Although the Centre has set an ambitious disinvestment target this year, it may be looking at better prospects in terms of fulfilling the target.

Starting with a 9.2% stake sale in Nalco and strategic sale of Scooters India, the government disinvestment portfolio this year, has a line-up of some highly lucrative public companies. The Finance Ministry is looking to raise Rs 72,500 crore for 2017-18 to help improve the country’s fiscal deficit situation, estimated at 3.2% of GDP. Last year, a volatile stock market was able to deliver only 66% of the revised disinvestment target of Rs 45,500 crore for the government.

During 2015-16, the government could manage to achieve less than half the budget estimates of divestment at Rs 25,312 crore, as against the target of Rs 69,500 crore. However, this year’s target seems to appear achievable, analysts estimates.

Target in sight

“The target for this fiscal seems to be far more pragmatic and achievable. The target largely being unmet emanated from unfavourable market conditions, global economic volatility leading to uncertainties and sentiments for better part of the last fiscal still being subdued,” Siddharth Purohit, Senior Research Analyst, Angel Broking opined.

“With the economy on a mend and systems, laws and processes being streamlined along with global conditions appearing far more stable coupled with liquidity towards equities as an asset class improving should lead to the prospects of targets being achieved provided the issues are attractively priced,” he added.

Besides the fiscal deficit aspect, disinvestment also seeks to bring PSUs on a better footing to improve efficiency and scale operations. There are many considerations for the decision for a strategic sale vs stake sale. Typically, an organisation that is expected to increase in value under a private sector management is considered for a strategic sale.

“Strategic sale should theoretically unlock value in the PSUs through unfettered and focused management. Therefore, it should actually lead to wealth generation, leading to more jobs and further growth in the eonomy,” Jaijit Bhattacharya, Partner and Head, Economics and Regulatory, KPMG India said.

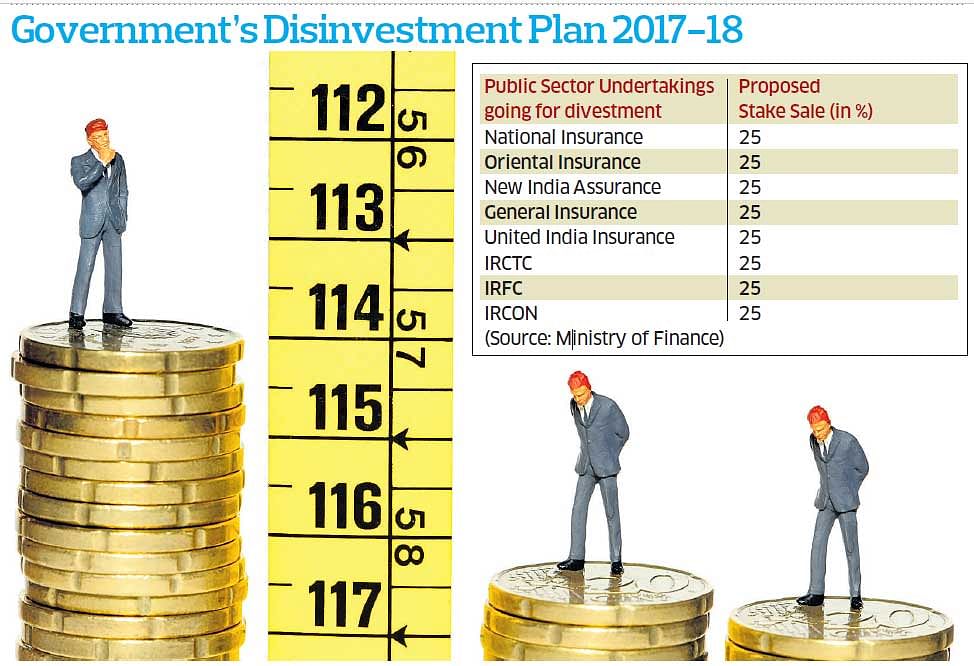

Some of the prominent PSUs going on the market this year, include five wholly-owned general insurance companies — National Insurance Company, Oriental Insurance Company, New India Assurance Company, General Insurance Corporation of India and United India Assurance; three railway arms — Indian Railway Catering and Tourism Corporation (IRCTC), Indian Railway Finance Corporation (IRFC) and IRCON (Indian Railway Construction) International, alongside others.

With PSUs like Indian Oil Corporation (IOC), Steel Authority of India (SAIL), Housing and Urban Development Corporation (Hudco) and National Thermal Power Corporation (NTPC) hitting markets this year, buyer sentiment is also said to be encouraging. This was evident during the recent IPO of Hudco, which saw record oversubscription by 79 times. The firm received Rs 97,000 crore worth of bids for an issue of Rs 1,200 crore.

Bull ride

“Buyer sentiment completely depends on which stock is being offered. Buyers are looking for safe value purchases and many of the PSUs have significant locked value. Therefore, buyer sentiment will depend on the particular PSU IPO on offer,” said Bhattacharya.

“The sentiments for quality PSU primary offerings has been very positive. With a strong government at the centre and reform processes continuing, the PSU units operating efficiencies are improving leading to positive sentiments towards these stocks,” asserted Purohit.

However, on the flipside, disinvestment puts PSUs in quite a soup, in that the financial performance is put under pressure as it is watched by the public consistently. While a company, which is fully-owned by the government, is only required to publish its annual results, with private stakeholders in the picture, the PSU will have to publish results every quarter. In fact, there is a contention that the perception of the company itself changes, as the work culture also gets affected.

Here, Bhattacharya said, “The current government has been taking up audacious targets in most areas, ranging from road building targets to even the number of satellites being sent in a single rocket. So perhaps in line with its general unsaid policy of taking up stretched targets, the government may have taken such a large disinvestment target. However, if the stock market is not depressed this year, then it may very well be possible to meet such a large target.”

Nalco’s share sale saw oversubscription by 1.63 times while CPSE ETF was oversubscribed more than 2.5 times. Further, in order to reach its target, the government has eased its approach towards investment banks participating in public sector undertakings (PSU) share sales. As per the Department of public asset management (Dipam), which is the government body in charge of divestment, investment banks with PSU mandates can take up certain types of capital market offerings by rival companies in the private sector.

Staying positive

While Nomura had called the divestment target optimistic, “some shortfall, as is the norm every year, is likely,” it said.

Rating agency Icra had said the target appeared high, but its achievement “would be crucial to ensure the budgeted reduction in the fiscal deficit and the lower than expected gross borrowing figure”, in February, when Finance Minister Arun jaitley had announced the disinvestment target as a part of the Union Budget for this fiscal.

So, while it remains to be known if victory is far-fetched, the government definitely seems to have brought on a better game this time around.

Starting with a 9.2% stake sale in Nalco and strategic sale of Scooters India, the government disinvestment portfolio this year, has a line-up of some highly lucrative public companies. The Finance Ministry is looking to raise Rs 72,500 crore for 2017-18 to help improve the country’s fiscal deficit situation, estimated at 3.2% of GDP. Last year, a volatile stock market was able to deliver only 66% of the revised disinvestment target of Rs 45,500 crore for the government.

During 2015-16, the government could manage to achieve less than half the budget estimates of divestment at Rs 25,312 crore, as against the target of Rs 69,500 crore. However, this year’s target seems to appear achievable, analysts estimates.

Target in sight

“The target for this fiscal seems to be far more pragmatic and achievable. The target largely being unmet emanated from unfavourable market conditions, global economic volatility leading to uncertainties and sentiments for better part of the last fiscal still being subdued,” Siddharth Purohit, Senior Research Analyst, Angel Broking opined.

“With the economy on a mend and systems, laws and processes being streamlined along with global conditions appearing far more stable coupled with liquidity towards equities as an asset class improving should lead to the prospects of targets being achieved provided the issues are attractively priced,” he added.

Besides the fiscal deficit aspect, disinvestment also seeks to bring PSUs on a better footing to improve efficiency and scale operations. There are many considerations for the decision for a strategic sale vs stake sale. Typically, an organisation that is expected to increase in value under a private sector management is considered for a strategic sale.

“Strategic sale should theoretically unlock value in the PSUs through unfettered and focused management. Therefore, it should actually lead to wealth generation, leading to more jobs and further growth in the eonomy,” Jaijit Bhattacharya, Partner and Head, Economics and Regulatory, KPMG India said.

Some of the prominent PSUs going on the market this year, include five wholly-owned general insurance companies — National Insurance Company, Oriental Insurance Company, New India Assurance Company, General Insurance Corporation of India and United India Assurance; three railway arms — Indian Railway Catering and Tourism Corporation (IRCTC), Indian Railway Finance Corporation (IRFC) and IRCON (Indian Railway Construction) International, alongside others.

With PSUs like Indian Oil Corporation (IOC), Steel Authority of India (SAIL), Housing and Urban Development Corporation (Hudco) and National Thermal Power Corporation (NTPC) hitting markets this year, buyer sentiment is also said to be encouraging. This was evident during the recent IPO of Hudco, which saw record oversubscription by 79 times. The firm received Rs 97,000 crore worth of bids for an issue of Rs 1,200 crore.

Bull ride

“Buyer sentiment completely depends on which stock is being offered. Buyers are looking for safe value purchases and many of the PSUs have significant locked value. Therefore, buyer sentiment will depend on the particular PSU IPO on offer,” said Bhattacharya.

“The sentiments for quality PSU primary offerings has been very positive. With a strong government at the centre and reform processes continuing, the PSU units operating efficiencies are improving leading to positive sentiments towards these stocks,” asserted Purohit.

However, on the flipside, disinvestment puts PSUs in quite a soup, in that the financial performance is put under pressure as it is watched by the public consistently. While a company, which is fully-owned by the government, is only required to publish its annual results, with private stakeholders in the picture, the PSU will have to publish results every quarter. In fact, there is a contention that the perception of the company itself changes, as the work culture also gets affected.

Here, Bhattacharya said, “The current government has been taking up audacious targets in most areas, ranging from road building targets to even the number of satellites being sent in a single rocket. So perhaps in line with its general unsaid policy of taking up stretched targets, the government may have taken such a large disinvestment target. However, if the stock market is not depressed this year, then it may very well be possible to meet such a large target.”

Nalco’s share sale saw oversubscription by 1.63 times while CPSE ETF was oversubscribed more than 2.5 times. Further, in order to reach its target, the government has eased its approach towards investment banks participating in public sector undertakings (PSU) share sales. As per the Department of public asset management (Dipam), which is the government body in charge of divestment, investment banks with PSU mandates can take up certain types of capital market offerings by rival companies in the private sector.

Staying positive

While Nomura had called the divestment target optimistic, “some shortfall, as is the norm every year, is likely,” it said.

Rating agency Icra had said the target appeared high, but its achievement “would be crucial to ensure the budgeted reduction in the fiscal deficit and the lower than expected gross borrowing figure”, in February, when Finance Minister Arun jaitley had announced the disinvestment target as a part of the Union Budget for this fiscal.

So, while it remains to be known if victory is far-fetched, the government definitely seems to have brought on a better game this time around.