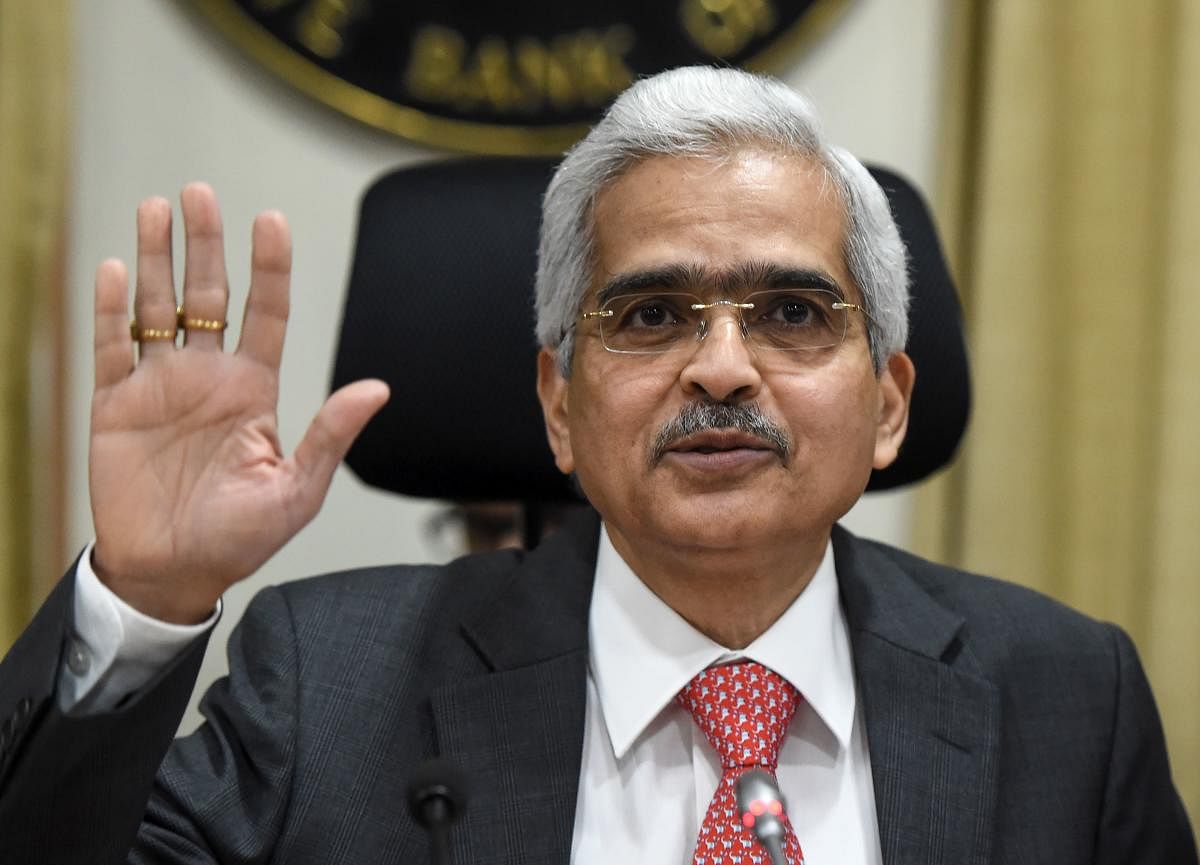

RBI Governor Shaktikanta Das on Friday addressed the nation amid the economic tension that India is facing as a result of the coronavirus crisis. He began with a quote that of Mahatma Gandhi, highlighting the fighting spirit of India and the hope that the nation will come back from this setback and come out from this gruelling period with flying colours.

Here are some of the points he mentioned in his presser:

Governor Shaktikanta Das announced that MPC voted with a 5:1 majority for the repo rate cut by 40 basis points from 4.4 % to 4%. Reverse repo rate stands reduced to 3.35%.

He pointed out that domestic economic activity has been impacted severly. High-frequency indicators point to demand in collapse both in urban and rural areas, and the industrial production shrank by close to 17% in March with manufacturing activity down by 21% while the output of core industries contracted by 6.5%.

He also said that Liquidity Facility for EXIM Bank: RBI to extend Rs 15,000 crore line of credit for 90 days to avail USD swap facility.

The RBI Governor said that the agriculture and allied activities have given a beacon of hope for the country. He further added that a ray of hope is also brought in from the normal south-west monsoons this year.

He stressed the fact that the prices of oil, cereals, milk emerged as pressure points, with the prices having increased at this time of crisis. He suggested that immediate step-up of open market sales can cool down cereal prices.

He also mentioned that in the external sector, India's merchandise export contracted by 60.5%, further adding that India's foreign exchange reserves have increased by 9.2 billion during 2020-21 from 1st April onwards. So far, up to 15th May, foreign exchange reserves stand at 487 billion US dollars.

He warned that the GDP growth in 2020-21 is expected to remain in the negative category with some pick up in the second half and much will depend on how quickly the COVID curve will flatten.

He announced that the Group Exposure Limit of banks is being increased from 25% to 30% of eligible capital base for enabling the corporates to meet their funding requirements from banks. The increased limit will be applicable up to 30th June, 2021.

Regarding inflation, the MPC assessed that the inflation outlook is highly uncertain; an elevated level of inflation in pulses worrisome and requires a review of import duties. He also said that by Q3 and Q4 of the current financial year it is expected the headline inflation will fall below 4%. Though in a positive note, he said that the prices of metals and raw materials are likely to remain soft.

He also said that RBI has decided to roll over the facility of Rs 15,000 crore for another 90 days in SIDBI.

He mentioned that the biggest blow from COVID-19 came from private consumption slump with consumer durables production falling 33 percent in March 2020.

He divided the measures announced today into 4 categories:

1. To improve the functioning of markets.

2. To support exports and imports.

3. To ease financial stress by giving relief on debt servicing and better access to working capital.

4. To ease the financial constraints faced by state governments.

"Three-month moratorium we allowed on term loans and working capitals we allowed certain relaxations. In view of the extension of the lockdown and continuing disruption on account of COVID-19, these measures are being further extended by another three months from June 1 to Aug 31," he said and later added that the lending institutions are being permitted to restore the margins for working capital to the origin level by March 31, 2021.

He ended his address by saying, "Central banks are typically seen as conservative but when the chips are down, the world turns to the central bank. We will take all measures necessary to tackle COVID-19 pandemic."