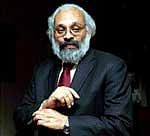

“Very soon we are going to place the discussion paper in the public domain,” Deputy Governor Subir Gokarn told reporters here. He declined to comment on when the guidelines would be out. “It is in the final stages of drafting,” he said.

Early last month, the apex bank said it would come out with the discussion paper on granting new banking licences by the end of July. Under the current guidelines, a new private sector bank should have a minimum net worth of Rs 300 crore and no single entity or group of related entities should hold more than a 10 per cent stake in it.

Many business houses, including Religare, the AV Birla Group, Anil Ambani Group, Bajaj Auto and city-headquartered non-banking finance company Shriram Group have evinced interest in acquiring banking licences.

In his Budget speech this fiscal, Finance Minister Pranab Mukherjee had said, “RBI is considering giving some additional banking licences to private sector players. Non-banking financial companies could also be considered, if they meet the RBI’s eligibility criteria.”

Stating that RBI has done enough to manage inflation, Gokarn said the central bank would wait and see the impact of its action in the latter half of this year. “We expect to see the effect in second half of this year”, he said, adding that softening of commodity prices will help in inflation management.

Gokarn said the situation in Europe and the United States was a cause for concern, “as it may impact capital inflows”.

Admitting that global growth was looking a little more unsettled, he said there is still some uncertainty about the robustness of the global economic recovery. However, he said the slower growth of recovery was actually an opportunity, as it would contribute to inflation management. “There is fair amount of excess capacity on manufacturing products, which are easily traded, and that will help to manage domestic inflation,” he said. Gokarn said the combination of a good monsoon and the softening of commodities at the global level will help ease supply side pressures.

Earlier, addressing a conference on ‘Financial Inclusion’ organised by business school Great Lakes Institute of Management at Manamai, about 80 km from here, Gokarn saidthat the percentage of older people in the country will increase after 25-30 years and it will be a challenge to address this issue.

However, he said the setting up of the Pension Fund Regulatory Authority and the new Pension Scheme were an “important development” in this regard.