The Reserve Bank of India’s Monetary Policy Committee on Friday kept the key policy interest rates unchanged once again at record low levels, ensuring the bank loans do not get costlier and handed out special cheap loan facility to covid-battered contact –intensive hospitality sector.

It also promised to be accommodative to the needs of the economy as the country continues to recover from the second wave of Covid-19.

The Repo rate has been maintained at 4 per cent while the reverse repo rate is at 3.35 per cent.

It, however, cut the economic growth forecast for the current fiscal 2021-22 to 9.5 per cent from the earlier 10.5 per cent and projected retail inflation to go up to 5.1 per cent in the current year.

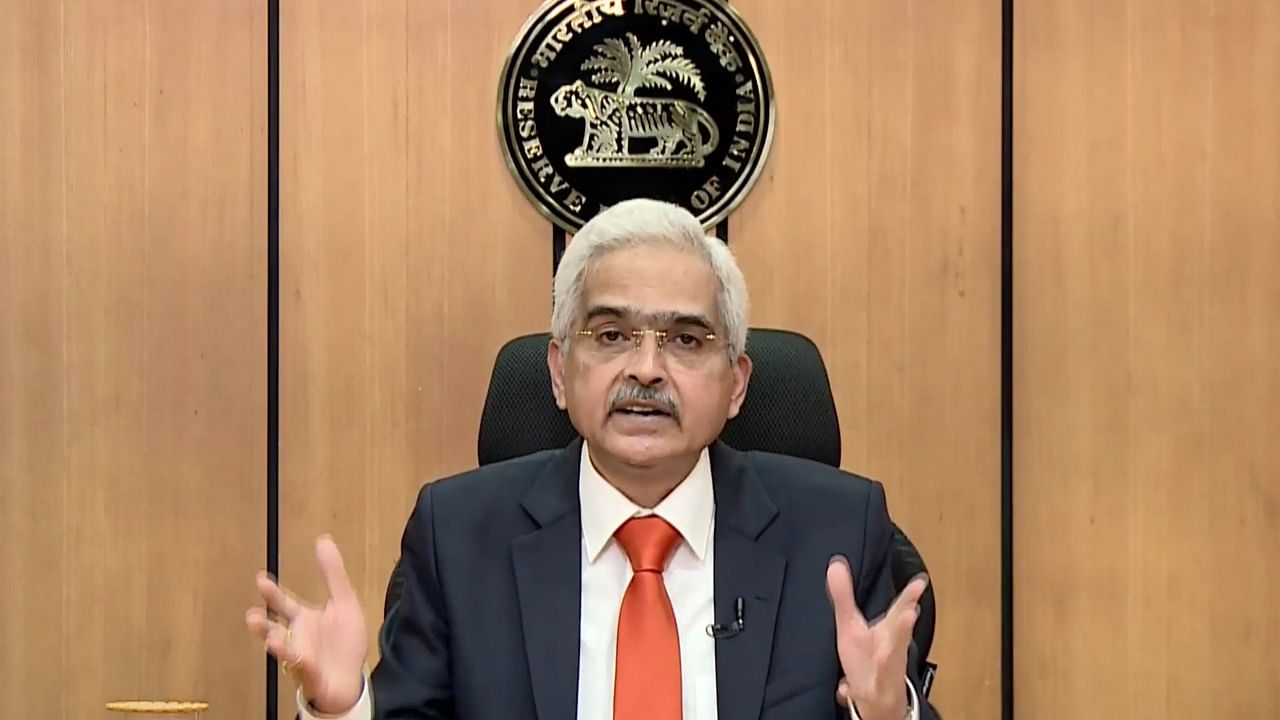

Governor Shaktikanta Das said the dent on urban demand and spread of Covid in rural areas posed downside risk to growth but the recent fall in inflation provided enough elbow room for policy support from all sides required to regain growth momentum

He said a normal monsoon would provide tailwind for economic revival.

To fight the impact of the pandemic’s second wave, it extended a helping hand to small and medium industries and the vulnerable high contact intensive sectors by promising to provide easy loans of Rs 15,000 crore till March 2022 with tenor up to three years at repo rate.

Those who stand to benefit through this include hotels, restaurants, tourism, rent-a-car services, spa clinics, beauty parlours and saloons.

It also extended special liquidity facility of Rs 16,000 crore to SIDBI for on-lending and refinancing to small businesses. This is on top of the Rs 50,000 crore already announced by the central bank in April to all Indian financial institutions that included SIDBI too.