The high court in London granted Swiss bank UBS permission to take control of Vijay Mallya's London property, which overlooks Regents Park, on January 18. The bank claimed Mallya had failed to repay a 20 million pound mortgage that had been issued with the mansion as collateral, prompting the bank to issue a possession order for the over 30-bedroom residence.

A favourable order by the Supreme Court of Bahamas on 11 February, less than a month after that ruling, means that UBS will have access to enough funds to repay the mortgage and any associated interest.

The order allows Vijay Mallya's mother and children to be named as beneficiaries of the three Balaji Trusts, which are registered in the Bahamas and have more than enough money to pay off the UBS mortgage.

Balaji One Three-Gift Settlement, Balaji Two Three-Gift Settlement, and Balaji Three Three-Gift Settlement are all trusts registered in the Bahamas, with Black Stone PTC Limited serving as trustee. Mallya's children and mother, who live on the property, were to be shown as beneficiaries in order to secure the court's authority to use the money to pay UBS.

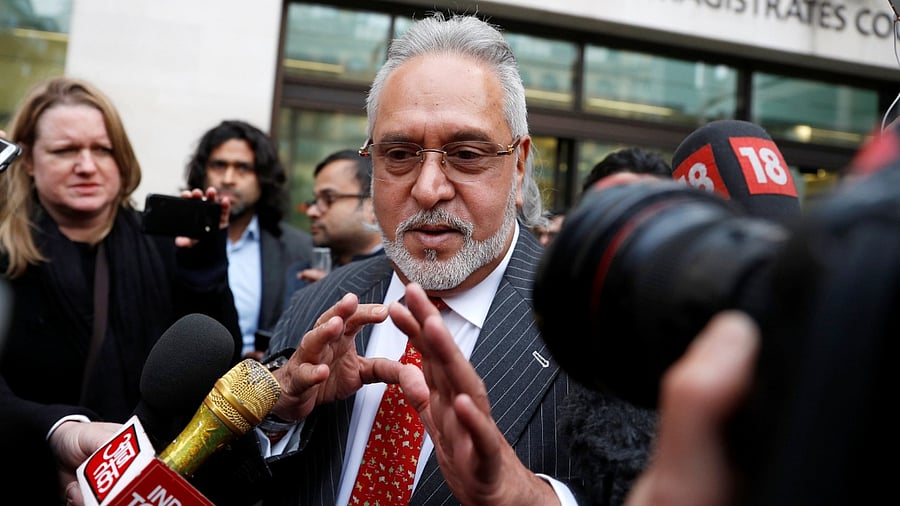

The development offers a glimpse into the complicated web of trust funds and tax havens that high-net-worth individuals use. The outcome of the Bahamian court's decision is that Mallya would be entitled to keep his London property. Mallya's ability to turn around adversity is also demonstrated by this development. Despite exhausting all legal alternatives, Indian agencies were successful in having him extradited in British courts, and Mallya remains in the UK due to an asylum plea.

While it is true that Mallya (or rather Rose Capital Ventures, which on paper owns the London property) did not repay the mortgage, it was revealed during the proceedings that the bank had sufficient security to cover the loan amount. However, because it included the complicated structure of trusts registered in the Bahamas, it necessitated a new series of court actions before the funds could be released.

After the January 18 ruling, Mallya said that UBS has cash in excess of the mortgage, but that using cash in the Trust requires a Bahamian court order, according to a report by Moneycontrol.

The Supreme Court of the Bahamas granted permission to Birchwood Hills Inc, which is owned by the Balaji One Three settlement, to enter into a loan and mortgage agreement with Rose Capital Ventures Limited for the "sole and exclusive purpose of repaying the amounts payable to UBS" earlier this week.

This is the second time Mallya has used deft manoeuvring to keep UBS from acquiring the property. Rose Capital was allowed to enter into a mortgage deal with another company incorporated in a tax haven by Justice Teare of the High Court in London in March 2020. However, while Indian banks resisted the plea to declare Mallya bankrupt, it does not appear that they are opposing the proceedings in the Bahamas court in the same way. Mallya has been declared bankrupt by the court, and the State Bank of India has filed a letter with the Bahamian court through its lawyer TLT LLP to protect its interests.

The main players in the Bahamian court were his son Siddhartha Mallya and daughters Leana and Tanya Mallya, as well as Mallya's mother Lalitha Mallya, who were all named as prospective beneficiaries of the trusts. Sidhartha Mallya appeared before the court in person, which may indicate the importance of this application to save the London property.

Watch the latest DH Videos here: