A number of registered unrecognised parties with less than 1% vote share are managing to encash electoral bonds despite the rules barring it, thanks to a lax monitoring system, an analysis of two RTI responses and a report by a private election watchdog have said.

As per the provisions, only parties registered under section 29A of the Representation of People Act, 1951 and securing not less than 1% votes polled in the latest Lok Sabha or Assembly election will be eligible to receive or redeem electoral bonds.

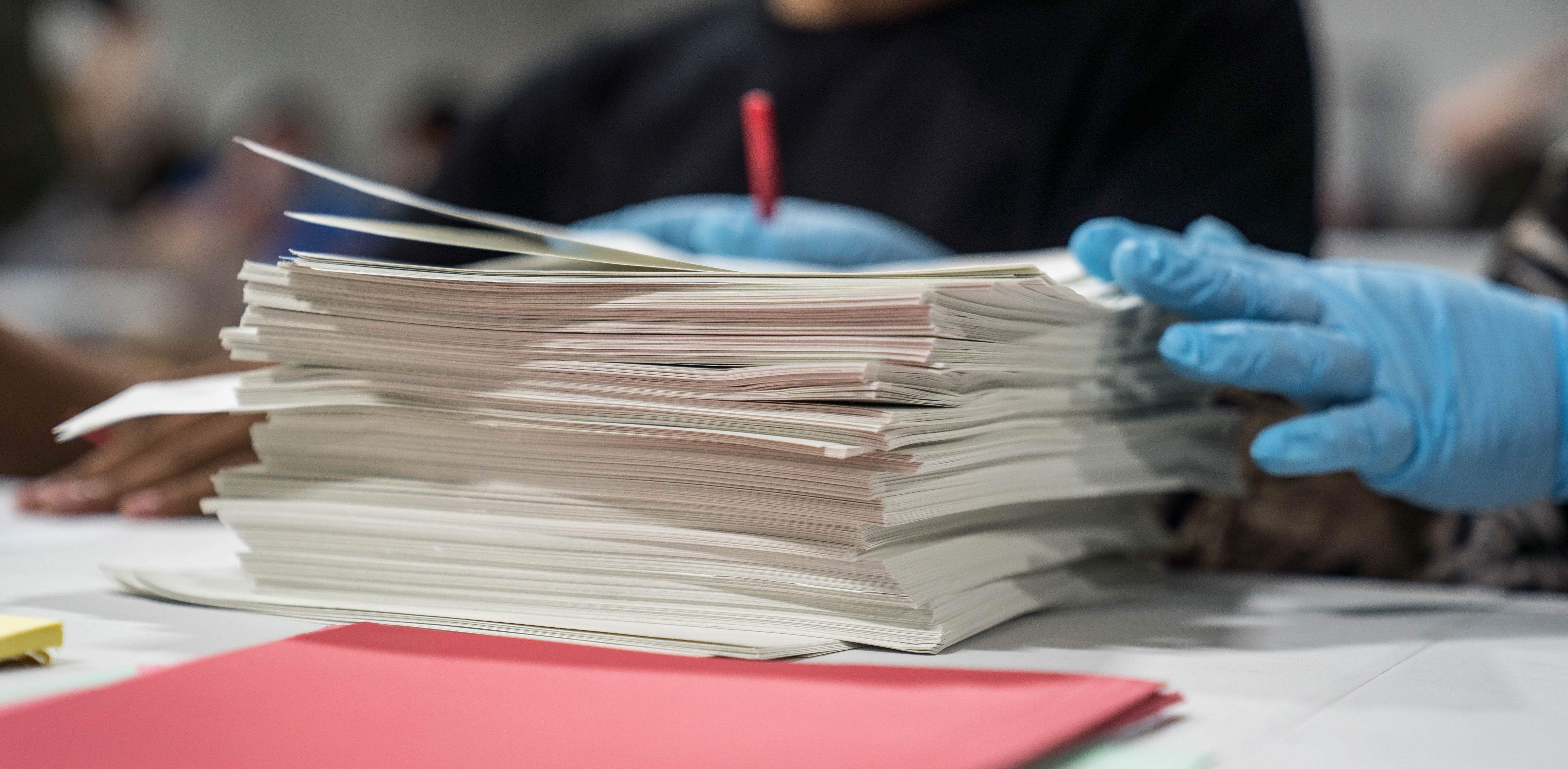

Altogether, 7 national parties, 20 state parties and 69 registered unrecognised parties had received donations through electoral bonds. The parties had submitted the details to the Election Commission in a sealed cover and the poll body submitted it to the Supreme Court in February this year.

Through an RTI, both the Association for Democratic Reforms (ADR) and transparency activist Commodore Lokesh Batra (Retd) had separately received the list of 96 parties which received these electoral bonds.

An analysis by ADR showed that at least 42 registered unrecognised parties with less than 1% vote share had managed to encash donations received through electoral bonds.

Only one among unrecognised parties -- Gondwana Ganatantra Party -- was found to be eligible to collect donations through electoral bonds by getting more than 1% votes.

Parties like Vijay Kanth-led MDMK, People's Party of India and Bharat Dalit Party managed to get donations through electoral bonds despite not winning more than 1% votes.

This number could be much more as the ADR could not analyse the eligibility of 26 other unrecognised parties that redeemed electoral bonds, due to non-availability of their vote share details on the Election Commission website.

It remains a question how these parties, which fail to meet the eligibility criteria, manage to redeem these bonds when it can be encashed only by depositing it in their designated bank account. This also indicates that there is no scrutiny or monitoring at any stage about the sale and management of the bonds.

While the ADR report speaks about ineligible parties managing to get money through electoral bonds, the SBI that administers the "sale and management" of electoral bonds said in response to RTIs by Batra that it has no such information about ineligible parties cashing in on the bond scheme.

A question was raised by Batra in his RTI filed in May this year about the "list of actions" taken by the SBI to tackle the issue of non-eligible parties redeeming electoral bonds. "No information as regards the information request is held by the Bank," the SBI said in its response dated June 24.

It had then said that the SBI verifies the eligibility criteria from the Election Commission website and to ensure the proper control, it "centrally monitors the opening of Current Account of eligible political parties for redemption of electoral bonds."

In response to another RTI query in October this year about the frequency with which the SBI monitors the eligibility of parties, the Bank said on November 24 that it verifies the criteria of parties before the start of each phase.

While the ADR analysis points out that at least 42 parties were ineligible to redeem electoral bonds, the SBI said it has "no information as regards the information request is held by bank" on non-eligible parties despite a claim that it gleaned the EC website before sale of these bonds.

Activists also point out that the EC website does not have all information as seen in the ADR report, which said it could not access details of 26 parties.