The Reserve Bank of India on Friday cut the policy repo rate by 40 basis points to 4% to help businesses and the public avail cheap loans from banks. It also extended the moratorium on loan repayments by three more months in view of the COVID-19 crisis and made the first official remarks on India’s economic growth in 2020-21, saying that it would remain in the negative territory for the most part of the financial year.

But along with the rate cut on loans, the interest rates on savings are also expected to come down.

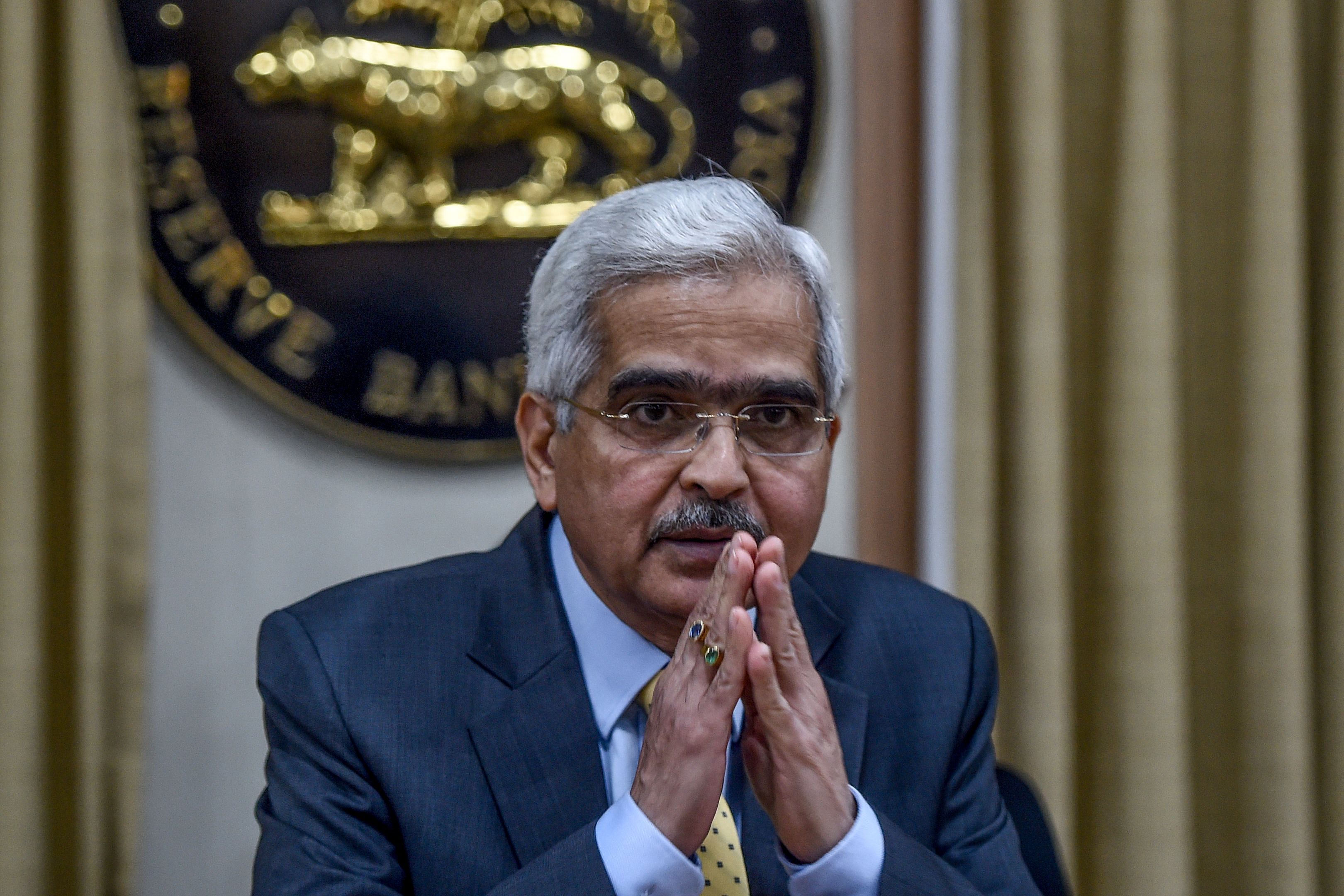

The monetary policy committee (MPC) voted 5:1 to reduce policy repo rate by 40 basis points, Das said while addressing his third press conference in the past two months.

"The MPC unanimously voted for a 40 basis points policy repo rate cut," Das said.

The Sensex fell 300 points to 30,626 and Nifty was down 100 points after the RBI's rate cut as the banks did not get any relief, said traders, who were also expecting a greater than 40 bps rate cut.

On his outlook for inflation, he said it was "highly uncertain" and said a timely intervention on the supply-side is important, lobbing the ball in the government’s court once again. The headline inflation is expected to fall below 4% in the second half, he said adding the MPC outlook on inflation is directional, rather than on levels.

“The pressure on food prices seen in the April data may persist for some time. Oil prices are likely to remain low. The elevated level of pulses inflation is worrisome, warrants swift supply-side action,” Das said, adding the high-frequency indicators point to collapse in demand.

“The biggest blow from COVID-19 has been to private consumption, which accounts for 60% of domestic demand," said Das.

While the governor extended bank loan moratorium to three months to August 31, he said the interest accumulated on a moratorium to be paid through 2020-21.