The Reserve Bank of India (RBI), which will meet this week to review the monetary policy, is likely to leave interest rates unchanged for the eighth consecutive policy review amid heartening signs of growth recovery and inflation pressure cooling off.

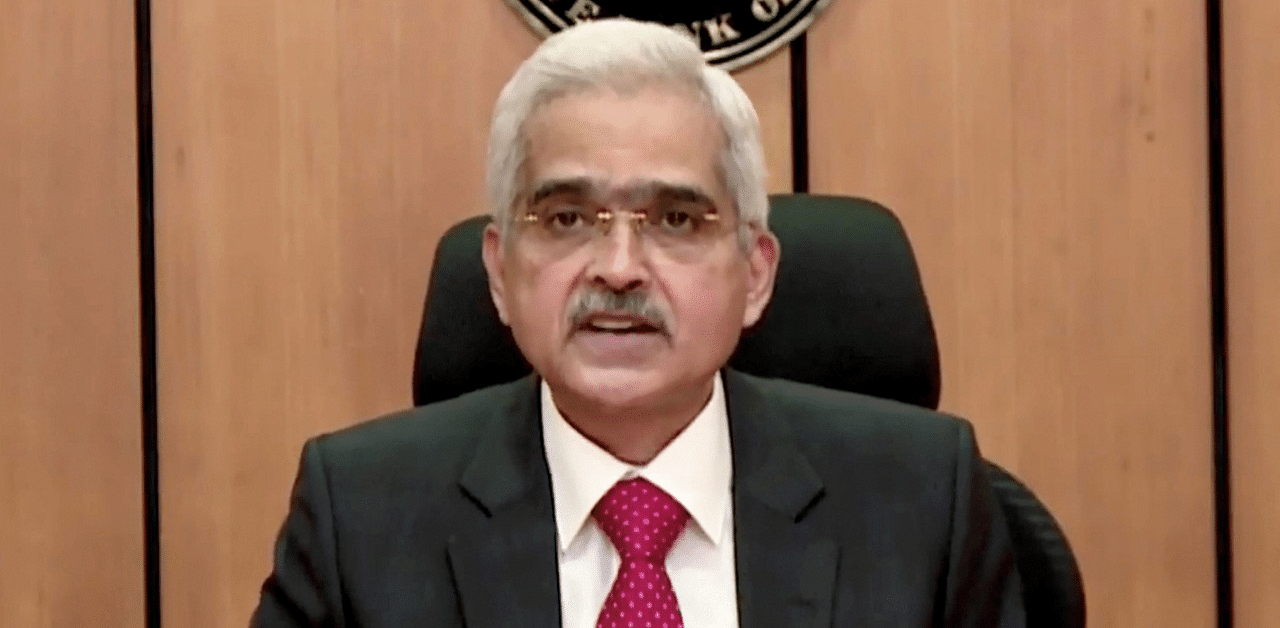

The six-member monetary policy committee which will announce the decision of the review later this week is expected to continue with the accommodative stance. The RBI Governor Shaktikanta Das assured that such a stance will be continued till the time a durable revival of growth is in place. In the last policy review meeting of August, one of the members – Jayath Varma – voted against the accommodative stance.

“We expect the RBI to continue to keep rates on hold and retain its accommodative stance in the upcoming policy review,” Morgan Stanley said in a note.

“Incoming high-frequency data reflects improving growth conditions, thus supporting our expectations of positive growth from the September-21 quarter on a 2Y CAGR basis,” the note said.

During the August policy review, the central bank maintained its growth projection of 9.5 per cent made in June policy for the current financial year.

India’s manufacturing sector recorded an uptick in September as per the Purchasing Managers’ Index (PMI), which rose from 52.3 in August to 53.7 in September. This was the third straight month of expansion in manufacturing activity.

Read | Indian economy's fundamentals strong as FY21 Q3,Q4 GDP crosses pre-pandemic level: Panagariya

Furthermore, output from India’s eight core sectors accelerated for the second successive month in August, rising 11.6 per cent, compared to a 6.9 per cent contraction recorded a year ago.

“The output of eight core sectors rose to 11.6 per centYoY in Aug-21 from 10 per cent YoY in July-21, underscoring the continued recovery in industrial activity with the economy getting gradually back on track. While the annualised growth figures are largely driven by the favourable base factor, the core sector output has turned in an encouraging performance even when compared to the pre-pandemic period,” Acuité Ratings said.

The improvement in growth impetus could prompt the central bank to revise its growth forecast.

“The RBI is likely to have more confidence about growth. Indeed, high-frequency indicators over the last two months signal a recovery that is gaining momentum and getting more broad-based,” Barclays said in a report.

“We expect the RBI to acknowledge the favourable macro developments by increasing its growth forecasts and slashing inflation projections. Still, the MPC is expected to keep policy rates steady, though it could signal a ‘live’ December policy meeting,” the Barclays report said.

During the August policy, the inflation projection was increased sharply by the central bank from 5.1 per cent to 5.7 per cent for 2021-22.

Consumer price-index based inflation – which is the main yardstick for the central bank for policymaking – grew at a slower pace in August as sequential momentum eased in both food and core components. Retail inflation was 5.3 per cent in August – which was within the comfort zone of the central bank – down from 5.59 per cent in July and 6.69 per cent in August 2020. RBI has the mandate to target inflation at 4 per cent, within a range of +/- 2 per cent on either side.

The downward trend in inflation prints in the last few months could encourage the central bank to revise its projection downward for the current financial year. “Aug’21 CPI inflation has set the tone for easing near-term pressures, ahead of the Oct’21 MPC meeting… We see FY22 inflation at 5.2 per cent+,” Emkay Global said in a report.

“However, noises within the MPC may remain steady as the pass-through of impending input price pressures and the ensuing demand revival in contact-sensitive household services may keep core goods inflation under pressure…The RBI’s focus may remain on liquidity normalisation measures amid system liquidity deluge,” the Emkay report said.

Liquidity

RBI has been maintaining ample liquidity in the economy to keep interest rates benign in order to support growth.

At present, the liquidity in the banking system is around Rs 8 lakh crore. There has been a debate on when the central bank starts to exit the ultra-loose monetary policy of high liquidity and negative real interest rates.

Average inflation was 6.22 per cent in 2020-21 and projected at 5.7 per cent for 2021-22 – which is higher than the return on one year bank fixed deposits.

“This growth-inflation mix, we believe, sets the pace of the RBI to gradually exit from the emergency monetary policy settings,” said Radhika Rao, Senior Economist, DBS Bank.

“There are implicit signs this is already underway, even as RBI’s policy guidance leans on the accommodative end of the scale. Liquidity management is in centre stage as the banking system surplus remains high at Rs 8 lakh crore, layered further by the government’s cash balances, bond purchases and FX operations. A rise in the reverse repo cut-offs – within reach of the repo rate – at the recent auction, is also a signal of RBI’s discomfort with prevailing overnight and short-term yields, which was earlier held down by the liquidity surfeit,” Rao said.

The higher cut-off yield set by RBI in last week’s variable rate reverse repo auction has sparked speculation if the central bank is preparing to

exit the extreme easy money policy which was in force since March 2020 after the nationwide lockdown was imposed to curb the spread of Coronavirus.

One has to wait for the October policy announcement if the central bank indeed starts to exit the ultra-loose policy with some liquidity tightening measures, even if it continues to maintain the accommodative stance.

(The writer is a Mumbai-based senior journalist.)