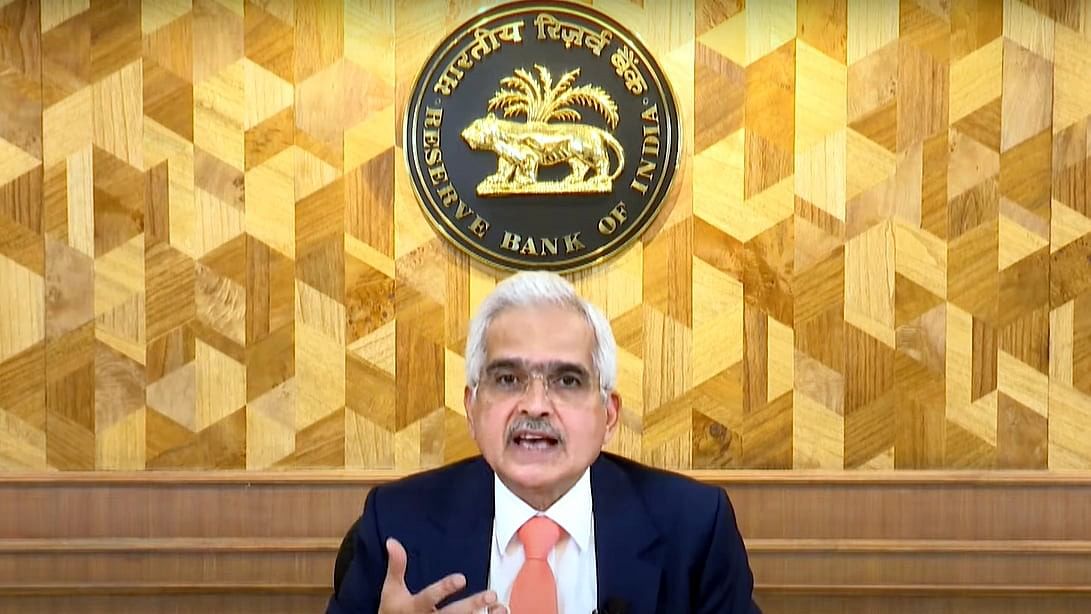

Reserve Bank of India (RBI) Governor Shaktikanta Das

Credit: PTI Photo

New Delhi: It is not enough to bring inflation within the tolerance band of below 6 per cent, Reserve Bank of India (RBI) Governor Shaktikanta Das said on Thursday adding that the central bank remains committed to align inflation with its legally mandated goal of 4 per cent on a durable basis.

In his address at the High-Level Policy Conference of Central Banks from the Global South, Das said, “it is not enough to be within the tolerance band and that our job is not finished until we reach the target of 4 per cent on a durable basis.”

The governor’s comment dashes the expectations of any rate cut by the central bank in the near future.

The annual retail inflation rose to a 14-month high of 6.21 per cent in October driven by a sharp jump in food prices. The headline retail inflation soared after remaining below 4 per cent during July-August period.

Das underlined that stable inflation is the bedrock for sustained growth.

“Resilient growth has given us the space to focus on inflation to ensure its durable descent to the 4 per cent target. A stable inflation or price stability is in the best interest of the people and the economy. It acts as a bedrock for sustained growth, enhances the purchasing power of the people and provides a stable environment for investment,” he said.

The government has given the RBI the target to maintain inflation in the 2 to 6 per cent band. This is referred to as the tolerance band, while the median target is 4 per cent.

Das said the RBI Monetary Policy Committee (MPC) decisions have been focused on aligning inflation to the median target on a durable basis.

In the tightening phase, which commenced in April-May 2022, the nature of communication was appropriately fine-tuned to ensure successful transmission of policy rate hikes. When we took a pause on the policy rate in April 2023 after having raised it by 250 basis points, it was important to anchor market expectations from running ahead or front running the central bank, Das said.

“It was, therefore, emphasised that it was a pause and not a pivot. This was to ensure that past rate actions were transmitted fully to the broader economy. The focus was on anchoring inflation expectations by emphasising our firm commitment to re-align inflation with the target,” he added.