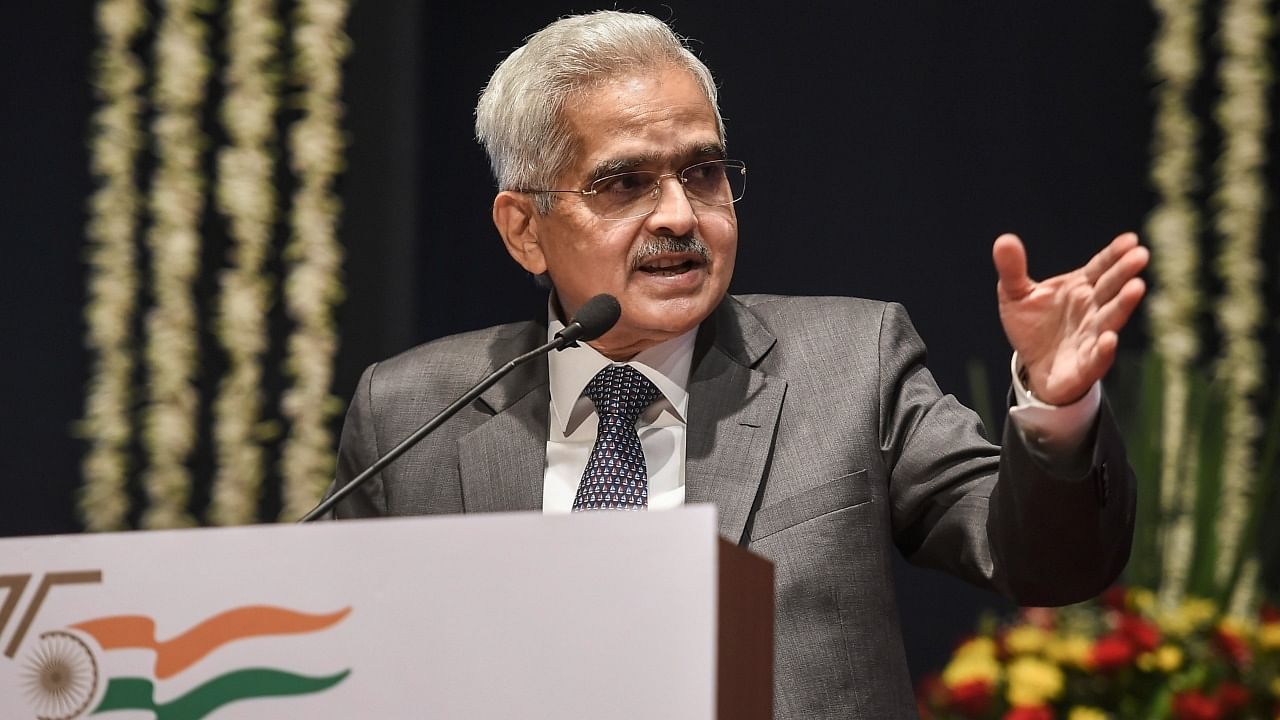

In order to avoid the US and Europe like financial crisis, the Reserve Bank of India (RBI) has taken several proactive measures to strengthen risk management, audit and compliance functions and nudged banks to build up capital buffers during the Covid pandemic when there were plenty of liquidity and interest rates low, Governor Shaktikanta Das said on Thursday.

“We have not only prescribed regulatory norms for capital adequacy and liquidity ratios, but even gone beyond to nudge banks to build up capital buffers in good times and times of plenty,” Das said while addressing a conference on financial resilience in Mumbai.

“We did this during the Covid-19 pandemic when there was plenty of liquidity, the interest rates were low and the full impact of the pandemic on the financial sector was still highly uncertain,” he said.

Referring to the banking crisis in the western countries triggered by the collapse of Silicon Valley Bank (SVB) in the US, RBI Governor said, “the recent events in the banking landscape of the US and Europe suggest that risks for an individual bank could crop up from segments of its balance sheet which might have been considered relatively safer.”

Das asked the Board of Directors of each bank to continually assess the financial risks and focus on building up adequate capital and liquidity buffers even beyond the regulatory minimum for continued resilience and sustainable growth.

According to the RBI Governor, the gross non-performing assets (NPA) ratio for the scheduled commercial banks in India came down to 4.41 per cent at end December 2022 from 5.8 per cent on March 31, 2022.

There has been a significant improvement in asset quality of banks in the recent years. The gross NPA of scheduled commercial banks stood at 7.3 per cent on March 31, 2021. The NPA level in December 2022, was the lowest since March 2015.

The capital adequacy ratio of banks stood at 16.1 per cent at the end of December 2022, well above the regulatory requirement.

“Macro stress tests for credit risk indicate that SCBs would be able to comply with the minimum capital requirements even under severe stress scenarios,” Das said.

The Governor claimed that the Indian banking system has remained resilient and has not been affected adversely by the recent sparks of financial instability seen in some advanced economies.

He advised banks to remain cautious saying vulnerabilities arise from inappropriate business models adopted by banks and other financial entities. “Over-aggressive growth strategies or mindless pursuit of bottomlines, for instance, are often a precursor to future problems,” he added.