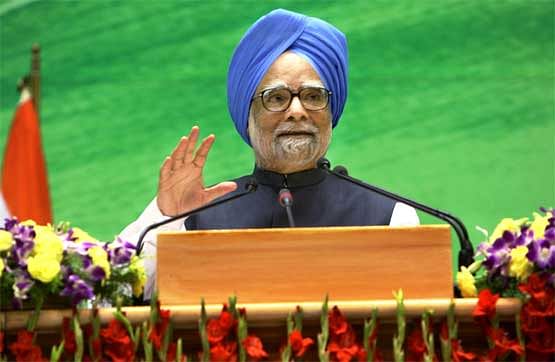

"Prices continue to be a matter of concern ... it is affecting the country's masses ... but I believe by December we can bring it down to 5 to 6 per cent," he told reporters at a national press conference to mark completion of one year of UPA-II in office.

Singh said the government has been monitoring inflation and has been taking measures to check the rising prices, particularly food products hit by poor monsoons last year.

"But for this (high inflation), international financial crisis and high prices of petroleum prices in global markets are to blame.

Besides, droughts and floods in some parts of the country last year also affected our economy as whole," Singh said.

Monsoon accounts for a bulk of rains India receives and nearly 66 per cent of the country's agriculture sector depends on rains for cultivation.

High food and fuel prices fuelled overall inflation to over 10 per cent in February and provisional numbers for April put it at 9.59 per cent.

"As a result of steps we have taken, there are signs of prices showing a moderating trend," Singh said.

"We are closely monitoring the situation and together with state governments take all steps to bring down prices and protect the vulnerable section of our society from the impact of high prices," Singh added.

Food inflation, which had shot above 20 per cent in December has since moderated but is still above 16 per cent.

Economy to expand by 8.5%

Manmohan Singh said the economy is expected to grow by 8.5 per cent this fiscal and the country was capable of achieving 10 per cent expansion in the medium term.

The forecast comes on top of an estimated 7.2 per cent growth in 2009-10, the year that saw India weather the effects of the global economic crisis.

"We need a rapidly growing economy to generate productive employment and also resources to finance our ambitious social and economic agenda," Singh said

Growth had slipped to 6.5 per cent in 2008-09 at the height of the economic crisis triggered by collapse of financial institutions in the West.

"Our medium term target is to achieve a growth rate of 10 per cent per annum. I am convinced that given our savings and investment rates, this is an achievable target," Singh, regarded as the architect of India's financial reforms, said.

India's savings and investment rate is nearly 35 per cent of GDP, next only to China's 49 per cent.

"However, its (high growth) achievement will require determined efforts to increase investment in social and economic infrastructure, enhance productivity in agriculture and give a fresh impetus to the manufacturing sector," the Prime Minister said.

"Our annual rate had averaged 9 per cent for four years before the crisis. It reduced to 6.5 per cent in 2008-09, but recovered to 7.2 per cent in 2009-10. We expect 8.5 per cent growth in this financial year," he said, noting that the first concern in the wake of the financial crisis was to protect the economy from the global slowdown.

This had prompted the government to deviate from fiscal prudence by way of stimulus measures (involving high borrowings to step up public spending and foregoing of revenue to boost manufacturing), leading to fiscal deficit shooting to over 6 per cent of GDP - a broad measure of a country's economic wealth.

In the Budget for 2010-11, the government partially withdrew the stimulus, saying economic recovery was strong.

"The record of our first year is a record of reasonable achievement," Singh said.