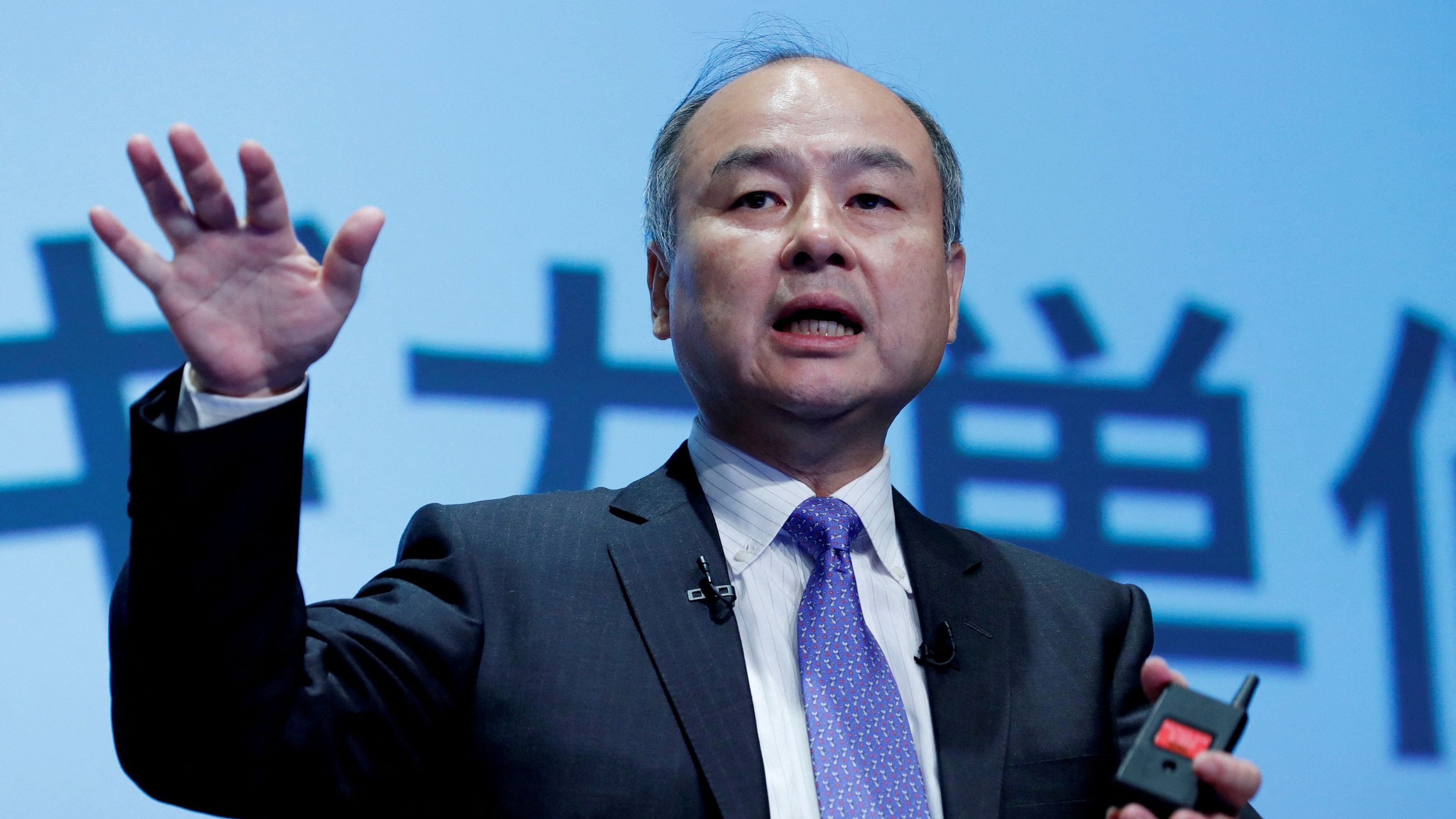

SoftBank Group Corp CEO Masayoshi Son's stake in the company has risen to 34 per cent - a key threshold level that gives him more control.

Son now owns 34.2 per cent of the tech investment giant, up from 32.2 per cent as of the end of September, the company said, declining further comment. A shareholder in a Japanese company with more than a one-third stake is able to block special resolutions brought by other investors at shareholder meetings.

Son's stake has grown in percentage terms as a result of a recent series of massive share buybacks, a SoftBank spokesperson said.

Hit hard by steep share price declines in its portfolio companies and a regulatory crackdown by Beijing on Chinese tech companies, SoftBank has launched a series of large buybacks. It announced a buyback of up to 400 billion yen ($2.9 billion) in August which followed its November 2021 buyback announcement of up to 1 trillion yen or almost 15 per cent of its shares. It completed a 2.5 trillion yen buyback in May 2021.

"It's a good thing for shareholders in general. This (higher stake) is another reason for Mr. Son to work even harder to drive the company's growth," Ichiyoshi Asset Management director Mitsushige Akino said. "If things are the other way around and he was shedding his stake, that would not be very good."

Bloomberg, which first reported the news, said the increase in Son's stake has taken him closer to the point where he could mount an effort to take the conglomerate private. SoftBank has considered going private, sources have previously told Reuters.

Son has often complained about investors valuing the company well below the combined market value of its investment portfolio which includes a 14.6 per cent stake in Alibaba Group Holding Ltd. Ichiyoshi Asset Management's Akino said he believes there is a good chance of a management buyout. "There are times when being listed gets in the way. You need to announce earnings every quarter ...But quarterly performance has little to do with SoftBank's business. Their scope for investments is much longer," Akino said.

Although SoftBank last month logged its first profit in three quarters, its massive Vision Fund, which upended the world of technology with its big bets on startups, posted another heavy quarterly loss.

Shares in SoftBank closed up 2.2 per cent, outperforming a 0.4 per cent drop for the Nikkei average.