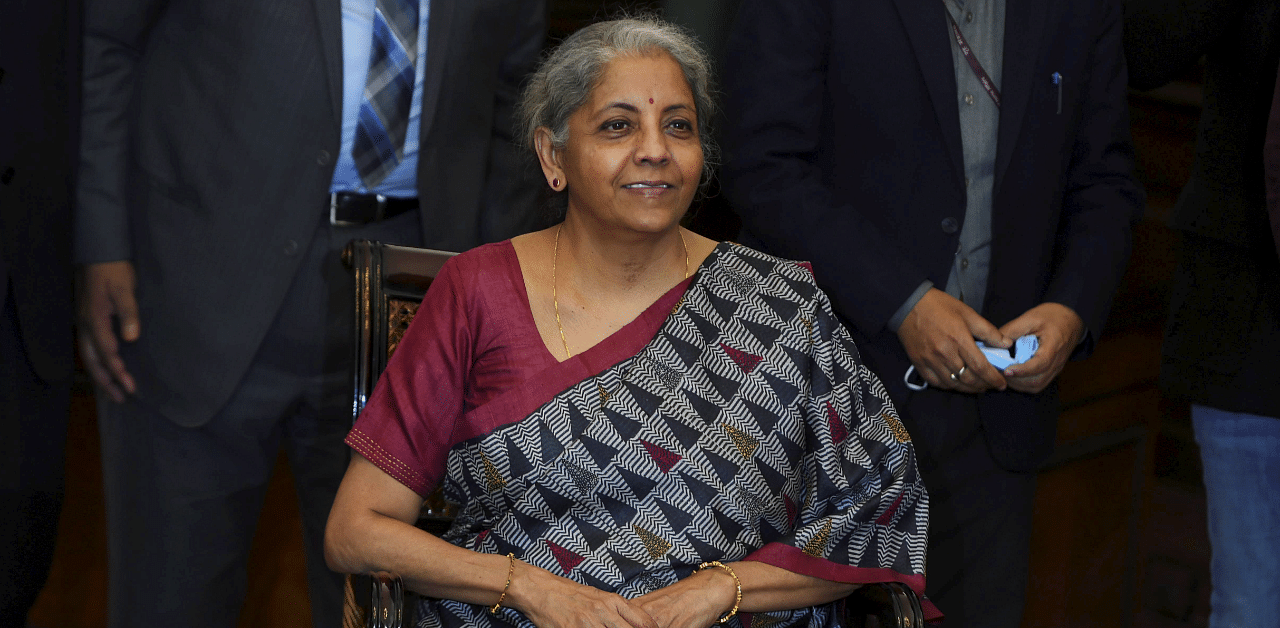

Economists hailed Finance Minister Nirmala Sitharaman for a "bold budget" focused on fiscal expansion but flagged concerns over the proposals for not addressing the problems of inequitable growth.

Concerns over the impact on the sovereign rating have been sidestepped in the budget by using a wider fiscal deficit for addressing the growth needs, they said.

The budget was widely expected to be a fiscally expansionary one, given the concerns on the growth front.

"The budget does not adequately address concerns over inequitable growth which has been a worry across the globe due to the pandemic. There has been no specific support for sectors stressed due to the pandemic like the hospitality sector," HDFC Bank's chief economist Abheek Barua said.

Terming it as a budget which is not populist, Japanese brokerage Nomura's country head Prabhat Awasthi said, "There is no major attempt to redistribute incomes by increasing taxes on high income groups, as was the case earlier."

Barua said this is a "bold budget" in many senses and the central intent has been to use expansionary fiscal policy to support growth sidestepping concerns over debt sustainability and sovereign rating with the fiscal deficit pegged at 6.8 per cent of GDP in FY22 from 9.5 per cent for FY21.

Siddhartha Sanyal, chief economist and head of research at Bandhan Bank said the budget was expected to emphasise supporting the nascent recovery in growth but the quantum of the total fiscal spending has surpassed expectation.

However, he said a “decisive and credible stance on near term fiscal deficit and the FRBM (Fiscal Responsibility and Budget Management Act) targets was the need of the hour”.

He said the fear of wider fiscal deficit resulting into risks to sovereign rating is only a partial picture, as dent in growth potential can also lead to rating downgrades.

Barclays India's chief economist Rahul Bajoria said the measures require a large increase in the fiscal deficit, and an overhaul of the deficit reduction glide path.

Rajni Thakur of RBL Bank said the budget announcements check all the right boxes for a year that needs unprecedented support from the government to revive economic activities.