Amazon and one of the world’s richest men are engaged in a multibillion-dollar, politically fraught clash over Rani Pillai’s favourite place to buy groceries.

Pillai, 47, a retired nurse, is a regular shopper at Big Bazaar, a low-slung supermarket nestled beneath a metro station at a middle-class neighbourhood in east Delhi. She tried online shopping last year, during India’s coronavirus lockdown. It did not compare to Big Bazaar, where jars of mango pickle jostle for space with pasta sauce, while family packs of instant noodles are stacked near giant sacks of basmati rice.

“I like to see things first,” said Pillai, whose shopping trip that day netted her a T-shirt and several bags of cookies. “Here I can look at the products before I buy them.”

Big Bazaar is owned by an Indian company called the Future Group, which owns 1,500 supermarkets, snack shops and fashion outlets in 400 cities in India. That brick-and-mortar footprint makes it a prize for companies that, paradoxically, want a piece of India’s fast-growing technology and e-commerce market.

Those companies include Amazon. It is betting big on India, where it already accounts for about one-third of e-commerce sales.

The American technology giant two years ago put down $200 million to get first dibs to buy the retail assets of the Future Group, and it structured the deal to avoid the Indian government tightening limits on foreign involvement in local businesses.

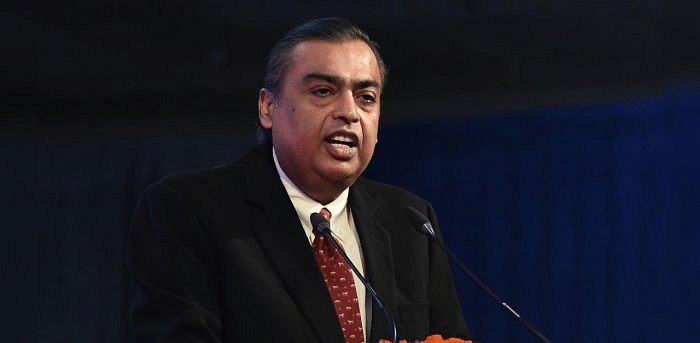

Read more: Mukesh Ambani draws nil salary in FY21: How much does he earn?

But that put Amazon in the way of Reliance Industries, one of the biggest and most powerful companies in India. It is controlled by Mukesh Ambani, a tycoon whose holdings include telecommunications, energy and manufacturing. In August, Reliance shouldered aside Amazon and struck a deal to buy all of the Future Group for $3.4 billion.

Amazon is now trying to stop the deal through arbitration proceedings in Singapore. The fight has spilled over into India’s courts, where the American company has asked the Supreme Court to halt the deal until the Singapore arbitration is completed.

Though India’s near-term prospects have been hit hard by a coronavirus second wave, the country promises huge growth potential once the pandemic ends. Its increasingly connected population and aspirational middle class remind many global businesses of China, which in a few short years became the world’s biggest internet market by population.

Also read: Jio accelerating rollout of digital platforms, indigenously-developed 5G stack: Reliance Industries

India’s online market is expected to be worth $85.3 billion by 2024, according to Forrester Research. Facebook, Walmart and others have joined Amazon in investing heavily there.

Online groceries are a small but growing piece of the market. For now, Indians shop online primarily to buy fashion products and cellphones. But a chain of brick-and-mortar stores could be a valuable asset for conquering the online business, for many of the same reasons Amazon bought Whole Foods four years ago to build its grocery business in the United States. Grocery stores can make handy distribution centres and bring both brand-name recognition and long-term relationships with suppliers.

“No one is fighting on a monthly or quarterly basis,” said Satish Meena, an analyst with Forrester Research. “This is a 10-, 15-year game.”

Amazon and other international companies have found that game increasingly difficult to play, however. Prime Minister Narendra Modi and his Hindu nationalist government are whipping up sentiment against foreign forces as part of a campaign to develop homegrown players in manufacturing, the internet and other industries.

Indian officials have kept silent about Amazon’s fight with Reliance, but they have pressured the American company on other fronts. The Reserve Bank of India and the Enforcement Directorate, India’s federal crime-fighting agency, are investigating Amazon for suspected violations of India’s foreign investment laws. Amazon and Walmart’s Flipkart are also fighting a legal battle to stop the Competition Commission of India, the country’s antitrust regulator, from pursuing a formal investigation into their sales practices.

In a statement, Amazon said that company officials “take compliance with all applicable laws and policies seriously” and that it was trying to protect its rights in trying to stop the Reliance-Future Group deal.

“We are disappointed by the motivated attempts to influence the FDI policy with the view to create an unlevel playing field,” the statement said, referring to India’s restrictions on foreign direct investment.

Neither Reliance nor the Future Group responded to emails requesting comment.

In 2018, the Indian government enacted a law that said foreign-owned e-commerce companies could work only as neutral marketplaces where independent sellers placed their products. The government said the limits would protect small businesses by limiting the ability of platforms like Amazon to sell their own products. Strictly following the law would have meant, for instance, that Amazon could not sell its popular Echo device on its own service.

The Indian government is not alone in its concerns over Amazon’s potentially dominant market power. Officials and lawmakers in the United States and Europe have taken an increasingly dim view of Amazon’s ability to use its data to develop and sell its own products. Still, the law was widely interpreted as beneficial to Ambani’s foray into e-commerce.

“India’s foreign investment laws in retail didn’t make sense in the mid-2000s, when they were enacted, and they don’t make any sense today,” said Arvind Singhal, chairman and managing director of Technopak Advisors, a management consultancy that focuses on retail and consumer products. “The laws are protecting local big players in the name of protecting mom and pop stores.”

Against that environment, Amazon moved cautiously to make a deal with the Future Group. The Indian company was heavily in debt when they struck their pact in 2019. The agreement was structured to comply with tough laws already on the books about foreign companies investing in retail.

The Future Group deal amounted to an option by the American company to expand into brick-and-mortar stores in India should New Delhi ease its retail laws. It also allowed Amazon to use Future’s network of stores as centers for quickly dispatching fresh fruits and vegetables to customers ordering provisions online. Before the dispute between the companies broke out, customers could order vegetables from Big Bazaar stores from the Amazon app.

But Reliance Industries, Ambani’s sprawling conglomerate, saw some of the same potential. In an investor call soon after the acquisition, Reliance Retail’s chief financial officer, Dinesh Thapar, spoke of a similar strategy of using brick-and-mortar stores as distribution centers. Even before the Future acquisition, Reliance used its own network of offline stores to ensure that over 90% of online orders were delivered within six hours, Thapar said on the call.

The winner of the clash between Reliance and Amazon could have a big say in how e-commerce develops in China. E-commerce creates ecosystems for smaller startups working on payments, logistics, artificial intelligence and machine learning, said Arun Mohan Sukumar, an independent technology analyst. Government rules could shape that outcome.

“If the government decides to pick a winner in the e-commerce domain, that winner will end up picking the winners in multiple, so-called ‘sunrise’ sectors,” Sukumar said.

However the dispute is resolved, Ambani’s imprint is already visible in Big Bazaar aisles, where Reliance Industries’ Good Life range of beans, peas and lentils have been accorded a prominent place.

“We’ve started stocking a lot more Reliance products over the past six months,” said Ridh Nath, a Big Bazaar employee who oversees the groceries section. As the Future Group struggled under debt, Reliance showed a willingness to supply a credit line for its products.

Nath said he was initially unsettled by all the conflicting headlines about the Future Group.

“But the company told us not to worry about the news, just focus on the customer, and that is what we are doing,” he said.