The Reserve Bank of India (RBI) on Friday maintained a status quo ante on key policy interest rates keeping the repo unchanged at 4 per cent and also maintained an accommodative stance to revive and sustain economic growth and mitigate the impact of Covid-19 pandemic. The central bank, however, lowered inflation forecast for the current financial year ending March 2022 to 5.3 per cent from the earlier 5.7 per cent.

The central bank saw the recovery in the pandemic-ravaged economy gaining traction and retained the growth forecast at 9.5 per cent for fiscal 2021-22.

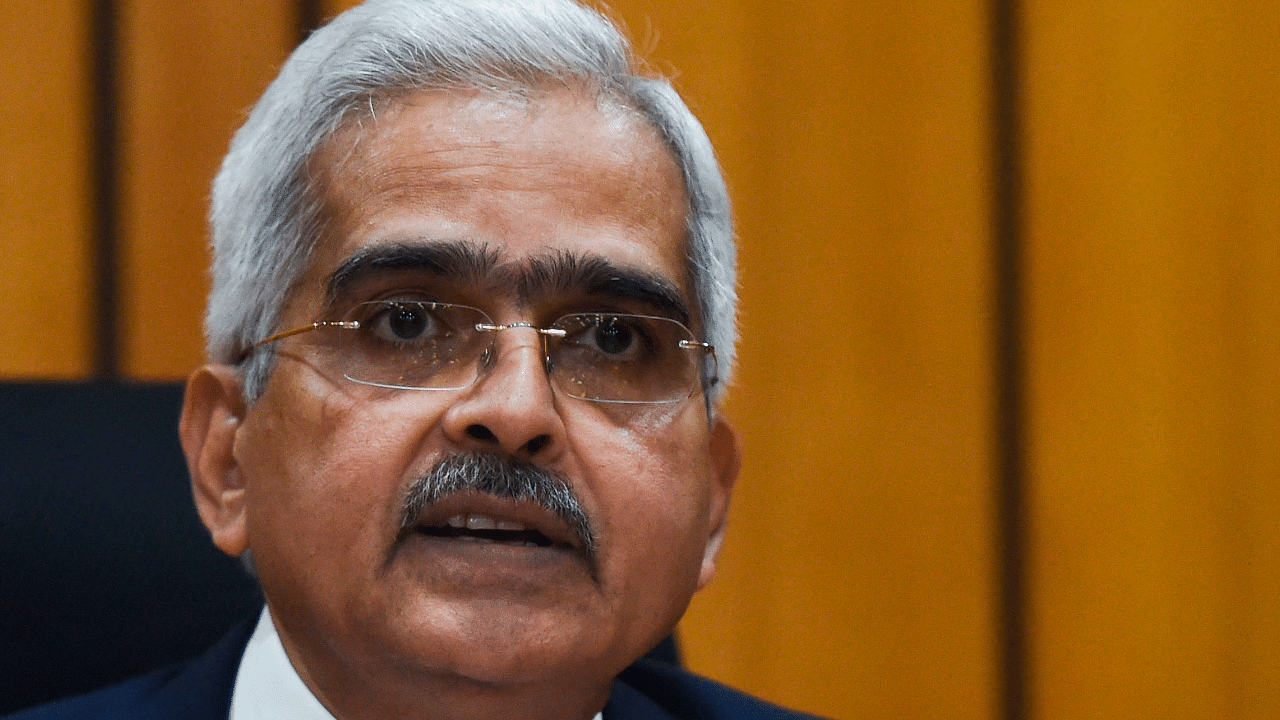

"With the worst of the second wave behind us and substantial pick-up in Covid-19 vaccination giving greater confidence to open up and normalise economic activity, the recovery of the Indian economy is gaining traction. While vaccine reach is the real fault line in the current global recovery, India is in a much better place today than at the time of the last MPC meeting," said Governor Shaktikanta Das while announcing the monetary policy decision.

On inflation side, although it saw pressure on food prices muted, non-food, non-fuel prices continued to be sticky. “Improvement in monsoon in September, the expected higher kharif production, adequate buffer stock of foodgrains and lower seasonal pickup in vegetable prices are likely to keep food price pressures muted. Core inflation, however, remains sticky. Elevated global crude oil and other commodity prices, combined with acute shortage of key industrial components and high logistics costs, are adding to input cost pressures. Pass-through to output prices has, however, been restrained by weak demand conditions,” Das said.

The RBI's Monetary Policy Committee voted 5:1 to maintain an accommodative stance and keep the repo rates unchanged at 4 per cent as recovery remained uneven. The reverse repo rate remaieds unchanged at 3.35 per cent.

“Our growth impulses are strengthening and the inflation trajectory is more favourable than expected,” the Governor said in his opening remarks.

Watch the latest DH Videos here: