COVID-19 effect: RBI allows banks to defer EMIs on home, auto loans for 3 months

In a big relief to the common man, the Reserve Bank of India (RBI) has allowed banks to defer EMIs on the term loans, including housing, personal and auto loans for three months.

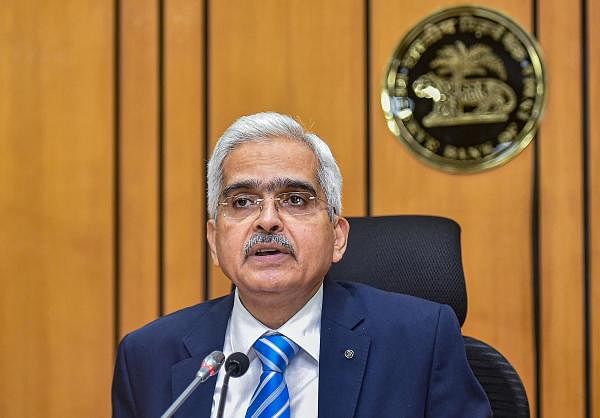

"All banks, lending institutions may allow a three-month moratorium on all the instalment on long-term loans," RBI Governor Shaktikanta Das.

With this, RBI Governor Shaktikanta Das'spress conference comes to an end.

In spite of the challenging environment, I remain optimistic, says Das. "This too shall pass," he adds.

India has locked down economic activity and financial markets are under severe stress. Finance is the lifeline of the economy, keeping it following is the paramount objective of the Reserve Bank of India at this point of time: Shaktikanta Das

RBI reduces CRR by 100 basis points to 3% of NDTL with effect from 28 March for a period of one year. This would release primary liquidity of Rs.1,37,000 crore across the banking system.

RBI allows deferring EMIs on long-term loans for next three months, says Das

All banks and shadow banks are being permitted to allow a moratorium of 3 months for repayment of instalments on term loans, says Das.

The need of the hour is to shield the domestic economy. All banks must ensure that credit flow is maintained, says Das.

RBI reduces the Cash Reserve Ratio by 100 bps to 3%. This will release Rs 1.37 lakh crore in the system, says Das.

This kind of uncertain outlook has never been seen before, says Das.

Government has taken timely and appropriate measures to contain intensity, spread and duration of coronavirus, says RBI Governor Shaktikanta Das.

Growth outlook highly uncertain, negative, says RBI Governor.

There are downside risks to growth from prolonged lockdown. Actual CPI outcomes are running 30 bps above our projection, says Das.

RBI Governor says outlook is now heavily contingent upon intensity, spread and duration of pandemic.

"We are living in an extraordinary and unprecedented situation. A war effort has to be mounted to combat the virus," says RBI Governor Shaktikanta Das.

As part of business continuity plan, RBI has quarantined 150 key people at office, says Das.

Average daily liquidity surplus of Indian banks during March has been Rs 3 lakh crore, says Das

RBI cuts repo rate by 75 bps to 4.4% from 5.15%. It cuts reverse repo rates by 90 basis points.

MPC has decided to prepone its meeting scheduled on March 31, says RBI Governor.

Governor Shaktikanta Das addresses media now

RBI Governor's press briefing to begin shortly

Watch RBI Governor’s address to the media live at 10:00 am here

Many largely expect the central bank to cut interest rates to help tide an already slowing economy threatened by the pandemic.

Indian stocks rise ahead of RBI governor address

Indian shares rose in early trade on Friday, a day after the government announced a relief package to help the poor cope with widespread disruptions from a coronavirus-triggered lockdown, as investors hoped for more stimulus measures from the country's central bank. (Reuters)

RBI Governor will be addressing the media at 10:00 am.

Good morning readers and welcome to our live coverage of RBI Governer Shaktikanta Das's press conference. Stay tuned for live updates.