By Debjit Chakraborty

Indian sales of diesel -- the lifeblood of the Asian giant’s economy -- appear to have fallen sharply last month as several provinces imposed small-scale lockdowns to curb record daily infection rates.

Diesel sales at India’s three biggest fuel retailers dropped 13% in July from the previous month and were down 21% year-on-year, according to preliminary data from officials with direct knowledge of the matter. It’s a stark reversal from the previous couple of months when rebounding sales of the fuel were heralded as evidence the economy was on the mend following the world’s biggest national lockdown.

While diesel demand typically falls at this time of the year due to the monsoon, the decline exceeds the 8% month-on-month drop at the same point last year.

Should Indian fuel demand weaken -- as the provisional data suggest -- the ability of the world’s third-biggest crude importer to buy as much feedstock will be thrown into question, just as the OPEC+ alliance starts to unwind its production cuts. It may also put more downward pressure on Asian diesel, which has just flipped into a contango market structure that indicates concerns about over-supply are increasing.

With around 1.75 million confirmed infections, India has the most virus cases after the U.S. and Brazil, and its Home Minister Amit Shah, a close aide of Prime Minister Narendra Modi, has just tested positive. Provincial and local governments have been imposing mini-lockdowns in recent weeks as the pandemic spreads from major cities into the hinterlands, while hikes in fuel taxes may have also curbed consumption.

Indian Oil Corp., the country’s biggest refiner, said on Friday that it had slashed throughput at its plants to 75% from 93% in the first week of July and that it doesn’t see activity increasing soon. That’s making Oil Minister’s Dharmendra Pradhan’s late-June prediction that fuel demand would be back to normal by the end of this quarter look increasingly unattainable.

“The number of lockdowns states are now announcing, that is taking its toll on the demand numbers,” Indian Oil Chairman Shrikant Madhav Vaidya said Friday. “One thing is sure, we aren’t going back to the normal times at least in the near future.”

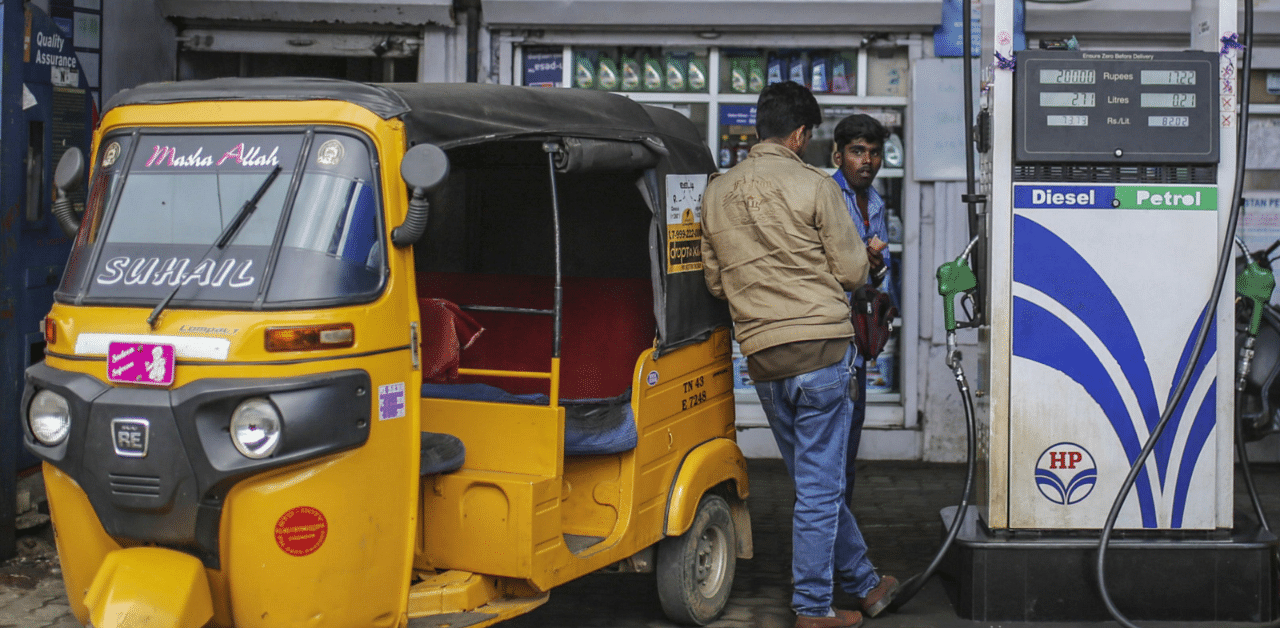

Gasoline sales at the three retailers -- Indian Oil, Bharat Petroleum Corp. and Hindustan Petroleum Corp. -- declined 1% in July from a month earlier and were down 12% on a year-on-year basis, according to the officials. Aviation fuel sales rose 4% month-on-month while staying 65% lower than at the same time in 2019. Spokespeople at the three companies, which account for more than 90% of Indian fuel sales, couldn’t immediately comment on the provisional data.