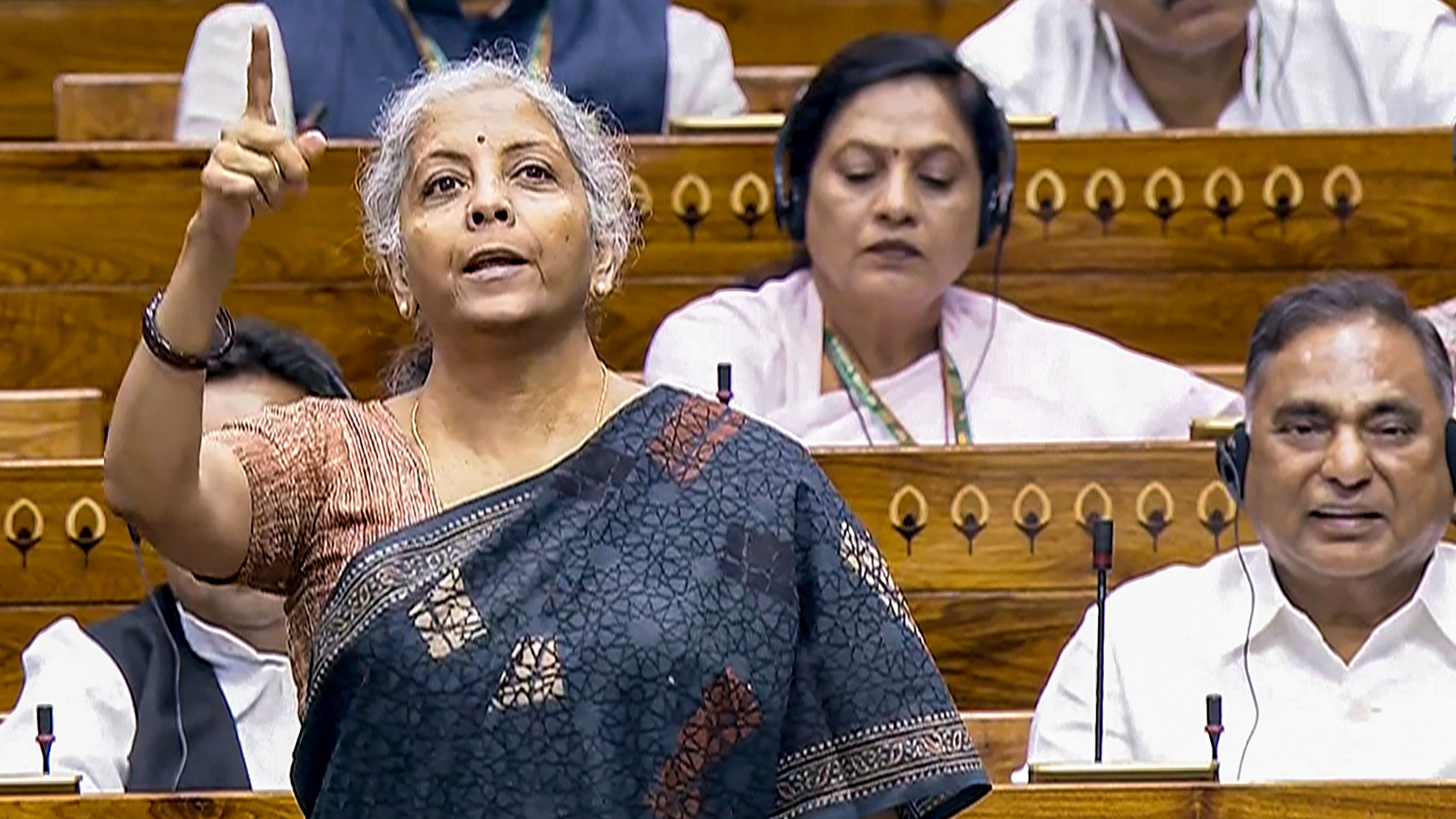

Union Finance Minister Nirmala Sitharaman speaks in the Lok Sabha during the first day of the Parliament session, in New Delhi, Monday, July 22, 2024.

Credit: PTI Photo

New Delhi: Amid strained diplomatic relations due to standoff on borders, the Economic Survey 2023-24, advised allowing higher equity investments from China, saying it would help in strengthening India’s participation in the global supply chain and boosting exports.

The Survey, drafted by Chief Economic Advisor V Anantha Nageswaran and his team, and tabled in the Parliament by Finance Minister Nirmala Sitharaman, suggested that choosing foreign direct investment (FDI) as a strategy to benefit from the China-plus-one approach appears more advantageous than relying on trade.

“The trade deficit with China has been growing. As the US and Europe shift their immediate sourcing away from China, it is more effective to have Chinese companies invest in India and then export the products to these markets rather than importing from China, adding minimal value, and then re-exporting them,” the report noted.

India’s imports from China crossed $100 billion during 2023-24. While there has been a sharp increase in import of goods from China to India over the year, the inflow of capital remains insignificant. China’s share in India’s merchandise imports has increased to 30% from around 21% recorded 15 years ago, as per a recent report by Global Trade Research Initiative (GTRI).

FDI equity inflow from China stood at $2.5 billion between April 2000 and March 2024, just around 0.37% of total equity inflows to India during this period. While up to 100% FDI is permitted in several sectors, any investment from China requires the government’s approval.

As per the Survey, India faces two choices to benefit from China plus one strategy: it can integrate into China’s supply chain or promote FDI from China. “Among these choices, focusing on FDI from China seems more promising for boosting India’s exports to the US, similar to how East Asian economies did in the past,” it said.

China plus one refers to a business strategy by large companies to diversify their manufacturing or sourcing operations beyond China, which has benefitted countries like Mexico, Thailand, and Vietnam.

“Can India benefit from this ‘China plus one’ strategy? The appeal of India lies in its large domestic consumer market, which makes it attractive for companies to set up operations there,” the Survey underlined.

The report further added that while India may not be an immediate beneficiary of the trade diversion from China, it has witnessed a substantial increase in its electronic exports over time.

The implementation of the PLI scheme has been a key driver of this growth. For instance, India’s electronic exports to the US have transitioned from a trade deficit of $0.6 billion in FY17 to a trade surplus of $8.7 billion in FY24, underscoring a significant increase in value addition. Within the electronics sector, the category that has experienced the most growth is mobile phones, with exports to the US rising from $2.2 billion in FY23 to $5.7 billion in FY24.

Union Budget 2024 | Making a record for any Finance Minister, Nirmala Sitharaman will be presenting her 7th Union Budget on July 23, 2024 under the Modi 3.0 government. While inflation has burnt a hole in the pockets of 'aam janata', will this Budget spell relief for Indians? Track the latest coverage, live news, in-depth opinions, and analysis only on Deccan Herald. Also follow us on WhatsApp, LinkedIn, X, Facebook, YouTube, and Instagram.