Adani group and NDTV's promoter entity RRPR Holding Ltd have approached Sebi, seeking clarity on the applicability of the regulator's earlier order regarding the conversion of warrants into shares, a decisive factor in the hostile takeover battle for the media group.

Days after Adani group on August 23 announced acquiring a 29.18 per cent stake in NDTV through the acquisition of VCPL, which holds a 99.99 per cent stake in RRPR Holding, the media group's promoters have asserted that the deal cannot go ahead without Sebi's nod.

In an order passed on November 27, 2020, the Securities and Exchange Board of India (Sebi) restrained NDTV founders -- Radhika Roy and Prannoy Roy -- from the securities market for two years and that period ends on November 26.

As restrictions are still in force, hence a prior written approval from Sebi was required for Vishvapradhan Commercial Private Limited (VCPL) for the exercise of the conversion option on the warrants, NDTV founders had said.

Against this backdrop, both sides have approached Sebi for clarity on the issue and the regulator's response will be crucial in the takeover battle.

In a filing to the stock exchanges on Monday, NDTV said its founders have informed that RRPR Holding has written a letter on August 28 to Sebi, "EBI, asking it to determine whether the Sebi order dated November 27, 2020, restricts the conversion of warrants issued to VVCPL into equity shares of the promoter group vehicle RRPRH".

Hours later, Adani Enterprises informed the bourses that VCPL has also sought clarity on the warrants conversion matter.

On August 29, VCPL wrote to Sebi requesting to "help provide clarity, certainty and avoid confusion in the minds of public shareholders of NDTV that has arisen due to the stand taken by RRPR and issue an appropriate response to RRPR clarifying that the Sebi order does not restrain RRPR from allotting shares to VCPL".

The latest development also comes days after the Adani group rejected NDTV's assertion that promoter entity RRPR Holding is not a part of the regulator's order that restrained Prannoy and Radhika Roy from accessing the securities market.

Terming the contentions raised by RRPR Holdings as "baseless, legally untenable and devoid of merit", VCPL had said the holding firm is "bound to immediately perform its obligation and allot the equity shares" as specified in the Warrant Exercise Notice.

VCPL said RRPR is not a party to the Sebi Order dated November 27, 2020, and the restraints do not apply to it.

The Warrant Exercise Notice was issued by its subsidiary VCPL under a contract, which is binding on RRPR, it added.

"RRPR is therefore obligated to comply with its contractual obligations," Adani Enterprises had earlier said.

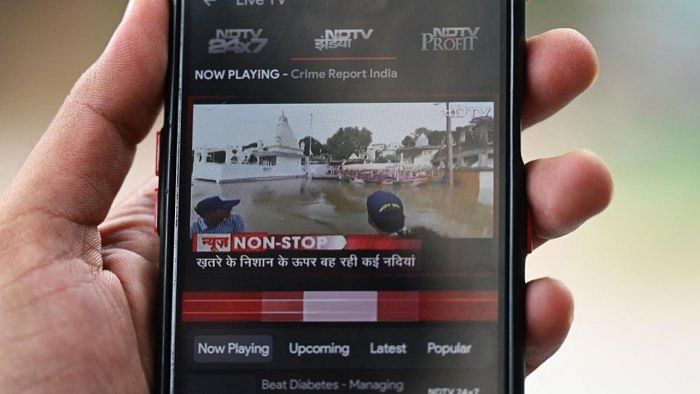

On August 23, the Adani group announced to acquire 29.18 per cent shareholding in NDTV and to launch an open offer to buy an additional 26 per cent stake in the company, which operates three national news channels - English news channel NDTV 24x7, Hindi news channel NDTV India and business news channel NDTV Profit.

The key element behind the takeover bid is an unpaid loan that NDTV's promoter entity RRPR Holding Pvt Ltd had availed from VCPL.

NDTV had taken a loan of Rs 403.85 crore in 2009-10 and against this amount, warrants were issued by RRPR. With the warrants, VCPL had the right to convert them into a 99.9 per cent stake in RRPR in case the loan was not repaid.

Adani group first acquired VCPL from its new owner and exercised the option to convert unpaid debt into a 29.18 per cent stake in the news channel company.

The promoters of NDTV had claimed that they were completely unaware of the takeover until Tuesday and that it was done without their consent.