With the resurgent Covid-19 pandemic impacting the nascent economic revival and creaking healthcare infrastructure, the Reserve Bank of India on Wednesday unveiled a Rs 50,000-crore fund to support Covid-related healthcare and allowed small borrowers and firms more time to repay loans.

The Rs 50,000 crore is roughly 9 per cent of India’s total health expenditure of Rs 6 lakh crore under private final consumption expenditure in 2019-20. A direct support to the sector will generate total output demand of Rs 80,000 crore, an SBI estimate says.

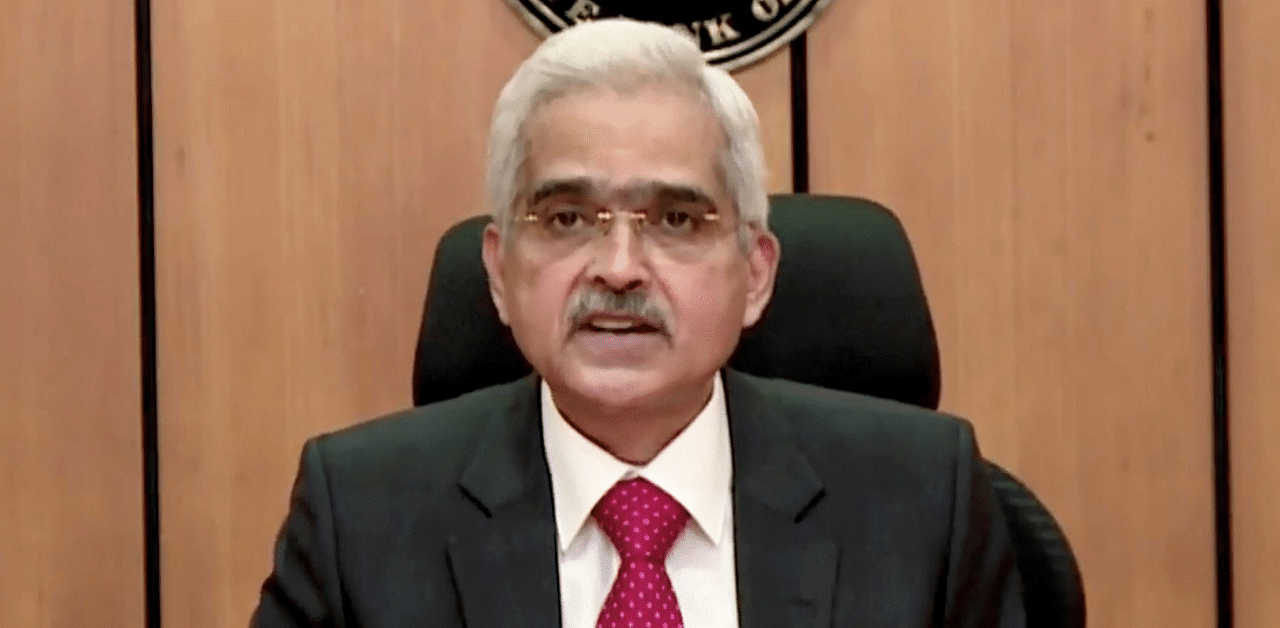

“Small businesses and financial entities at the grassroot level are bearing the biggest brunt of the second wave,” RBI Governor Shaktikanta Das said.

The Rs 50,000-crore window allows banks to lend to vaccine manufacturers, importers and suppliers, hospitals and dispensaries, pathology labs, manufacturers and suppliers of oxygen and ventilators, importers of vaccine and Covid-related drugs, logistics firms and patients.

The facility of on-tap liquidity with tenors of up to three years at the repo rate will remain open till March 31, 2022. Das said banks may deliver these loans to borrowers directly or through intermediary financial entities regulated by the RBI. Banks are expected to create a Covid loan book.

Under the individual loan recast scheme, restructuring of up to two years will be available to individuals and SMEs that did not restructure loans in 2020 and were classified as standard accounts till March 2021. The is open to those with exposure of Rs 25 crore.