a 10-year visa if they buy property worth at least 2 million dirhams.

Foreign residents make up more than 80% of the population of the United Arab Emirates and have been a mainstay of the economy for decades, doing mostly private-sector jobs and spending their money on property or shopping in some of the world’s largest malls. Indians, in particular, have consistently ranked among the top buyers of Dubai real estate.

The global property market has been on fire lately. Swiss billionaire Ernesto Bertarelli was said to be buying a home in London’s exclusive Belgravia district for about £92 million ($108 million) in June, and the Financial Times reported earlier this month that an estate 20 miles west of London sold for £125 million.

In the US, Joe Tsai’s Blue Pool Capital recently acquired a New York penthouse previously owned by Dan Och for $188 million, while Asia’s most-expensive apartment per square foot sold in Hong Kong for HK$640 million ($82 million) in November.