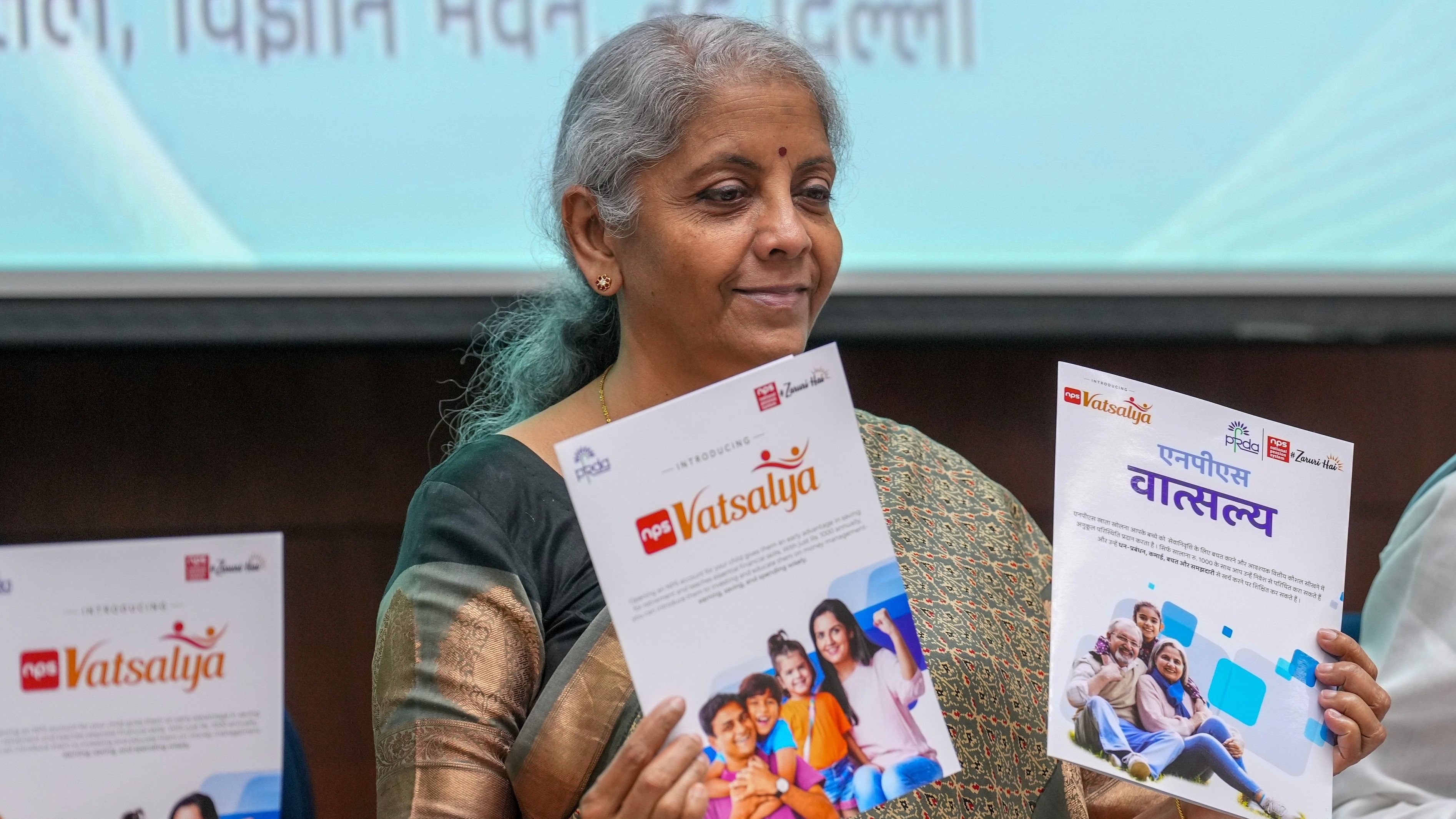

Union Finance Minister Nirmala Sitharaman during the launch of NPS Vatsalya Scheme, in New Delhi, Wednesday.

Credit: PTI Photo

Finance Minister Nirmala Sitharaman, on Wednesday, launched the ‘NPS Vatsalya’, the National Pension Scheme’s variant for children. The new scheme seeks to promote long-term financial planning and security.

In a country where a majority of the population don’t have retirement support, starting a plan for minors is a significant advancement for the pension system. In this issue of DH Deciphers, Gyanendra Keshri explains the key features of the new pension schemes, including eligibility, investment options and the processes.

What is NPS Vatsalya?

NPS Vatsalya is a saving-cum-pension scheme administered by the Pension Fund Regulatory and Development Authority (PFRDA), which is the regulatory body for managing and overseeing pension funds in India. The scheme is meant for individuals who have not yet reached the age of 18. This new scheme, which was proposed in the Union Budget 2024-25, enables contributions by parents or guardians on behalf of minors until they reach adulthood.

Who is eligible for opening NPS Vatsalya accounts?

Minor individuals under the age of 18 with a PAN card are eligible to open NPS Vatsalya accounts. The account is opened in the name of a minor and operated by a guardian, and the minor will be the sole beneficiary, and will be issued a PRAN (Permanent Retirement Account number).

How to open an NPS Vatsalya account?

You can either open it through NPS Trust’s online platform eNPS or through Point of Presence (POPs) registered with PFRDA either online or physical mode, which include major banks, India Post and Pension Funds.

What are the documents required?

The documents required for an NPS Vatsalya account are more or less the same for opening a bank account. Guardians would be required to submit proof of identity and address for KYC. The documents like Aadhaar, Passport, Voter ID card, NREGA Job Card, and National Population Register can be used for this purpose. You will also be required to provide Date of Birth proof of the minor, like birth certificate, school leaving certificate, matriculation certificate, PAN or passport.

Is this service available for NRIs?

Yes. Non-Resident Indians (NRIs) and Overseas Citizen of India (OCI) cardholders are both eligible for this scheme. NRI and OCI subscribers can make contributions for NPS Vatsalya accounts through their NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts.

What will happen to NPS Vatsalya once the individual turns 18?

Once the beneficiary reaches adulthood, the NPS Vatsalya account will be converted into a regular NPS account, on the same PRAN. Fresh KYC of the minor within three months from date of attaining 18 years will be required. Upon transitioning from NPS Vatsalya, the features, benefits, and exit norms of the NPS will apply.

Is there any limitation on the amount of investment?

An NPS Vatsalya account can be opened with a minimum contribution of Rs 1,000. There is no maximum limit. Subsequent contribution required is at least Rs 1,000 per annum. There is no maximum limit on annual subsequent contribution.

What are the options for exit and withdrawal?

There is a lock-in period of three years. After that, upto 25% of contribution can be withdrawn for the purpose of education, specified illness, and disability. The amount can be withdrawn a maximum of three times. The entire corpus can be withdrawn as a lump sum if the amount is upto Rs 2.5 lakh. If the corpus is more than Rs 2.5 lakh, 80% of the corpus can be utilised for the purchase of annuity and 20% can be withdrawn as a lump sum. In the case of death of the minor, the entire corpus would be returned to the guardian.