Noting that the stickiness of core inflation remains a "matter of concern", the Reserve Bank of India (RBI) on Wednesday hiked the policy repo rate by 25 basis points (bps) which will lead to an increase in EMIs on home, car and other loans and make fixed deposits more attractive.

This is the sixth consecutive increase in policy rates in less than a year. The repo rate, the rate at which the central bank lends to the commercial bank, has been increased to 6.50 per cent, the highest level in four years. The cumulative increase in the policy rates since May 2022 stands at 250 bps or 2.50 per cent.

The hike in repo rate will lead to a hike in the cost of borrowing for all types of loans and thus negatively impact demands. On the other hand, it will bring cheers to fixed deposit investors, notably senior citizens and pensioners who rely heavily on interest earnings.

The RBI, in line with the major central banks across the world, has aggressively hiked policy rates to curb inflationary pressure. While a 25 bps hike in key policy rates by the Monetary Policy Committee (MPC) was on the expected lines, the indication for a further increase has come as a surprise.

The six-member rate setting panel decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth.

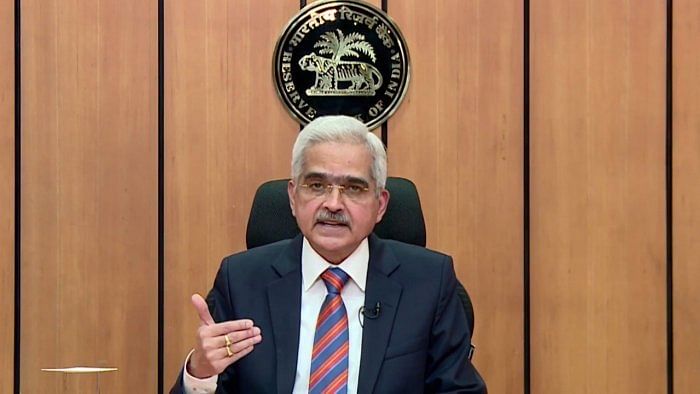

"Headline inflation has moderated with negative momentum in November and December 2022, but the stickiness of core or underlying inflation is a matter of concern," said RBI Governor Shaktikanta Das.

"We need to see a decisive moderation in inflation. We have to remain unwavering in our commitment to bring down inflation," he added.

GDP and inflation forecasts

In its first monetary policy review after the union budget, the RBI also tweaked its projections for economic growth and inflation.

The GDP growth is projected to come down to 6.4 per cent in 2023-24 from the estimated 7 per cent for the current fiscal. GDP growth in Q1 of 2023-24 is projected at 7.8 per cent; Q2 at 6.2 per cent; Q3 at 6 per cent; and Q4 at 5.8 per cent.

The RBI’s GDP growth forecast is largely in line with the projections made by the government in the economic survey released on January 31. The economic survey has pegged the GDP growth for 2023-24 in the range of 6 to 6.8 per cent with a baseline projection of 6.5 per cent.

The headline inflation is projected to come down to 5.3 per cent in the financial year beginning April 2023 from the estimated 6.5 per cent in the current fiscal. In its previous monetary policy review announced in December the RBI had pegged the inflation forecast for the current fiscal at 6.7 per cent.

In the economic survey, the government has pegged the retail inflation for 2022-23 at 6.8 per cent as compared to 5.5 per cent in the previous year.

The consumer price index (CPI) based retail inflation, which the RBI tracks for its policy action, eased to 5.72 per cent in December from 5.88 per cent in the previous month. The headline inflation declined below 6 per cent in November after remaining above the RBI’s upper tolerance limit of 6 per cent for 10 consecutive months.

As per the RBI projection retail inflation is likely to remain at 5.7 per cent in the fourth quarter of the current fiscal. In Q1 of 2023-24 inflation is projected to come down to 5 per cent. It is projected at 5.4 per cent in Q2 as well as Q3 but may accelerate marginally to 5.6 per cent in Q4 of 2023-24.

The stock markets reacted positively to the RBI action with key indices Sensex and Nifty closing in the positive.