Oil prices crossed $100 a barrel for the first time since 2014 and Indian equities tumbled 4.7% on Thursday after Russia launched missiles at several Ukrainian cities and the West threatened to impose more sanctions on Moscow.

The move came after the Russian military buildup near the Ukrainian border. Russian President Vladimir Putin unveiled plans of the military operation through a surprise address on television on Thursday. He asked the Ukrainian military to lay down arms and warned of strong retaliation against anyone who interfered.

“Tomorrow, I will be meeting with the Leaders of the G7, and the United States and our Allies and partners will be imposing severe sanctions on Russia. We will continue to provide support and assistance to Ukraine and the Ukrainian people,” US President Joe Biden tweeted after Russia’s attack on Ukraine.

The escalation of tensions in Eastern Europe made many investors across the globe move away from risky assets and seek refuge in safe havens such as gold.

The stakes are high as Russia is the largest exporter of natural gas and the second-largest oil producer in the world, while Ukraine is a crucial grain exporter. Also, the rise in oil prices came at a time when governments around the world struggled to tame inflation. India is the world’s third-largest importer of oil.

“Oil is on a boil as markets are jittery that the West will ramp up its sanctions on Russia that can restrain crude supplies in an already tight market,” said Sugandha Sachdeva, vice president of Commodity and Currency Research, Religare Broking.

The Ukraine crisis could push crude oil prices higher to touch as much as $110 a barrel, Sachdeva said, adding that the market was still hopeful of the prices stabilising at those levels because of the likelihood of a separate deal to remove the sanctions on Iranian oil sales that could increase global supply.

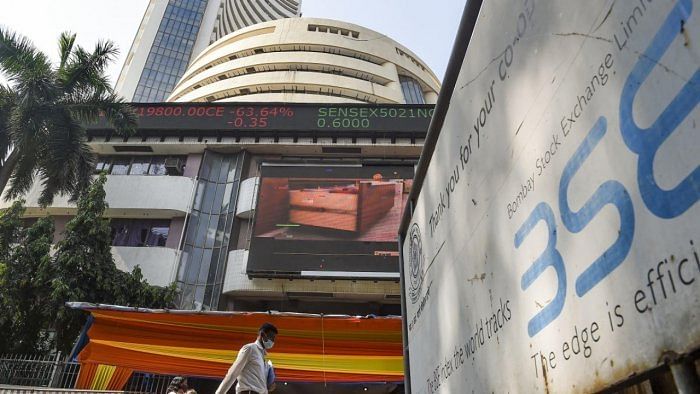

The escalating conflict’s potential risks to Russian energy exports made Brent oil touch $105.08 a barrel on Thursday, crossing the $100 threshold for the first time since September 2014, while gold hit its highest since early 2021. The S&P BSE Sensex fell 4.72% to close at 54,529.91, while the NSE Nifty 50 index closed down 4.78% at 16,247.95, marking their worst session since May 2020. The rupee fell 1.4%, the most since April 2021.

“Indian markets have not been immune to the same and have witnessed a massive selloff. This is a time when investors will be tested for their patience and discipline. Markets are choppy and will probably remain this way for some time,” said Nitasha Shankar, Head PRS Equity Research at Yes Securities.

Watch the latest DH Videos here: