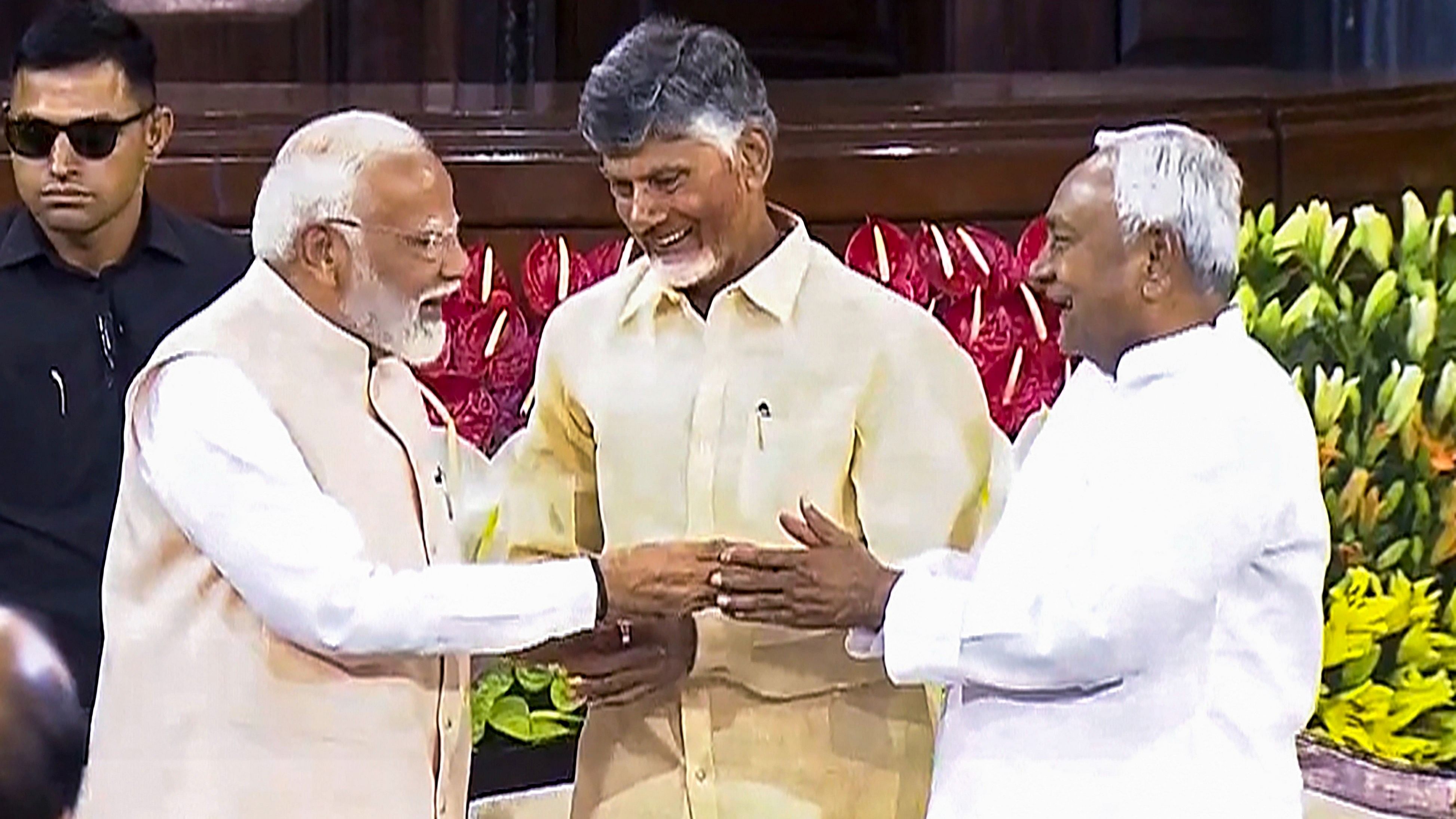

PM Narendra Modi with TDP chief N Chandrababu Naidu and Bihar CM and JD(U) leader Nitish Kumar.

Credit: PTI Photo

Bengaluru: Finance Minister Nirmala Sitharaman took the lessons from a chastening Lok Sabha election on board to present a budget geared towards creating jobs, supporting small businesses, keeping key states happy and providing some relief to salaried classes to boost consumption.

However, those investing in the markets were in for an unpleasant surprise, as the budget increased both long-term and short-term capital gains tax, hiked the securities transaction tax for futures and options in an effort to widen the tax base, and put the burden of taxation on buyback of shares on the investor.

The market reaction to the first budget of Prime Minister Narendra Modi’s third term was the very definition of lukewarm, as both the BSE Sensex and the NSE Nifty50 closed almost flat. But the indices fell as much as 1.2 per cent and 1.5 per cent respectively in the wake of the speech.

“We think the government has walked a fine line between balancing economic and political priorities,” said Shreya Sodhani, regional economist at Barclays.

The most prominent theme was job creation, a pain point widely thought to have cost the NDA heavily in the election.

Sitharaman announced three employment-linked incentive schemes.

For over 200 lakh youth entering the workforce across formal sectors, the government will provide a one-month wage of up to Rs 15,000 in three installments with a salary eligibility cap of Rs 1 lakh per month.

To boost job creation in manufacturing, new employees and employers will get an incentive with respect to their EPF contributions for four years, while in another scheme, the government will reimburse employers for up to Rs 3,000 per month for two years towards EPF contributions for each additional employee.

Job push

Sitharaman also announced a scheme for internships in the top 500 companies in the manufacturing sector, in which interns will be provided a stipend of Rs 5,000 per month along with a one-time assistance of Rs 6,000. To encourage more female participation in the workforce, the government will set up working women’s hostels and creches in partnership with employers.

There was largesse for two allies who helped Modi form a government for a third straight term, Nitish Kumar and Chandrababu Naidu, in the form of road projects worth Rs 26,000 crore for Bihar and the promise of facilitating multilateral agency loans of Rs 15,000 crore for Andhra Pradesh to build its new capital.

The salaried classes got some relief on the tax front as Sitharaman raised the standard deduction limit to Rs 75,000 from Rs 50,000, and the family pension deduction to Rs 25,000 from Rs 15,000. There were minor tweaks to the personal income tax slabs, though the rates remained largely unchanged.

The Budget stuck to the fiscal consolidation roadmap, with the FM improving the fiscal deficit target for the current fiscal year to 4.9 per cent of GDP from 5.1 per cent announced in the interim Budget in February. “The fiscal consolidation path announced by me in 2021 has served our economy very well, and we aim to reach a deficit below 4.5 per cent next year,” she said, adding that from 2026-27, she would try to keep government debt on a declining path as percentage of GDP. New 109 high-yielding and climate-resilient varieties of 32 field and horticulture crops will be released for cultivation, and a comprehensive review of the agriculture research setup would be undertaken to focus on raising productivity and developing climate-resilient crops.

Details of six crore farmers and their lands will be brought into the registries by implementing Digital Public Infrastructure. The Micro, Small and Medium Enterprises (MSME) sector, which over the past eight years had been impacted by demonetisation, implementation of Goods and Service Tax and then Covid-19 pandemic, got credit guarantee cover for loans intended for buying machinery and equipment. Public sector banks will build their in-house capability to assess MSMEs for credit, focusing also on the companies’ digital footprint. The limit on Mudra loans will be enhanced to Rs 20 lakh from the current Rs 10 lakh for those entrepreneurs who have availed and successfully repaid previous loans.

Union Budget 2024 LIVE | Making a record for any Finance Minister, Nirmala Sitharaman presented her 7th consecutive Union Budget on July 23, 2024 under the Modi 3.0 government. This Budget brought tax relief for the middle class, while focusing on jobs through skilling, incentivising employers. Track the latest coverage, live news, in-depth opinions, and analysis only on Deccan Herald. Also follow us on WhatsApp, LinkedIn, X, Facebook, YouTube, and Instagram.