“You don’t own ‘web3.’ The VCs and their LPs do.”

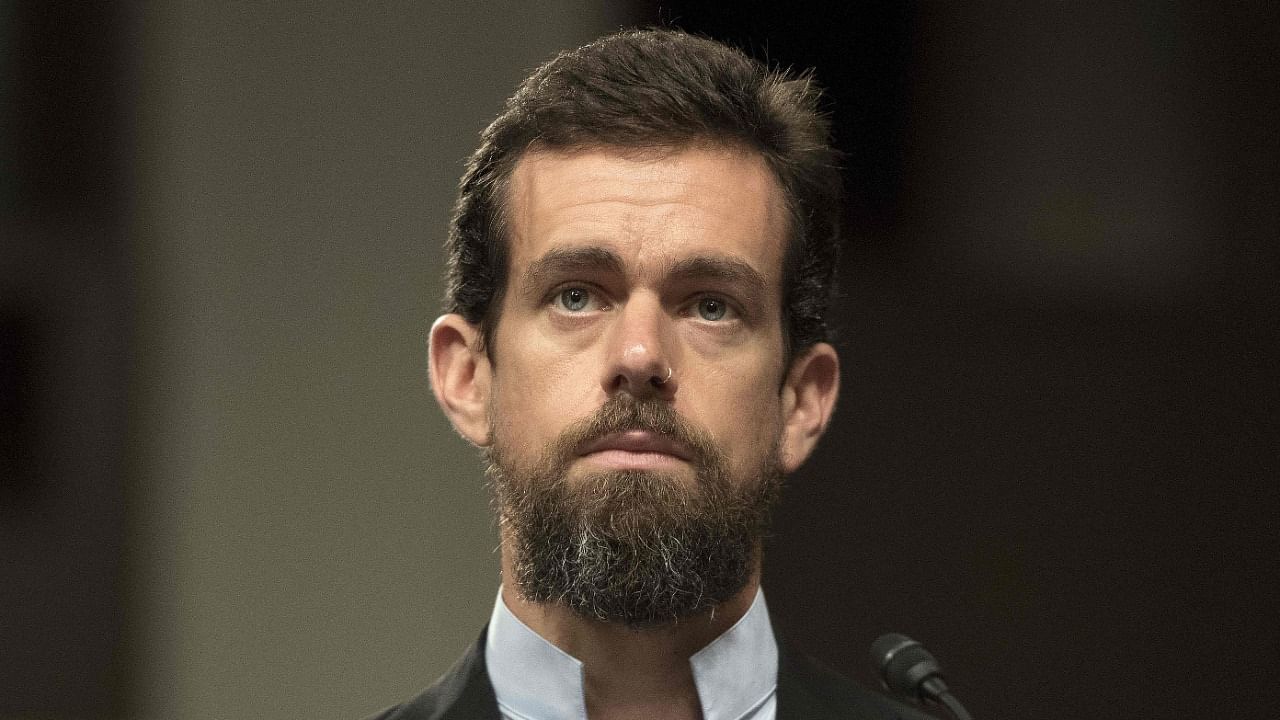

Jack Dorsey tweeted this esoteric salvo in late December, not long after he stepped down as the head of Twitter to focus on advancing his Bitcoin ambitions. The post, swiping at the power held by venture capitalists and their limited partners as they try to reorganize the internet around blockchain technology, an effort known as web3, soon set off a public feud among members of the Silicon Valley ruling class. The dispute over what many herald as the next arena of technological revolution has drawn increasingly hard lines. Elon Musk is with Dorsey; Marc Andreessen is his enemy.

The web3 revolution, backers say, promises the democratisation of commerce and information by building a better internet on blockchain networks — distributed ledger systems that form the basis of Bitcoin and other cryptocurrencies. It theoretically would cut out traditional middlemen and gatekeepers, letting users transact directly and have a greater stake in the programs they use.

But Dorsey has a different view. “It will never escape their incentives,” continued his post about the role of venture capitalists in web3. “It’s ultimately a centralised entity with a different label.”

If you find these messages mystifying and wonder what’s at stake, you are not alone. These billionaires are debating the future of the internet, a tool we all use, in a new language that few of us understand. Let’s decipher the code.

What is the problem?

First, tech types are divided on what web3 means and whether it matters.

“I don’t think it’s super easy to defin,” acknowledged Sam Bankman-Fried, the billionaire founder of the crypto exchange FTX, taking a few unsuccessful stabs at a simple explanation. “I think a lot of people see in it what they want to see,” he added.

Essentially, web3 refers to an internet operating on so-called tokenomics. Tokens are digital units of cryptocurrency, and in web3, developers and users have mutual financial interests and everyone can earn crypto. Users benefit directly from their contributions — creativity, play, engagement or deposits, say. They can also help govern futuristic community-run companies, where they can vote on decisions with tokens created by the particular project.

Believers say these innovations will change how companies are formed and run. A report on 2022 trends by the crypto research firm Messari called web3 an “unstoppable force” that will take society “from an internet built on ‘rented land’ with monopoly overlords to an infinite frontier of new possibilities.” Messari’s founder, Ryan Selkis, contends that “crypto presents a credible revolution to all monopolies.”

Yet big investors also appear attracted to the infinite frontier. Last year, venture capitalists backed about 460 blockchain projects, spending nearly $12.75 billion, up from 155 deals worth $2.75 billion in 2020, per Pitchbook data provided to The New York Times. And the venture arms of crypto exchanges like Coinbase and FTX are some of the biggest deal-makers, compounding concerns about corporate concentration. That means major players increasingly control the decentralized entities said to democratize everything for little guys.

Before Dorsey’s warning, many in crypto muttered about insiders with outsize control hampering decentralisation and undermining the democratic ethos.

The venture firm Andreessen Horowitz, which Marc Andreessen co-founded, has stakes in Compound and Uniswap, two web3 programs that allow for lending, borrowing and trading. More than 95% of the coins that are used for governance on those two platforms are owned by just 1% of token holders, said Alexis Goldstein, the financial policy director of the progressive think tank Open Markets, in recent testimony to the Joint Economic Committee in Congress.

“While cryptocurrency industry insiders promote the ‘democratized’ benefits of digital assets,” Goldstein testified, “in truth, crypto concentrations of money and power match or surpass those in traditional financial markets.”

Read more: Blockchain to grow despite proposed rules

Why does the spat stand out?

The growing battle of barbs and memes between billionaires has exposed a rift in the increasingly lucrative crypto industry as it tries to sell policymakers and the public on its virtues. Crypto confounds as many people as it seduces, and the push to mainstream it has relied on a unified front from its influential proponents.

But that unity is cracking. In response to Dorsey, Musk, the chief executive of Tesla, quipped that he couldn’t find web3. Dorsey retorted that it was “somewhere between a and z,” a dig at Andreessen Horowitz, which is known as A16Z.

Marc Andreessen was displeased. Andreessen Horowitz is billions deep in crypto, and it just built a Washington lobbying team to push policies that ensure that its visions manifest. Marc Andreessen blocked Dorsey on Twitter and devoted his feed to memes about muting “bad followers” with “terrible opinions,” calling out “bad faith web3 takes.”

Andreessen Horowitz and Block, a company founded by Dorsey and formerly known as Square, did not respond to requests for comment.

The crypto industry has been hoping to build on successes it notched last year. Coinbase had a blockbuster initial public offering in April. In October, an exchange-traded fund linked to Bitcoin futures arrived, allowing crypto-linked investment activity to occur on established trading platforms. In December, six executives spoke at a House hearing to play up the democratizing powers of blockchains.

For crypto to truly flourish, however, policymakers and the public must be more than charmed by the possibilities. They must be persuaded that blockchains can be a tool for good in addition to speculation and profit. Instead, the fight over web3 has called attention to problems.

“It’s potentially super exciting,” Bankman-Fried said. He said that he was cautiously betting on web3, but that he was “definitely worried that some of what’s going on right now looks at least as much like a money grab.”

What’s the big deal?

Read more: Blockchain to grow despite proposed rules

There have already been instances of questionable activity with certain crypto projects.

Take ICP, the buzziest cryptocurrency of last spring. It fuels Internet Computer, a blockchain network that aims to replace cloud computing giants like Amazon and that is backed by Andreessen Horowitz. The price rose astronomically amid gushing reports of a token release and crashed spectacularly in weeks. A firm that tracks activity on blockchains found 44 IDs associated with project “insiders,” including venture capitalists, who deposited more than $2 billion in ICP to cryptocurrency exchanges, transfers that coincided with significant price drops while individual investors struggled to redeem tokens.

The developer behind Internet Computer denied that the process was made difficult to benefit insiders. But ICP’s price has never recovered, and some investors say they have since lost faith in the project.

In October, the crypto venture capital firm Divergence Ventures got caught gaming the system to collect $2.5 million worth of tokens meant for users of Ribbon Finance, a project it backs. This raised suspicions it had acted on inside information. The firm said it wasn’t the only one cheating.

Intentions aside, things go awry. There are bugs and hacks and there are kinks yet to be worked out.

ConstitutionDAO, a group hastily created to bid on an original copy of the US Constitution, raised about $47 million in November from thousands of investors. But after it lost the auction bid, DAO’s core team struggled to come up with a plan to return investments as contributors bickered in online group chats. The average investment was about $200, but now the investors may have to pay that much in fees to get their crypto back. (ConstitutionDAO did not respond to a request for comment.)

What now?

Proponents across the web3 ideological divide have been working to woo lawmakers. Venture capitalists are pushing policy proposals meant to influence officials to embrace web3. Believers in the revolution, like Selkis of Messari, have compiled lists of politicians to support. But the movement still appears to lack a unified front.

The debate that Dorsey sparked last month has continued online, though it appears he has begun to direct his attention elsewhere. On Thursday, he started a Bitcoin legal defense fund for developers who face “legal headaches,” and he said Block would get involved with mining Bitcoin.

Andreessen Horowitz’s policy team has been looking beyond Washington, publishing proposals for global leaders on how to become “web3 republics.”

Crypto, however, is not the only issue on every tech billionaire’s mind.

Bankman-Fried, the founder of the FTX exchange, gave roughly $5 million to the Biden campaign during the last election and said he had already made “a number of donations” to midterm election campaigns. He isn’t planning to flex his considerable financial muscle on behalf of web3. Instead, he said, his concern is “pandemic preparedness.”

There’s a little bit of lazy thinking going on right now in some cases where people will just say, like, ‘Ah, you know, like everything’s going to be better in web3 land,’” he mused. “And I don’t know — some things will be. But you can’t just say the word web3 and then assume that makes things better.”