The Reserve Bank of India’s Monetary Policy Committee (MPC) Friday left the key policy repo rate unchanged at 4% and said the economy will contract by 9.5% in 2020-21.

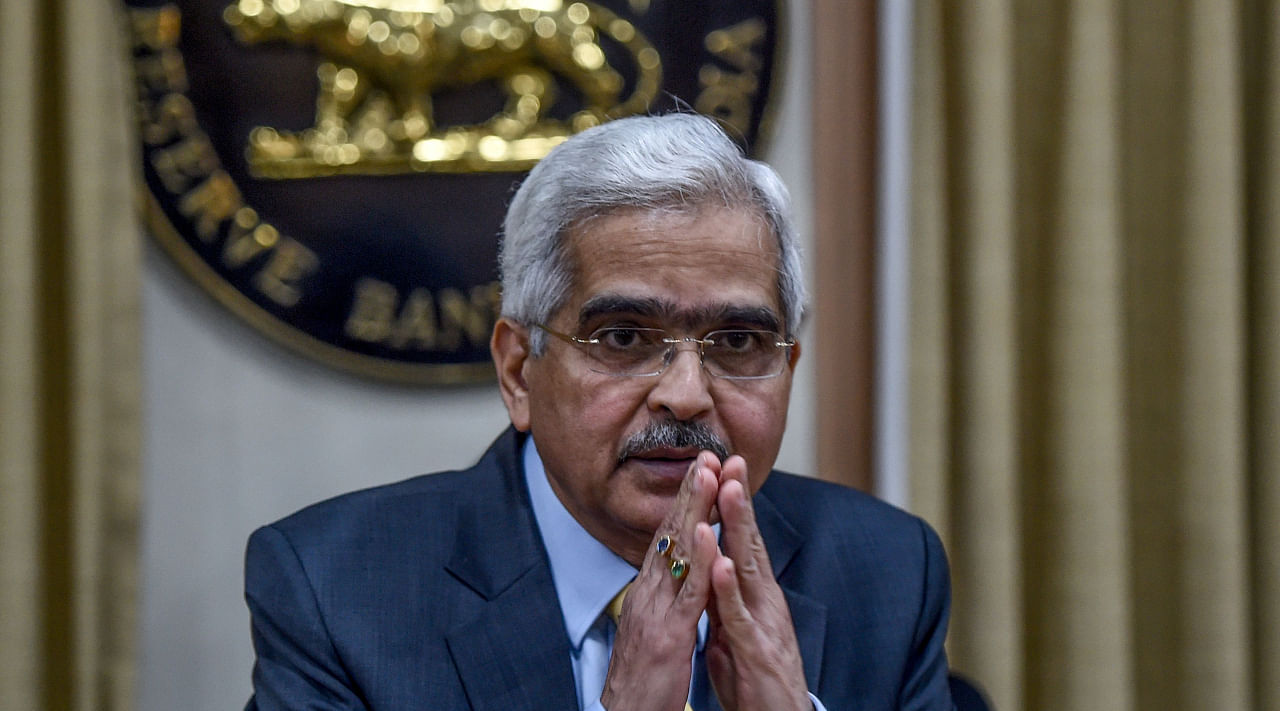

Governor Shaktikanta Das, however, said the phase of deep contraction is behind us. Silver linings are visible. Barring a second wave, India stands poised to shrug off the deadly virus and restart its tryst with pre-Covid-19 growth trajectory. He said the current inflation hump was transient.

The reverse repo rate was left unchanged at 3.35%.

Repo rate is the rate at which the central bank lends money to commercial banks in the event of any shortfall of funds. Repo rate is used by monetary authorities to control inflation.

Das said India’s GDP would contract by 9.5% in the current fiscal due to the disruptions caused by the coronavirus pandemic. However, he said the GDP growth may break out of contraction and enter a positive zone by the fourth quarter of this fiscal.

“Modest recovery in the first half of the year could further strengthen in second half… economic activity to gain traction in third quarter,” Das said.

On inflation outlook, he said the current inflation hump appeared transient as the agriculture outlook looked bright and oil prices were likely to remain range-bound.

RBI has reduced the repo rate by 115 bps in 2020 on the back of 135 bps of rate cuts in 2019 and has maintained an accommodative stance despite the worryingly high inflation levels due to a near-collapse of the economy.

This was the first meeting of the MPC with new external members–Ashima Goyal, Jayanth Varma, and Shashanka Bhide.

The four-year terms of Chetan Ghate, Pami Dua, and Ravindra Dholakia as external members had ended in September.