Around 42,000 student-applicants for educational loans under West Bengal government’s student credit card scheme are expected to have their loans sanctioned by January 15, Amit Mitra, principal chief advisor to Bengal’s chief minister said after the State Level Bankers Committee (SLBC) held its meeting in Kolkata on Friday.

Mitra said that 37,782 students have already been sanctioned loans worth Rs 1,105 crore since inception of the credit scheme. The issue that was of concern was the high rate of rejection of applications. Through scrutiny, it was observed that around 21,000 applicants have proper documents. Mitra said that bankers have agreed that to these students, loans will be approved by December 31. Another 21,000 applicants, it was observed, had some documents pending. Such students will also after a scrutiny be covered under loans by January 15. This will bring the total number of sanctions to 80,000.

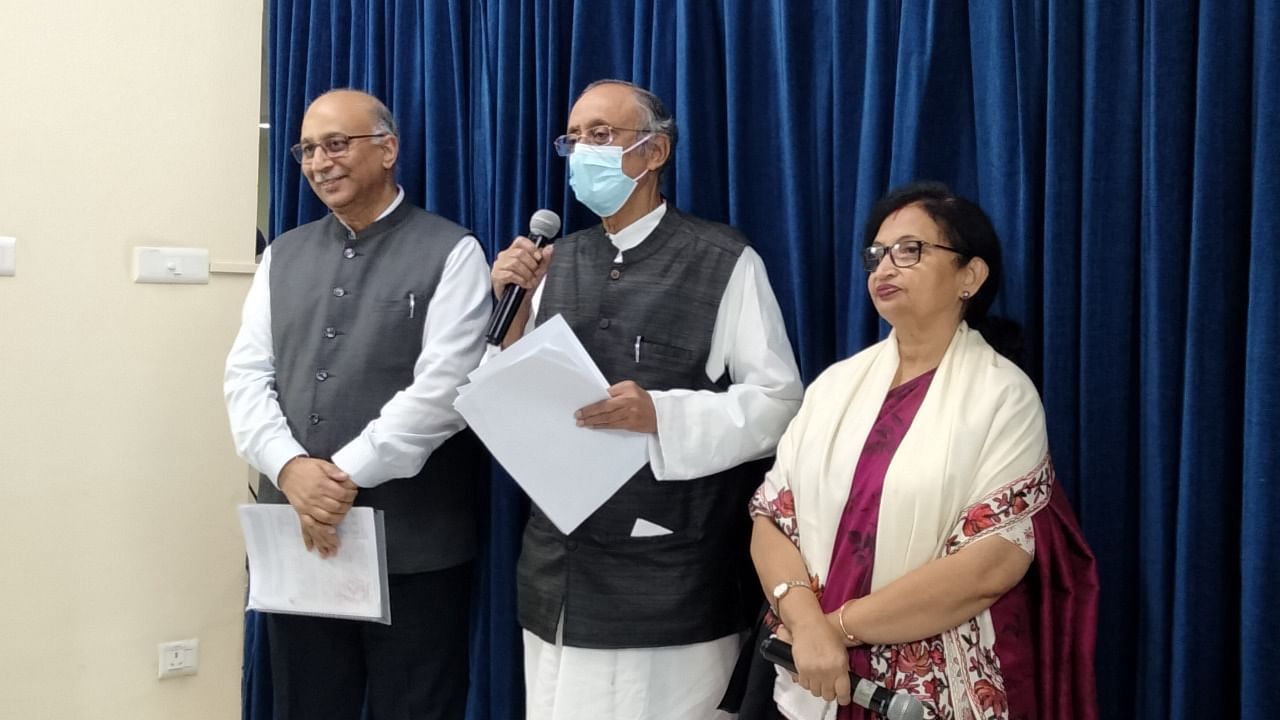

Besides Mitra, Chandrima Bhattacharya, MoS (independent charge) Finance, and Manoj Pant, additional chief secretary, also attended the meeting, after which they jointly addressed reporters at the state secretariat, Nabanna. Mitra also delved deeper into other state schemes and concerns that concern bankers:

KYC - Know Your Customer

The elderly, the villagers, and the uneducated individuals face immense difficulty while going through the KYC formality needed for opening of bank accounts. The issue was raised before the bankers. Also, a parallel customer verification system also works. The bankers were reminded of a recent Reserve Bank of India (RBI) circular that KYC done for one bank should be workable at other banks too. The KYC process needs to be rationalised and harmonised, Mitra said.

Life Certificate for Pensioners

Life pensioners, at present, have to be personally present for certification. How the elderly will go, Mitra said, adding that even in a video conferencing mode, a certain knowledge of software is expected. Again, referring to an existing notification, Mitra said that door-step banking has been requested, and bankers have agreed to the idea, and if this happens in West Bengal, other states are also likely to follow.

Bank account opening

Through Duare Sarkar, an outreach scheme of the state government, 25,502 applications were received for opening accounts. Of these, 24,462 accounts have been opened.

MSME

For the MSME, an amount of Rs 1,10,178 crore is the loan disbursement for the whole year. Mitra said that of this target, the Rs 70,667 crore – mark has already been achieved in six months. What propped up as an issue was disbursement for weavers and artisans. For loan, the makers are expected to have a PAN card, it got noticed during discussion. This turned out to be an important reason for rejection of loan, despite the fact that the weavers have already been certified by the state with credit cards. The state now intends to write to the Centre, and the RBI to point out at categorisation which is impractical, as bankers are simply following the guidelines.

Kisan Credit Card

The bankers, said Mitra, have assured that they will clear whatever disbursement is pending.

SHGs

Women borrowers – who are mostly part of self help groups, pay their loans. In this segment, around 77 per cent of the target has been achieved, whereas the target for six months was 50 per cent.

Egg production

Bengal annually produces 1,200 crore eggs. For self sufficiency, the target is to produce 1,400 crore eggs. Eighty four big companies (hatcheries) have already invested hugely in the state.