That's all for today readers. Thank you for tuning in to our live coverage of RBI Governor's press address. For the latest news happenings, make sure you follow www.deccanherald.com.

RBI cuts repo rate by 40 bps, extends moratorium on loans by 3 months

The Reserve Bank of India Friday cut policy repo rate by 40 basis points to 4% to help businesses and public avail cheap loan by banks. It alsoextended the moratorium on loan repayments by three more months in view ofCOVID-19and made the first official remark on India’s economic growth in 2020-21, saying it will remain in the negative territory for the most part of the financial year.

Read the full report here

Markets in red after the RBI presser. Sensex is down 300 points.

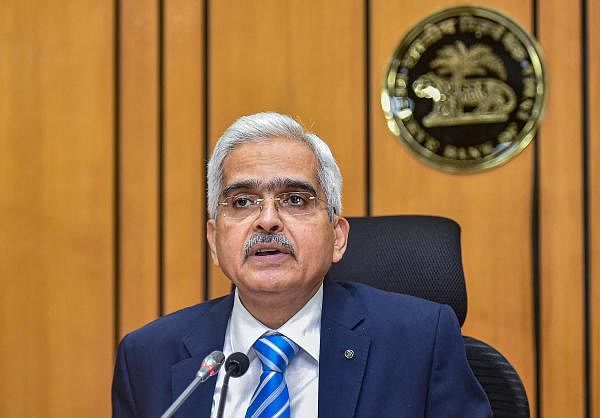

RBI is ready to use all its instruments to address the dynamics of an unknown future, says Shaktikanta Das. Today's trials will be traumatic but together we will triumph, says Das. With this, Das ends his address.

RBI extends moratorium on loan repayments by three more months in view of COVID-19, says Governor

Group exposure limit of banks will be increased from 25% to 30%, says Das.

Term loan moratorium extended till August 31

The loan moratorium will be extended till August 31, says RBI governor Shaktikanta Das. This makes it a six-month moratorium. He added that the lending institutions are being permitted to restore the margins for working capital to the origin level by March 31, 2021.

Measures announced today can be divided into fourcategories: to improve the functioning of markets, to support exports and imports, to ease financial stress by giving relief on debt servicing and better access to working capital and to ease financial constraints faced by state governments, says Das.

RBI increases export credit period to 15 months from 1 year: Governor Das

GDP growth in 2020-21 to be in negative territory: RBI Governor.

Liquidity Facility for EXIM Bank: RBI to extend Rs 15,000 crore line of credit for 90 days to avail USD swap facility, says Das.

Inflation outlook highly uncertain; an elevated level of inflation in pulses worrisome, requires a review of import duties: RBI Governor

RBI has decided to roll over the facility of Rs 15,000 crore for another 90 days in SIDBI, says Das.

Monetary policy transmission has improved, says RBI governor Shaktikanta Das. He added that an improvement in passing on a lower rate to borrowers has been noticed across various business segments.

If the inflation trajectory evolves as per the expectation, RBI governor Shaktikanta Das said that some room will open to look at risks to growth and take measures.

Private consumption has seen the biggest blow due to COVID-19 outbreak, investment demand has halted: RBI Governor Das

RBI cuts reverse repo rate to 3.35%; to maintain accommodative stance: Governor Shaktikanta Das

MPC is of the view that headline inflation in first half of 2020 will be stay intact but by Q3 and Q4 it may fall below the target of 4 percent, said the RBI Governor.

RBI Governor says India seeing a collapse of demand; electricity, dip in petroleum product consumption; fall in private consumption.

Domestic economic activity has been impacted severely. High-frequency indicators point to demand in collapse both in urban and rural areas, says Das.Industrial production shrank by 17% in March. The manufacturing PMI in April recorded the sharpest deterioration to 27.4% , he added.

NPC voted with a 5:1 majority for the repo rate cut by 40 basis points from 4.4 % to 4%. Reverse repo rate stands reduced to 3.35%: Reserve Bank of India (RBI) Governor Shaktikanta Das

Agriculture and allied activities have given a beacon of hope for the country, said the RBI Governor. A ray of hope is also brought in from the normal south-west monsoons this year, added Shaktikanta Das.

RBI Governor says maintaining an accommodative stance till growth revives.

The biggest blow from COVID-19 came from private consumption slump with consumer durables production falling 33 percent in March 2020, says RBI governor Shaktikanta Das.

There is a collapse in demand in both urban and rural demand since March 2020, says Shaktikanta Das. This, he said, has taken a toll on fiscal revenues.

RBI advances monetary policy committee meeting.

The repo rate has been cut by 40 basis points from 4.4 % to 4%. Reverse repo rate stands reduced to 3.35%, says Governor Shaktikanta Das.

Shaktikanta Das announces repo rate cut of 40 bps

COVID-19 has crippled the global economy, says Shaktikanta Das.

Watch RBI Governor Shaktikanta Das media address LIVE here:

Coronavirus: RBI may ease bad loan norms to boost COVID-19-ravaged economy

A moratorium on loan repayments by banks for another three months to August 31, easing of bad loan recognition norms to 180 days from the current 90 days and a one-time restructuring of loans as relief measures to help the COVID-19-ravaged economy could be some of the steps the RBI may announce when Governor Shaktikanta Das addresses the press at 10 am.

The Governor’s meeting with a host of economists in the past week had given rise to the speculation that the policy rate cut could be in the offing. Das may also announce a deeper than 75 bps cut in the reverse repo to further discourage banks from parking their extra cashback with the RBI.

At present, the RBI absorbs excess money within the banking system through the reverse repo mechanism but under this system, banks get government securities in return when they give excess cash to the RBI. An interest rate of reverse repo rate is also provided to banks.

Standing Deposit Facility or SDF could be one of the measures that the RBI has been mulling over for a long time.

What is SDF?

SDF is a collateral-free liquidity absorption mechanism that aims to absorb liquidity from the commercial banking system into the RBI without giving government securities in return to the banks.

In the wake of banks parking more and more surplus fund with the RBI than lending to businesses in the risk-averse environment, the economists are also hoping the Governor could announce certain liquidity management tools that discourage banks from parking such a huge amount with the RBI.

With the lockdown lifting in stages, the Governor is expected to make policy interest rates cheaper to help businesses invest and people spur their discretionary spending. The repo rate, or the rate at which RBI lends to banks, now stands at 4.40%. The street is expecting a further 50 basis points cut in the repo rate.

The buzz is also that the Governor Shaktikanta Das may advance the monetary policy review, which is due on June 6.

A moratorium on loan repayments by banks for another three months to August 31, easing of bad loan recognition norms to 180 days from the current 90 days and a one-time restructuring of loans as relief measures to help the COVID-19-ravaged economy could be some of the steps the RBI may announce when Governor Shaktikanta Das addresses the press.

Good morning readers and welcome to our live coverage of RBI Governor Shaktikanta Das's press address. Das will address the media at 10 am today. Stay tuned for live updates.